The US dollar saw a bearish day yesterday vs. the Japanese yen, following worse than expected US Retail Sales and Core Retail Sales figures which signaled to investors that the American economy still has a long way to go before recovering. Today, all eyes will be on a testimony from US Fed Chairman Bernanke, scheduled to take place at 14:00 GMT. Given the continuously disappointing economic indicators out of the US in recent weeks, investors are anxious to see if Bernanke will mention a new round of quantitative easing to boost the US economy. If he does, riskier currencies, like the EUR and AUD, could see significant gains against the greenback in afternoon trading.

Economic News

USD - All Eyes On Bernanke SpeechThe US dollar turned bearish against several of its main currency rivals yesterday, following disappointing US retail sales news that caused investors to shift their funds away from the greenback. The USD/JPY fell more than 40 pips over the course of the day, eventually reaching as low as 78.69 during the afternoon session. Against the British pound, the dollar dropped more than 100 pips during the European session. The GBP/USD was able to peak at 1.5622 toward the end of the day before staging a slight downward correction to stabilize at the 1.5600 level.

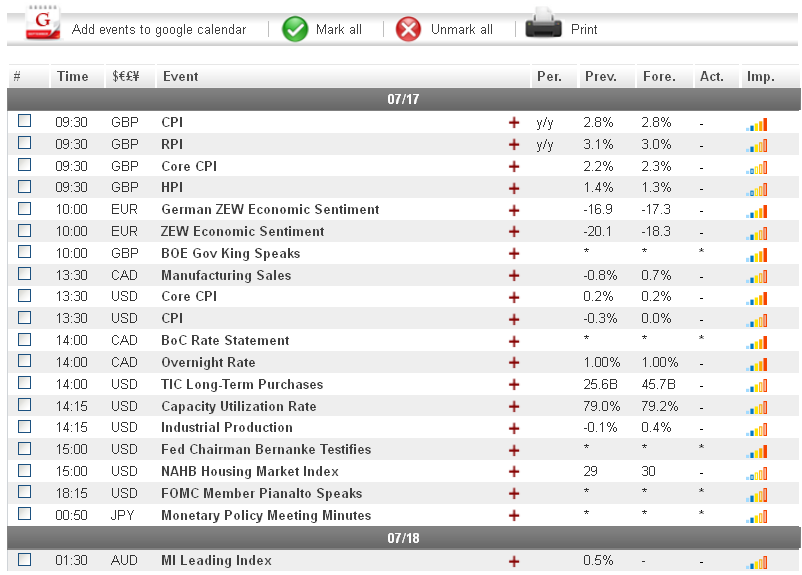

Turning to today, investors will be closely watching a speech from Fed Chairman Bernanke, scheduled to take place at 14:00 GMT. Any mention of a possible new round of quantitative easing to boost to the US economic recovery could result in the dollar extending yesterday's losses during afternoon trading. That being said, if the Fed Chairman refrains from mentioning a new stimulus plan, investors may shift their funds to safe-haven assets which could help the greenback recoup some of its recent losses.

EUR - Euro Remains Near Multi-Year Low

Despite moderate gains against the US dollar yesterday, the euro remained near a two-year low for much of the day, as investors remain concerned about the lack of progress in combating the eurozone debt crisis. The EUR/USD advanced more than 60 pips during mid-day trading, eventually reaching as high as 1.2246 before staging a slight downward correction and dropping back to the 1.2220 level. Against the Japanese yen, the euro fell close to 70 pips, eventually hitting the 96.15 level, a six-week low.

Today, the main piece of eurozone news is expected to be the German ZEW Economic Sentiment, scheduled to be released at 09:00 GMT. Investor concerns that the eurozone debt crisis is spreading to the region's biggest economy have been one of the main causes of the euro's recent bearish trend. Should today's news come in below the forecasted -14.5, the common-currency could see additional downward movement against its main currency rivals.

Platinum - Platinum Falls Amid Risk Aversion

Investor concerns regarding the eurozone debt crisis led to risk aversion in the marketplace yesterday, which resulted in the price of platinum falling by over $17 during European trading. The precious metal eventually found support at the $1412.89 level, and was able to rebound back to $1419 toward the end of the afternoon session.

Turning to today, platinum traders will want to pay attention to the German ZEW Economic Sentiment figure. Should the German data come in below its forecasted level of -14.5, risk aversion in the marketplace may increase, which could lead to additional losses for precious metals during the European session.

Crude Oil - Crude Oil Comes Off One-Week High

Crude oil came off a one-week high yesterday amid fears that demand in China will slow down due to slow economic growth in the country. That being said, oil's losses were fairly moderate, as tensions between Iran and the West continued to generate supply side concerns among investors. After dropping as low as $86.79 a barrel during mid-day trading, crude was able to rebound to the $87.40 level.

Turning to today, oil traders will want to pay attention to a speech from US Fed Chairman Bernanke, scheduled to take place at 14:00 GMT. Should the speech include any signs that the Fed is getting ready to initiate a new round of quantitative easing, the US dollar could turn bearish against its main currency rivals, which may result in substantial gains for crude oil.

Technical News

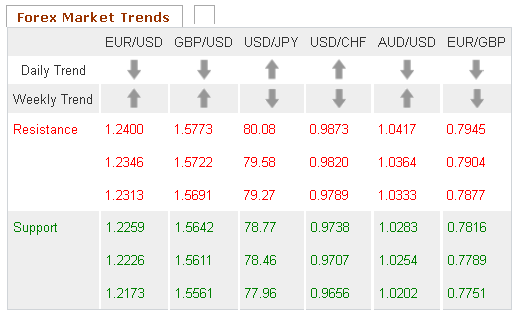

EUR/USDThe weekly chart's Williams Percent Range has dropped into oversold territory, signaling that an upward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the daily chart, which has formed a bullish cross. Going long may be the correct strategy for this pair.

GBP/USD

A bullish cross on the daily chart's MACD/OsMA indicates that this pair may see upward movement in the near future. In addition, the Williams Percent Range on the weekly chart is currently angling downward, and may soon cross into oversold territory. Traders will want to keep an eye on this indicator, as it may signal possible bullish movement in the near future.

USD/JPY

Most long-term technical indicators show this pair trading in neutral territory, meaning that no defined trend can be predicted at this time. Traders may want to take a wait and see approach, as a clearer picture may present itself in the near future.

USD/CHF

The daily chart's Relative Strength Index has crossed into overbought territory, indicating that this pair could see a downward correction in the near future. Furthermore, the weekly chart's Williams Percent Range is currently at the -10 level. Traders may want to go short ahead of possible bearish movement.

The Wild Card

USD/DKKThe daily chart's Slow Stochastic has formed a bearish cross, indicating that this pair could see downward movement in the near future. Additionally, the Relative Strength Index on the same chart has crossed into overbought territory. Forex traders may want to go short in their positions ahead of a possible downward correction.