The British pound remains under pressure from the US dollar, and is trading in the mid-1.52 range in Friday’s European session. UK releases have not impressed this week, and there was more bad news as GDP for Q1 was revised downwards, from 0.6% to 0.3%. As expected, British Consumer Confidence was very weak, and Nationwide HPI missed the estimate. GBP/USD has now lost over five cents in the past 10 days. In the US, it’s a very different story, as most US releases this week have been positive. On Thursday, US Unemployment Claims was very close to the estimate, while Pending Home Sales sparkled. Friday’s highlight out of the US is UoM Consumer Sentiment.

Current Account was the UK’s only major release this week, and any hopes that we would see some improvement were dashed, as the deficit continues to put on weight. The indicator rose to a deficit of GBP-14.5 billion, way off the estimate of GBP-11.9 billion. No less worrying is the fact that the deficit has been steadily rising since Q1 of 2012. Traders should note that this key indicator is directly related to currency demand, as a rising deficit means that foreigners are purchasing less British pounds to execute transactions, which hurts the value of the pound.

There was more tough medicine from U.K. Chancellor of the Exchequer George Osborne on Wednesday. Osborne outlined the projected spending cuts the government will make starting in 2015 and which will last till 2018. The government plans to cut some GBP 11.5 billion from government ministries, as the austerity program continues for a sixth straight year. Osborne said he was forced to take drastic action due to a weak British economy and lower than expected tax revenue. The new cuts are sure to be unpopular with the public, and the opposition Labor Party has wasted no time in criticizing the spending cuts and blaming the government of mismanaging the economy.

The pound has not only taken a hit from bad domestic news, but also has had to contend with strong US numbers this week. On Thursday, US Unemployment claims fell to 346 thousand, just below the estimate of 347 thousand. Pending Home Sales skyrocketed, posting a gain of 6.7%, its highest since 2006. This crushed the estimate of a 1.1% gain. On Tuesday, Core Durable Goods, CB Consumer Confidence and New Home Sales, all key releases, beat their estimates. Manufacturing data, often a sore spot, also looked good as the Richmond Manufacturing Index had its best performance since last November. Wednesday’s GDP figures missed the estimate, but the markets didn’t react negatively, as the US dollar held firm against the major currencies. These solid numbers are particularly encouraging, as they come from a wide range of economic sectors, and could signal a deepening recovery.

There was more tough medicine from U.K. Chancellor of the Exchequer George Osborne on Wednesday. Osborne outlined the projected spending cuts the government will make starting in 2015 and which will last till 2018. The government plans to cut some GBP 11.5 billion from government ministries, as the austerity program continues for a sixth straight year. Osborne said he was forced to take drastic action due to a weak British economy and lower than expected tax revenue. The new cuts are sure to be unpopular with the public, and the opposition Labor Party has wasted no time in criticizing the spending cuts and blaming the government of mismanaging the economy.

GBP/USD June 28 at 12:15 GMT

GBP/USD 1.5254 H: 1.5279 L: 1.5228

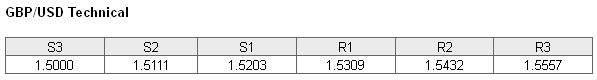

GBP/USD is not showing much movement in the Friday session, as the proximate support and resistance lines remain in place (S1 and R1 above). On the downside, there is support at 1.5203, but this is a weak line. This line looked strong at the start of the week, but has weakened badly as the pound continues to sag. There is stronger support at 1.5111. This line has remained intact since mid-March. On the upside, we continue to see resistance at 1.5309. This is followed by a resistance line at 1.5432, which has strengthened as the pair trades at lower levels.

- Current range: 1.5203 to 1.5309

- Below: 1.5203, 1.5111, 1.5000 and 1.4896.

- Above: 1.5309, 1.5432, 1.5557, 1.5700, 1.5800, and 1.5869

GBP/USD ratio has reversed directions on Friday, pointing to movement towards short positions. This is consistent with what we are seeing from the pair, as the dollar has edged higher against the pound. The ratio remains closely split between long and short open positions, indicating a lack of bias from traders regarding what to expect from GBP/USD.

GBP/USD Fundamentals

- 6:00 British Nationwide HPI. Exp. 0.4%. Actual 0.3%.

- 8:30 British Index of Services. Exp. 0.2%. Actual 0.8%.

- 12:00 US FOMC Member Jeremy Stein Speaks.

- 13:45 US Chicago PMI. Estimate 56.0 points.

- 13:55 US UoM Consumer Sentiment. Estimate 82.8 points.

- 13:55 US UoM Inflation Expectations.