Market Brief

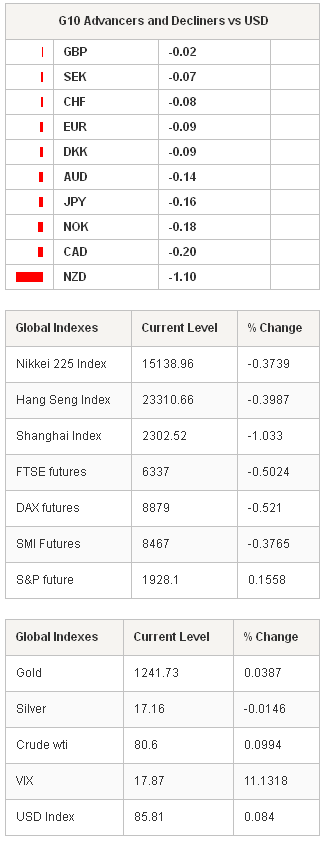

The USD is broadly in demand after the Ottawa attack yesterday, the DXY index advances to 1-week high. Released yesterday, the US September CPI has been marginally better than the market estimates. Both the CPI and the core CPI remained unchanged at 1.7% on year to September (vs. 1.6% & 1.7% exp. respectively). The soft advance in consumer price gives time to Fed before its first fund rate hike. The US 10-Year yields recovered to 2.24% in New York, yet failed to move higher. The uncertainties on monetary policy will likely keep the US rates subdued for some more time.

Wednesday has been an event-full day for Canada. The Ottawa attack combined to BoC verdict lifted up the volatilities in CAD-complex. The BoC maintained the bank rate unchanged at 1.0% in line with expectations, yet stepped away from its “neutral” stance and the use of “forward guidance” to our surprise. The signs of cool-off in September CPI and the low oil prices were rather proper for a dovish tone. USD/CAD spiked down to 1.1184 (over a week low), bids below 21-dma (1.1203) pushed the pair back to this week’s 1.12-1.13 range as the Ottawa attack and lower oil prices offset the BoC verdict. USD/CAD bias turns marginally negative; resistance zone is seen at 1.1296/1.1325 (week high / MACD pivot).

In Japan, the MoF data showed decreasing Japanese interest in foreign bonds on week to October 17th. Japanese investors were net short of 1’169.1 billion yen of foreign bonds (vs. + 796.0bn yen a week ago), foreign interest in Japan stocks decreased by an additional 412.6 billion yen. On broad based USD strength, USD/JPY advanced to 107.38. The bearish momentum slows, yet decent option barriers at 107.50+ challenge the upside attempts. We see consolidation towards the daily Ichimoku cloud cover (105.01/106.24). On EUR/JPY, the formation of tweezer bottom should trigger a minor bullish reversal if 135.44 (yesterday low) holds through the day.

The strength in GBP/USD halted as BoE minutes highlighted “mounting evidence of loss of momentum in the euro area […] increasing risks to the durability of the UK expansion in the long term”. Resistance remains solid at 1.6116/86 (21-dma / Fib 23.6% on Jul-Oct sell-off).

NZD recorded the largest losses versus USD overnight as 3Q inflation decelerated faster than expected (0.3% q/q vs. 0.5% exp.). The CPI y/y fell to 1.0% (from 1.6% previously). NZD/USD wrote-off a figure as RBNZ-doves jumped in. Further weakness is expected with resistance building pre-0.7975/0.8000 (Fib 23.6% on Jul-Oct drop / optionality). The key support stands at 0.7709 (Sep 29th low).

Today, Norges Bank gives policy verdict and is expected to maintain the deposit rates unchanged at 1.50%. Today’s economic calendar is heavy: French October Business Survey, Own-company Production Outlook, Production Indicator, Business and Consumer Confidence, Spanish 3Q Unemployment Rate, French, German and Euro-zone October (Prelim) Manufacturing, Services and Composite PMIs, Swedish September Unemployment Rate, UK September Retail Sales m/m & y/y/, UK September BBA Loans for House Purchase, Euro Area 2Q Government Debt and Deficit, UK October CBI Trends Total Orders , Selling Prices and Business Optimism, US October 18th Initial Jobless Claims & October 11th Continuing Claims, US October (Prelim) Manufacturing PMI, Euro-zone October (Advance) Consumer Confidence, Chicago Fed September National Activity Index, Kansas City Fed October Manufacturing Activity Index and US September leading index.

