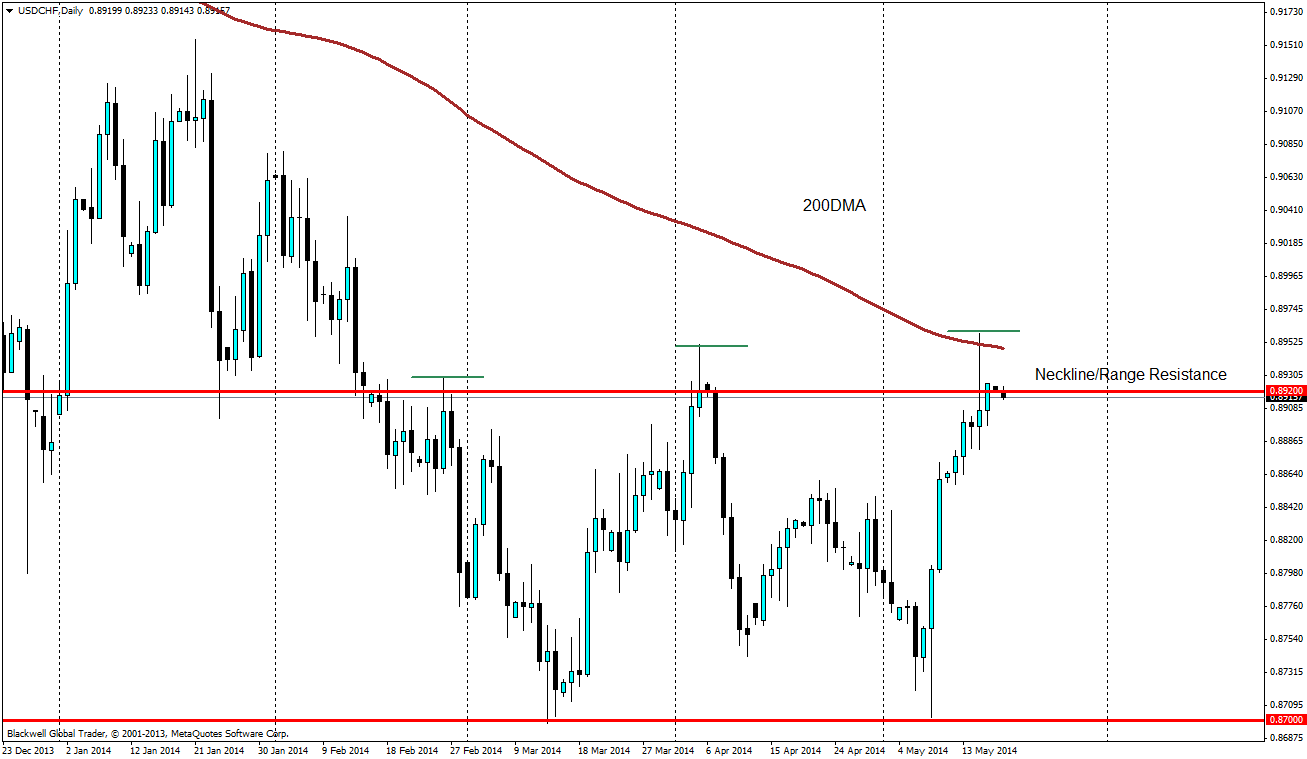

The bear run for the USD/CHF has had a good 1 year run with price ranging through solid bearish cycles. With the USD/CHF tagging a higher high just off the 200DMA and its recent failure to form a lower swing low; we are now looking at a double bottom reversal structure with a neckline at the 0.8920 zone. Technical traders can start look for price action signals toget in long or play the rejection of the zone.

Examining the D1 chart, we see 1 week of predominantly bullish candles engulfing the 220 pip range,as well as higher highs. Traders must tread carefully as prices are in a technical hotspot with the convergence of the neckline resistance and the 200DMA in play with the pin-bar rejection candle on 15/05/14. I would favour being light footed by looking at the smaller time frames for cues of either a reversal or a breakout play in this zone.

