USD/JPY continues to trade at high levels, as the pair trades close to the 105 line in Tuesday trading. Tuesday has just three releases, highlighted by US CB Consumer Confidence. The markets are expecting a sharp rise in the November reading. There are no Japanese releases this week. Trading is light ahead of the New Year's holiday on Wednesday, when US and Japanese markets will be closed.

The first US release of the week did not impress, as US Pending Home Sales gained just 0.2% in November. This was well short of the forecast of 1.1%. However, the modest gain did break a string of five straight declines, so perhaps the key indicator has turned the corner on its recent downward spiral. Last week’s housing data looked much stronger, as New Home Sales beat the forecast.

Late last week, Unemployment Claims bounced back nicely following two disappointing releases. The key employment indicator fell to 338 thousand, compared to 379 thousand in the previous release. The estimate stood at 346 thousand. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the US labor market continues to improve, the Fed could decide on another taper early in 2014, which would give a boost to the US dollar against its major rivals.

Japan's economy is heading in the right direction, but the Japanese consumer has not jumped on to the bandwagon just yet. Household Spending dropped to a paltry 0.2% in November. The markets had expected a much better release, with the estimate standing at 1.9%. Preliminary Industrial Production also fell, dropping to o.1%, well off the estimate of 0.6%. There was good news as well, as Retail Sales jumped 4.0%, its sharpest gain since August 2010. The estimate stood at 2.9%. Inflation continues to rise, as Tokyo Core CPI posted a respectable gain of 0.7%, matching the forecast.

The Bank of Japan released the minutes of its most recent policy meeting last week and there was a consensus that the economic recovery is continuing. However, two board members expressed concern about the pace of growth, as GDP in Q3 showed a gain of just 0.3%, well off the Q2 reading of 0.9%. Even if GDP expands in Q4, there is concern that a sales tax hike in April could slow growth in 2014. The minutes also indicated that one policy member expressed doubt that the BOJ would reach its inflation target of 2% by 2015. However, BOJ Governor Haruhiko Kuroda insists that the country is on track to meet this goal and he reiterated this on Thursday in a meeting with Prime Minister Shinzo Abe. The BOJ's aggressive monetary policy has revived the economy and put the breaks on deflation, but has severely weakened the yen, which has lost 17% of its value against the greenback in 2013. USD/JPY" border="0" height="300" width="400">

USD/JPY" border="0" height="300" width="400">

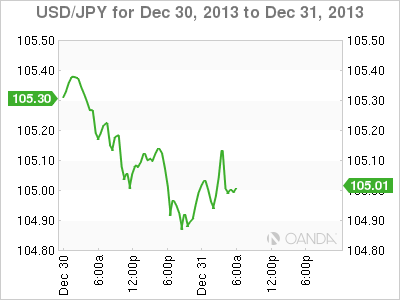

USD/JPY December 31 at 11:25 GMT

USD/JPY 105.00 H: 105.14 L: 104.87 USD/JPY Technical" title="USD/JPY Technical" height="83" width="574">

USD/JPY Technical" title="USD/JPY Technical" height="83" width="574">

- USD/JPY is almost unchanged in Tuesday trading, as the pair has stayed close to the 105 line in the Asian and European sessions.

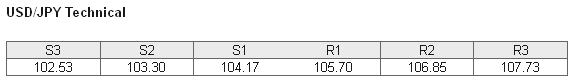

- 104.17 continues to provide support. This line has some breathing room as the pair trades around the 105 line. This is followed by support at 103.30.

- On the upside, there is resistance at 105.70. This is followed by a resistance line at 106.85, which has remained intact since September 2008.

- Current range: 104.17 to 105.70

Further levels in both directions:

- Below: 104.17, 103.30, 102.53, 101.19 and 100.00

- Above: 105.70, 106.85, 107.73 and 108.77

OANDA's Open Positions Ratio

USD/JPY ratio is pointing to gains in long positions in Tuesday trading. This is consistent with what we are seeing from the pair, which is up very slightly. The ratio is almost evenly split between short and long positions, reflecting a lack of bias in trader sentiment as to which direction the yen will take next.

USD/JPY continues to trade at high levels. We could some stronger movement in the North American session as the US releases key consumer confidence numbers later in the day.

USD/JPY Fundamentals

- 14:00 US S&P/CS Composite-20 HPI. Estimate. 13.4%.

- 14:45 US Chicago PMI. Estimate. 61.3 points.

- 15:00 US CB Consumer Confidence. Estimate. 76.5 points.