It’s been a relatively quiet start to the trading week, with the bank holiday in the US and Canada on Monday taking some of the spark out of the markets but futures are pointing higher once again which could pave the way for more record highs.

Spanish Assets Under Pressure on Catalonia Independence Rumours

Once again, the Spanish IBEX is lagging behind its peers in Europe – down around 1% on the day – as speculation that Catalan leader Carles Puigdemont may be preparing to declare independence today continues to grow. The uncertainty is weighing heavily on risk appetite but it currently only appears to be directly impacting Spanish assets, with the euro showing little or no sign of being negatively affected.

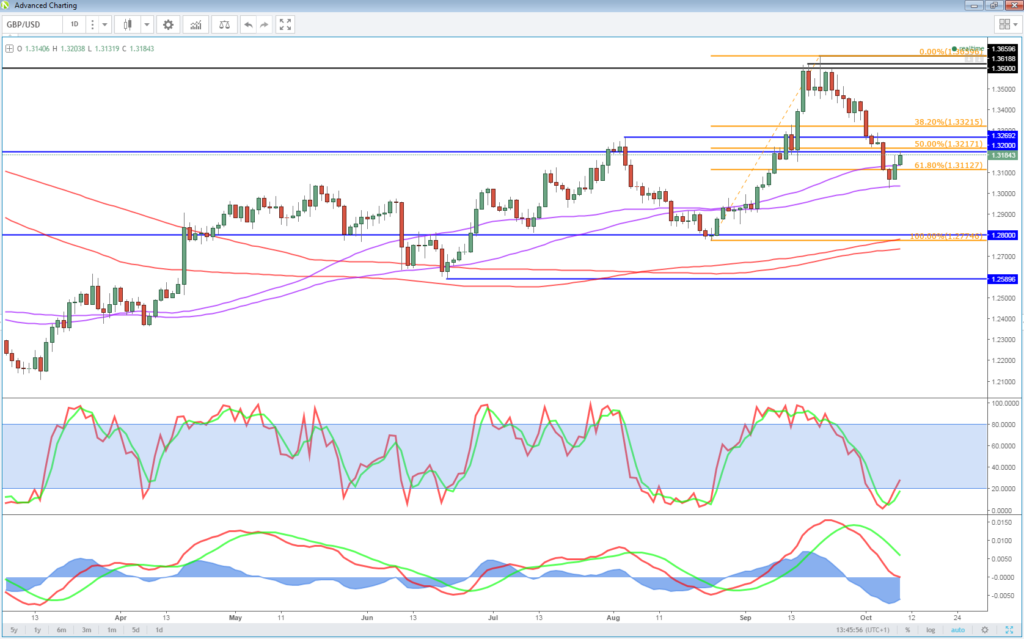

GBP Rebounds on Decent Economic Reports

The pound is rebounding against the dollar at the start of the week after having come within touching distance of 1.30 on Friday following the US jobs report. Decent retail sales data from BRC overnight and better than expected manufacturing production data this morning is helping to further support the pound although ultimately, both face significant headwinds in the coming months and years and sterling is strongly reliant on the Bank of England following through on a rate hike at these levels.

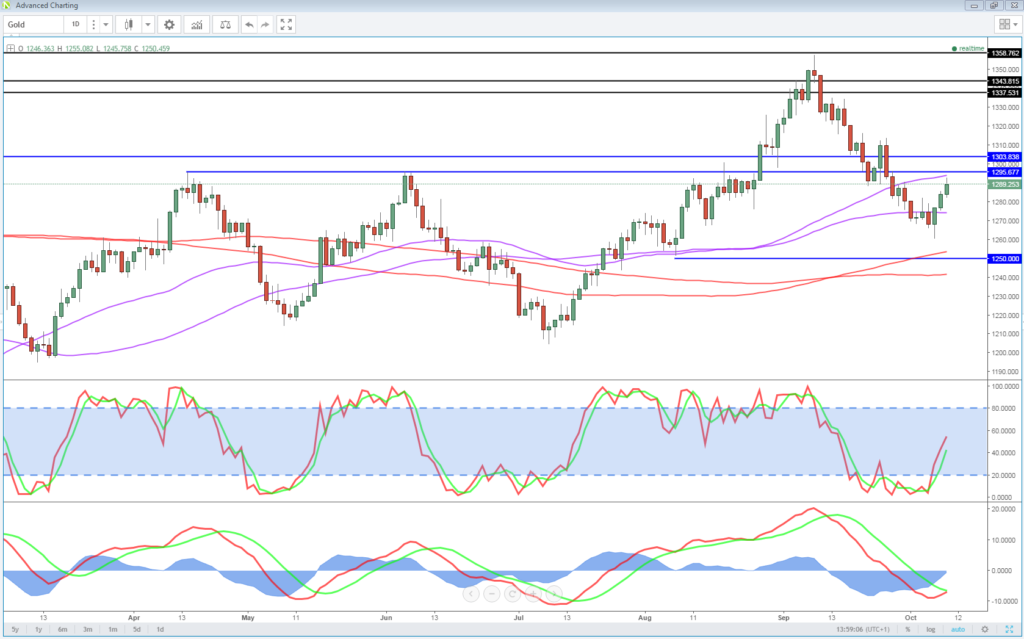

Gold Remains Well Supported Despite Falling 5% From Last Month’s Highs

The dollar’s losses are commodities gains today, with Gold, Silver and oil, among many others, enjoying some relief as the greenback pares recent gains. While Gold has fallen around 5% from its peak last month, it role as a safe haven means it remains relatively well supported in what continues to be a heightening political and geopolitical risk environment. The Catalonia referendum and what will follow is just another in a long list of downside risks for the EU while tensions between the US and North Korea may appear to have been but continue to bubble under the surface.

The calendar is looking a little light this week as far as economic data is concerned but we will get plenty of views from a range of central bankers in the coming days as well as the release of the minutes from the September FOMC meeting on Wednesday. Robert Kaplan and Neel Kashkari will both offer their views today, both of whom are voters on the FOMC for the remainder of this year.