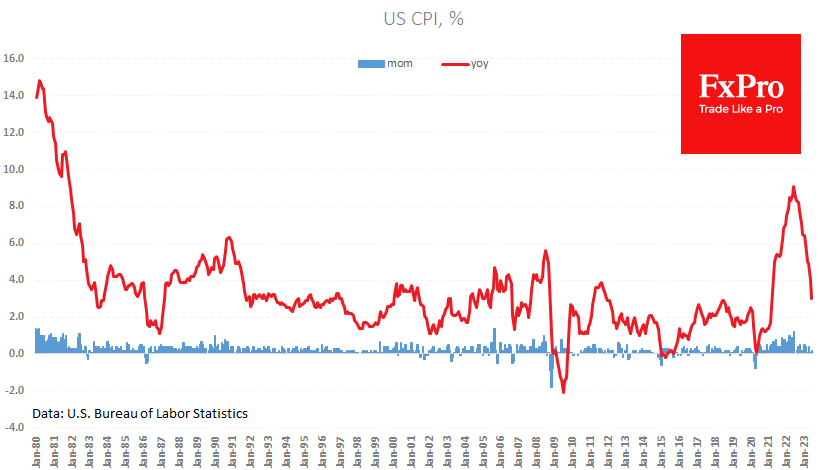

The US consumer price index slowed to an annual rate of 3.0% in June from 4.0% the previous month. This was slightly below the expected 3.1%. Core inflation slowed to 4.8% from 5.3%, and 5.0% expected. This is the ninth consecutive report where an indicator has been in line or weaker than expected, but we see a different market reaction.

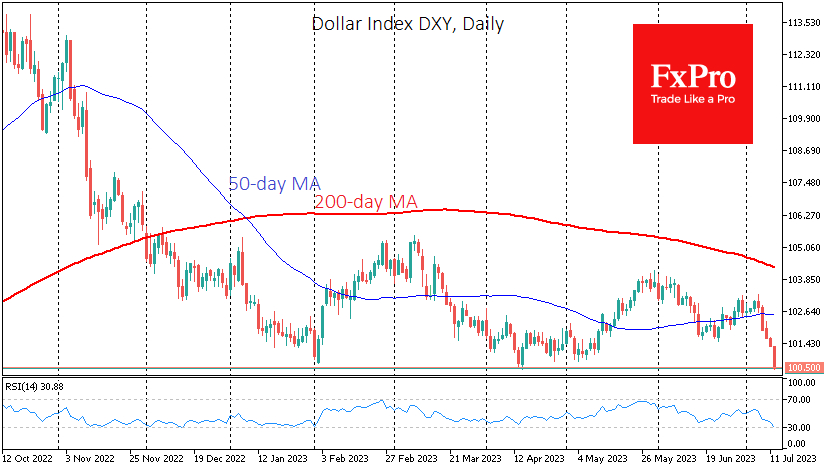

This time the markets are confident, risk appetite is rising, and the dollar is falling as the latest report has fuelled speculation that the Fed will not need to stick to its plan of two rate hikes this year or will allow for a quicker reversal to policy easing next year.

Traders' and investors' attention should now turn to the Federal Reserve's assessment of the latest data. In addition to the speeches by Barkin, Kashkari and Bostic, the Fed's Beige Book will be released today, which will be used as the basis for the Fed's observations at the July meeting.

While the Fed is often wrong in its forecasts, it is still the Fed that has the final say on interest rate decisions. Despite the constant inflation surprises, FOMC members remain hawkish in their comments, regularly pointing out that the fight against inflation is not over.

After the latest inflation report, the dollar index was close to its lowest level since April 2022, losing more than 12% from its peak last September. This decline creates additional pro-inflationary pressure, unlikely to please the central bank.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Inflation Slows, but Fed Has the Last Word

Published 07/12/2023, 10:46 AM

Updated 03/21/2024, 07:45 AM

U.S. Inflation Slows, but Fed Has the Last Word

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.