U.S. economic growth in Q1 2019 positively surprised. Indeed, on the upside. The doubting Thomases were proven wrong. And the Socialist Party just won the snap elections in Spain. Is the left back in vogue in the Eurozone? But what does it all mean for the gold market?

U.S. GDP Surprises on the Upside

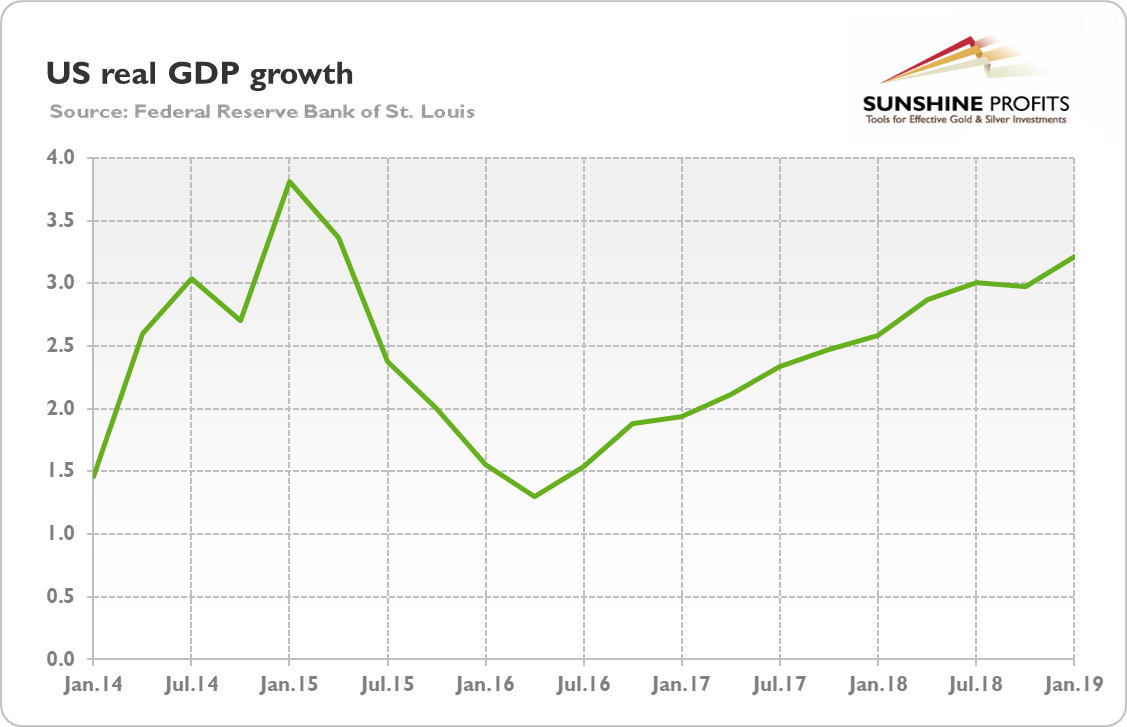

On Friday, the government said that U.S. GDP expanded at a 3.2 percent annual pace in the first three months of 2019. What is important is that the number significantly surpassed the forecasts. For example, the economists polled by MarketWatch had expected a 2.3 percent increase. The fears of the slowdown were overblown, as we have been warning for a long time.

Actually, the American economy accelerated in the first three months of 2019, as the economy grew at a 2.2 percent in Q4 2018, as one can see in the chart below.

Chart 1: U..S real GDP growth from Q1 2014 to Q1 2019.

We acknowledge that some transitory factors (such as inventories or government spending) supported GDP in Q1 2019 - so we could see some reversal in the future - but the report was nevertheless decent.

What does it mean for the gold market? Well, stronger U.S. economy than previously expected is not good news for the yellow market. The solid report could ease the fears about the recession and encourage more risk-taking, at the expense of safe havens such as gold. Moreover, although the report does not have to change significantly the Fed's stance, it should end the chatter about the interest rate cut. More hawkish expectations of the future path of the interest rates should be negative for the gold prices. Last but not least, the strong economy is a good sign for President Donald Trump in the 2020 presidential elections. A lot can, of course, change until next year, but if the U.S. economy stays on the solid track, it will be difficult to beat Trump. It's still very early to conclude, but gold would probably prefer a change of guard rather than the status quo.

Socialists Win Spain

The Socialists won parliamentary elections in Spain. They won 123 seats, up from 85 in 2016. This means that the left is not dead in Europe (if somebody doubted it). However, the party needs 176 mandates for majority, so it needs to form a collation to govern. The far-left Podemos has only 43 seats, so the socialists will have to either make an alliance with the right or with the smaller, regional parties (like the Basque Nationalist or Esquerra Republicana, the Catalan separatist group).

Another important change is that the right-wing and populist Vox entered the parliament for the first time. It means that right-wing populism arrived to Spain. However, the party does not want to pull the country out of the EU or to abandon the euro. Spanish citizens are very enthusiastic about the common bloc. We could see more populism in the upcoming elections to the European Parliament.

The biggest loser of the election is the conservative People's Party, which lost about half its seats and will have just 66 deputies in the new parliament. The Spanish voters turned out to not be very grateful, given the fact that the PP enacted crucial reforms in a response to the economic crisis that extracted the country from the disarray. Now, the Spanish economy is growing faster than the eurozone's average. But reforms are not very popular and cannot compete with the social spending. Pedro Sanchez - the leader of the Socialist Party, who headed the minority government for 10 months, but was ultimately forced to call a snap election - increased the minimum wage and pensions. And he promised even more of social expenditures financed by higher taxes on corporations and the wealthy.

However, the bond markets reacted positively to the results. The spread between yields on German and Spanish 10-year debt narrowed by three basis points yesterday. This is probably because Sanchez is committed to spend within the fiscal limits set by the European Union. In 2018, Spain's fiscal deficit declined to 2.5 percent, and the Socialists have pledged to keep whittling it down. Another issue is that the markets may hope that Sanchez will form the first stable government in a few years. The results of the Spanish elections can, thus, support the euro against the U.S. dollar. Gold would benefit, then, as well. However, the results were generally expected, so the short-term impact on the gold market should be minimal, if any.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.