Swissquote SQORE Trade Idea

G10 Currency Trend Model: Sell EURUSD at 1.2646

| Todays Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| FR Oct Business Survey Overall Demand | - | -6 | EUR / 6:45 AM |

| FR Oct Own-Company Production Outlook | - | 2 | EUR / 6:45 AM |

| FR Oct Production Outlook Indicator | - | -17 | EUR / 6:45 AM |

| FR Oct Manufacturing Confidence | 95 | 96 | EUR / 6:45 AM |

| FR Oct Business Confidence | 91 | 91 | EUR / 6:45 AM |

| SP 3Q Unemployment Rate | 24.10% | 24.47% | EUR / 7:00 AM |

| FR Oct P Markit France Manufacturing PMI | 48.5 | 48.8 | EUR / 7:00 AM |

| FR Oct P Markit France Services PMI | 48.3 | 48.4 | EUR / 7:00 AM |

| FR Oct P Markit France Composite PMI | 48.7 | 48.4 | EUR / 7:00 AM |

| NO Bloomberg Oct. Norway Economic Survey | - | - | NOK / 7:15 AM |

| GE Oct P Markit/BME Germany Manufacturing PMI | 49.5 | 49.9 | EUR / 7:30 AM |

| SW Sep Unemployment Rate | 7.50% | 7.40% | SEK / 7:30 AM |

| GE Oct P Markit Germany Services PMI | 55 | 55.7 | EUR / 7:30 AM |

| SW Sep Unemployment Rate Trend | - | 7.90% | SEK / 7:30 AM |

| SW Sep Unemployment Rate SA | 7.90% | 8.00% | SEK / 7:30 AM |

| GE Oct P Markit/BME Germany Composite PMI | 53.6 | 54.1 | EUR / 7:30 AM |

| Norges Bank Deposit Rates | 1.50% | 1.50% | NOK / 8:00 AM |

| EC Oct P Markit Eurozone Manufacturing PMI | 49.9 | 50.3 | EUR / 8:00 AM |

| EC Oct P Markit Eurozone Services PMI | 52 | 52.4 | EUR / 8:00 AM |

| EC Oct P Markit Eurozone Composite PMI | 51.5 | 52 | EUR / 8:00 AM |

| UK Sep Retail Sales Ex Auto MoM | 0.00% | 0.20% | GBP / 8:30 AM |

| UK Sep Retail Sales Ex Auto YoY | 3.40% | 4.50% | GBP / 8:30 AM |

| UK Sep Retail Sales Incl. Auto MoM | -0.10% | 0.40% | GBP / 8:30 AM |

| UK Sep Retail Sales Incl. Auto YoY | 2.90% | 3.90% | GBP / 8:30 AM |

| UK Sep BBA Loans for House Purchase | 41450 | 41588 | GBP / 8:30 AM |

| EC Euro Area Second Quarter Government Debt | - | - | EUR / 9:00 AM |

| EC Euro Area Second Quarter Government Deficit | - | - | EUR / 9:00 AM |

| UK Oct CBI Trends Total Orders | -3 | -4 | GBP / 10:00 AM |

| UK Oct CBI Trends Selling Prices | 0 | 1 | GBP / 10:00 AM |

| UK Oct CBI Business Optimism | 15 | 19 | GBP / 10:00 AM |

| US Sep Chicago Fed Nat Activity Index | 0.1 | -0.21 | USD / 12:30 PM |

| US Oct 18th Initial Jobless Claims | 280K | 264K | USD / 12:30 PM |

| US Oct 11th Continuing Claims | 2380K | 2389K | USD / 12:30 PM |

| US Aug FHFA House Price Index MoM | 0.30% | 0.10% | USD / 1:00 PM |

| US Oct P Markit US Manufacturing PMI | 57 | 57.5 | USD / 1:45 PM |

| EC Oct A Consumer Confidence | -12 | -11.4 | EUR / 2:00 PM |

| US Sep Leading Index | 0.70% | 0.20% | USD / 2:00 PM |

| US Oct Kansas City Fed Manf. Activity | 6 | 6 | USD / 3:00 PM |

Currency Tech

EURUSD

R 2: 1.2886

R 1: 1.2853

CURRENT: 1.2625

S 1: 1.2606

S 2: 1.2501

GBPUSD

R 2: 1.6186

R 1: 1.6116

CURRENT: 1.6030

S 1: 1.5944

S 2: 1.5875

USDJPY

R 2: 108.20

R 1: 107.50

CURRENT: 107.20

S 1: 106.24

S 2: 105.23

USDCHF

R 2: 0.9691

R 1: 0.9598

CURRENT: 0.9549

S 1: 0.9475

S 2: 0.9368