Source: Blackwell Trader

There are 2 plays we can look to do on the smaller timeframes:

Reversal Play

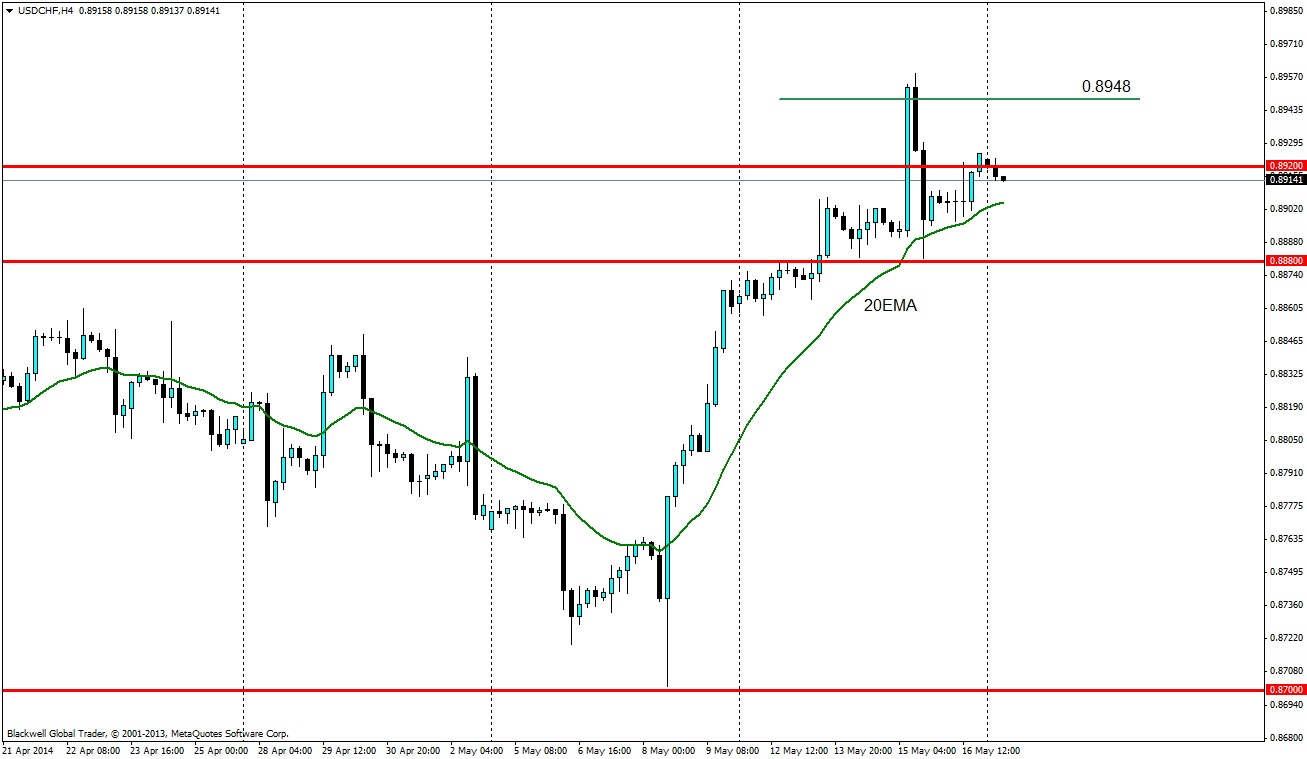

As with the previous rejection of the 0.8920 level, a downward wave should be fast and strong, showing commitment by the bears to drive the price down. We can look to trade the break of 0.8880 if the H4 and H1 charts show impulsive bearish movements (bigger candles with solid bodies) heading down to that level. Keep in mind that this would be a short term counter trend play so keep the profit targets right and the stops tighter for good risk/reward ratio trades.

Breakout play

If price starts forming higher lows on the intraday charts, it would indicate absorption of any bears left at the level by the bulls. I will be looking at the 20EMA as a dynamic support moving out of the zone as the last impulsive bear candle rejected nicely off it. Aggressive bulls can use rejections off the 20EMA for long entries with relatively right stops. More cautious bulls can wait for a breakout pull back setup. The ideal setup would involve a strong break above the 200DMA sitting at 0.8948. Traders shouldn’t feel the need to be hasty about reversal because a true reversal of this double bottom will have plenty of upside till 0.9150.