USD/CAD has edged higher on Wednesday, as the pair trades in the mid-1.11 range in the North American session. There is not much action on the release front, with only a handful of US releases. Crude Oil Inventories looked excellent, as the weekly release hit its highest level in 2014. There are no Canadian releases on Wednesday.

Tuesday's employment numbers could have been stronger, as JOLTS Job Openings dipped to 3.97 million in February. This fell short of the estimate of 4.02 million and marked a three-month low. On Friday, Nonfarm Payrolls jumped to 175 thousand in February, compared to just 113 thousand last month. This easily beat the estimate of 151 thousand. The Unemployment Rate edged up to 6.7%, up from 6.6% in the previous reading. With the markets expecting the Fed to trim QE next week, every employment release should be treated as a market-mover.

With some solid US employment numbers last week, it's a good bet that the Fed is likely to take its scissors and trim QE next week for the third time since the haircutting began in December. New York Fed President William Dudley stated last week that the threshold to alter the Fed's program to wind up QE was "pretty high". In other words, short of a serious economic downturn in the US economy, we can expect the QE tapers to continue. If all goes well, the Fed plans like to wrap up QE by the end of 2014.

Canadian releases started the week on the right foot. Housing Starts improved to 192 thousand, up from 180 thousand a month earlier. This edged above the estimate of 190 thousand. On Friday, Employment Change looked awful, posting its second decline in the past three releases. The indicator came in at -7.0 thousand, way off the estimate of +16.9 thousand. There was no change to the Unemployment Rate, which remains at 7.0%. The Canadian dollar responded to the weak employment news by coughing up 100 points on Friday, and the currency continues to struggle against the US dollar.

USD/CAD" title="USD/CAD" align="bottom" border="0" height="242" width="400">

USD/CAD" title="USD/CAD" align="bottom" border="0" height="242" width="400">

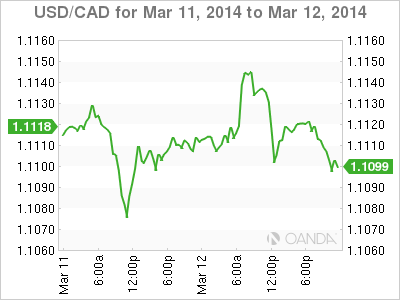

USD/CAD March 12 at 15:15 GMT

USD/CAD 1.1137 H: 1.1154 L: 1.1102

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.0906 | 1.10 | 1.1094 | 1.1177 | 1.1319 | 1.1496 |

- USD/CAD is slightly higher in Wednesday trading. The pair touched a low of 1.1102 late in the European session.

- 1.1094 is providing support. It is a weak line which could see activity during the day. Next is support at 1.10, a key psychological level.

- 1.1177 is a strong resistance line. This is followed by 1.1319.

- Current range: 1.1094 to 1.1177

Further levels in both directions:

- Below: 1.1094, 1.1000, 1.0906, 1.0852 and 1.0783

- Above: 1.1177, 1.1319, 1.1496 and 1.1639

OANDA's Open Positions Ratio

USD/CAD ratio is posting gains in long positions, reversing directions from the previous day. This is consistent with what we are seeing from the pair, as the US dollar has posted gains. The ratio has a majority of short positions, indicating trader bias towards the loonie moving higher.

The Canadian dollar is struggling, as USD/CAD trades above the 1.11 line on Wednesday. The pair is showing little movement in the North American session.

USD/CAD Fundamentals

- 14:30 US Crude Oil Inventories. Estimate 2.1M. Actual 6.2M.

- 17:01 US 10-year Bond Auction.

- 18:00 US Treasury Secretary Jack Lew Speaks.