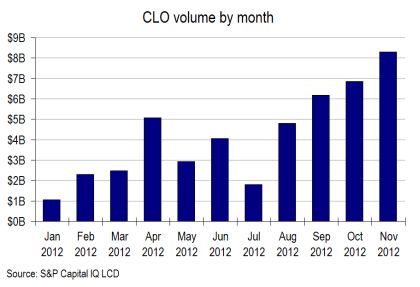

CLO issuance in the US hit a new post-2007 record in November. Driven by demand for yield and low default rates among US corporates, investor base for CLO paper has been growing. Institutions are realizing that this asset class actually performed relatively well during the financial crisis with no material losses to AAA tranches.

The volume of CLO deals is still significantly below the 2006-2007 period and the AAA tranches in current deals have 40% subordination rather than some 25% in the boom years. But the market is much healthier. There are no monoline insurers, "negative basis," or "CP conduits" involved.

LCD: For the first 11 months of 2012, the volume of new, regular-way arbitrage deals stands at $45.8 billion. Add to that what managers expect will be another $5-6 billion of December business, and 2012 volume will likely climb to about $51-52 billion, versus $12.5 billion in 2011. That’s a giant leap for a market that produced just $15 billion of new vehicles during the extremely lean years of 2008-2010.

CLO AAA tranches price in the LIBOR+130-140 range, while many A/BBB corporate bonds yield somewhere is in the same neighborhood as well. Let's see, AAA senior secured diversified pool of corporate loans or BBB single name unsecured bond - both yielding roughly the same. It's no wonder there is significant demand for senior CLO tranches.

But who is buying the lower rated tranches? Given the performance of the US corporate sector over the cycle, new buyers (various forms of credit funds) are coming in.

LCD: In today’s yield-starved environment, the low-to-mid-teens equity [the lowest (unrated) tranche of CLOs] returns suggested by CLO models play well, particularly in light of (1) how resilient vintage deals were across the cycle and (2) the fact that distributions are consistent and predictable. Participants note that business-development corporations have been major buyers of CLO equity.

Prospect Capital Corp. (PSEC), for instance, lists $215 million of CLO residual interest, at cost, on June 30, 2012 in its latest 10-K filing, up from none a year earlier. What’s more, several new CLO equity funds cropped up or expanded this year. Examples include Stone Point and Pearl Diver. In addition, sources say, Crystal Fund of London is raising a new CLO fund called BK Opportunities Fund that will invest in junior debt and equity tranches of U.S. CLOs.

GSO in June raised $125 million for its Carador Income Fund, a vehicle listed on the London Stock Exchange that invests in CLO liabilities and equity. Finally, Priority Senior Secured Income Management – an adviser jointly owned by Prospect Capital Management and a subsidiary of Behringer Harvard – filed a shelf registration at the SEC for the Priority Senior Secured Income Fund. If raised, the fund will invest proceeds in CLO equity and junior obligations.

As banks become cautious running certain corporate exposure due to new regulations, this old form of "shadow banking" is stepping up once again.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US CLO Market Booming

Published 12/05/2012, 04:01 AM

Updated 07/09/2023, 06:31 AM

US CLO Market Booming

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.