What a Difference a Week Makes

Stock are paring gains on Friday, with the mood soured by reports that Gilead Sciences' (NASDAQ:GILD) remdesivir flopped in its first randomized clinical trial.

This time last week, investors were full of hope after some very promising results were reported, prompting a 12% jump in Gilead’s share price. What a difference a week makes. These gains have been all-but wiped out, with the stock down almost 10% yesterday at one point, as the results were accidentally published by the WHO.

Gilead has since stressed that the results are inconclusive and the study was terminated early due to low enrolment but the damage has been done. This is a market – and global population for the matter – that’s craving good news and this just feels like another big setback.

Europe is playing catchup today, with the news having come out after the close which explains the disparity between Europe and the U.S. on Friday, with Wall Street eyeing small gains.

EU leaders agreed on a huge recovery package to fight the economic impact of the coronavirus, with the only details yet to be agreed being the size, how it will be generated and where it will go. That unenviable task will fall on the European Commission but it’s expected to be around one trillion euros and be linked to a new revamped seven year budget. What could possibly go wrong?

Oil Ends the Week on a More Stable Footing

Oil prices are looking unusually stable so far today. What a week it’s been in the oil market, one that started with the front WTI contract plunging to minus $40 a barrel as the end of trading approached. Things have calmed down a lot since and prices returned to a level thought to be devastating a couple of months ago but something of a relief now.

I doubt we’re going to see the pressure ease up at all, with ideas being floated but no action actually being taken to address the huge imbalance and lack of storage. A small rebound after Monday and Tuesday’s wild trading is understandable but there’s not much of a bullish case brewing at the moment.

Gold Edging Closer to April Peak

Gold are remaining elevated after rallying the last couple of days. It’s within touching distance of the peak from earlier this month but looking a little flat today. It’s not too dissimilar to what we’re seeing across the rest of the markets in all fairness. It’s been quite an exhausting week, I think we’re all ready for the weekend.

Bitcoin Finally Breaks $7,500

Bitcoin) finally sprung into action on Thursday, briefly breaking through $7,500 technical resistance and now continuing to hang around those levels, potentially retesting from above. This is a very bullish breakout after quite a tedious month so far. Perhaps we’re seeing sentiment track some of the moves in other risk associated markets, although this may remain fragile in the coming weeks. Still, it’s a very bullish move that could trigger more significant gains in the days ahead.

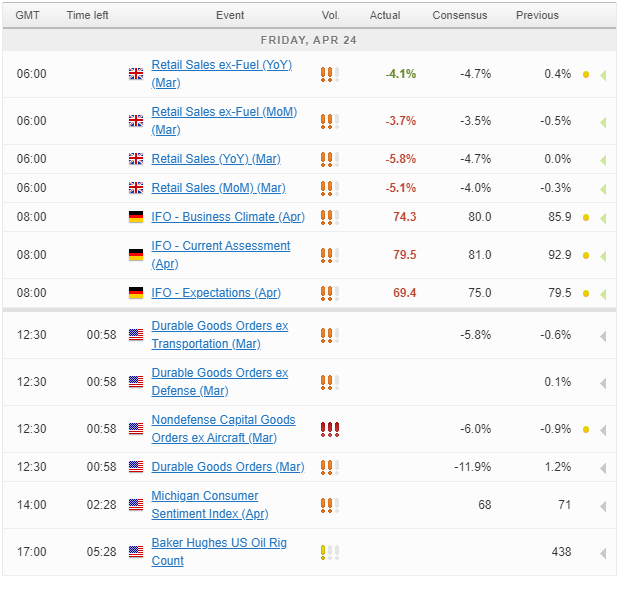

Economic Calendar