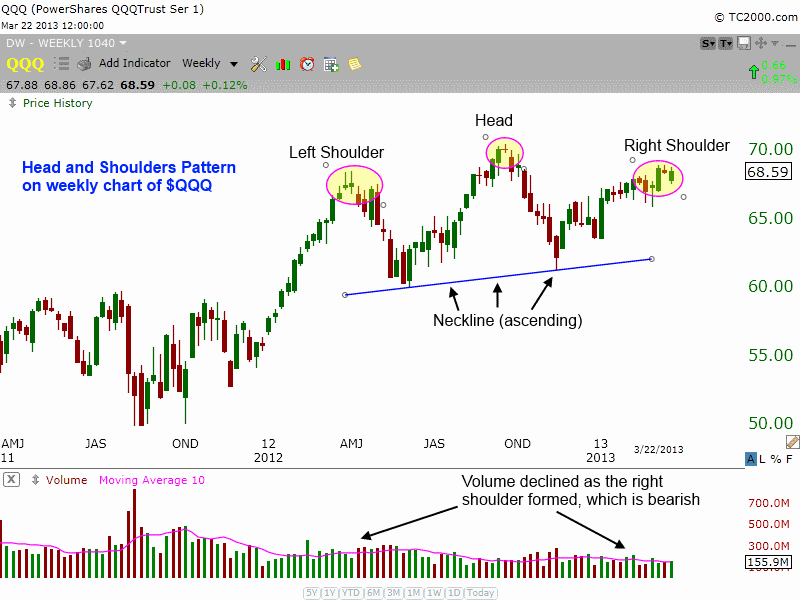

One ETF we have been watching closely for potential swing trade entry in recent weeks is PowerShares QQQ Trust (QQQ), a popular ETF proxy for the tech-heavy Nasdaq 100 Index. Specifically, we have been monitoring a bearish head and shoulders pattern that has been developing on the weekly chart interval of QQQ.

If this bearish chart pattern starts following through to the downside, it may create a low-risk entry point for short selling QQQ (or buying a short ETF such as ProShares Short QQQ (PSQ) or ProShares UltraShort QQQ (QID)).

In this article, we walk you through the details of this technical trade setup for QQQ, and present you with the most ideal scenario for actionable trade entry. For starters, check out the annotated weekly chart pattern of QQQ below:

When determining the validity of a head and shoulders pattern, there are a few factors we look for to determine whether or not this bearish pattern is likely to follow through to the downside.

One of the biggest technical considerations is the trend of the volume that accompanied the price. The best head and shoulders patterns will be marked by higher volume on the left shoulder and lighter volume on the right shoulder. Such a pattern indicates decreasing buying interest as the pattern progresses. As you can see by the 10-week moving average of volume (the pink line on the volume bars above), volume has indeed been declining during the formation of the right shoulder.

Another element we look for is whether the neckline is perfectly horizontal, ascending, or descending. The neckline on the QQQ chart above is ascending, which means a “higher low” was formed. This ascending neckline slightly decreases the odds of the head and shoulders following through by breaking below the neckline. Nevertheless, between the two technical elements of the volume trend and angle of the neckline, volume is considered a more significant factor in determining whether or not the price is likely to move lower after the right shoulder has formed.

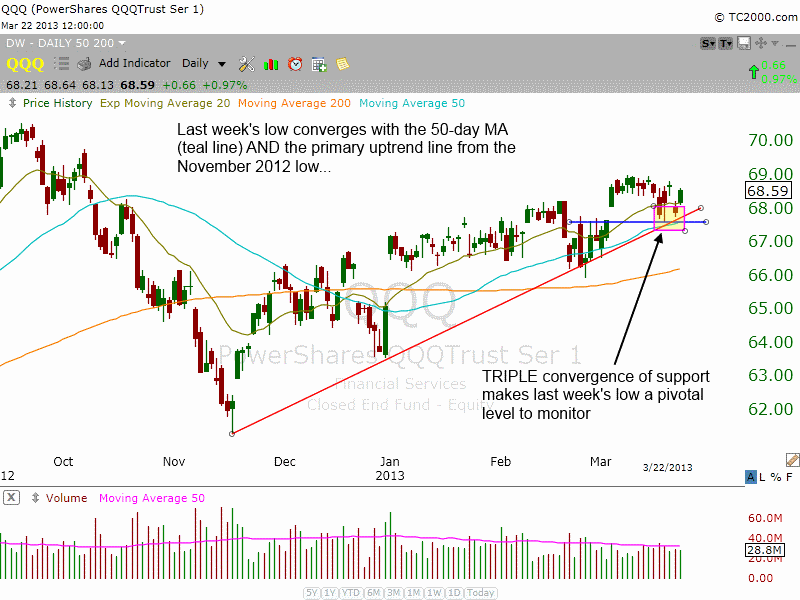

Since it’s always best to assess a potential swing trade setup on multiple chart time frames, let’s zoom into the rather interesting, shorter-term daily chart interval of QQQ:

Just as the “line in the sand” for price support of SPY is last week’s low, the same is true of QQQ, but even more so.

Notice how support of last week’s low in QQQ neatly converges with both the 50-day moving average (teal line) AND the intermediate-term uptrend line from the November 2012 low (red line). The more technical indicators that converge in one area to form price support, the more substantial and pivotal that support level becomes. As such, be sure to monitor the $67.60 area very closely in the coming days, as a convincing breakdown below that level could be the impetus that sends QQQ on its way down to testing the neckline of its head and shoulders pattern.

Despite the convincing head and shoulders pattern of QQQ, it is important to keep the following two things in mind:

First, due in no small part to recent weakness in heavily-weighted Apple Computer (AAPL), the Nasdaq has been a laggard throughout the multi-month rally in the broad market. Rather, the blue chip Dow Jones Industrial Average has been leading, and that index still remains very near its multi-year highs. In a fractured market with significant divergence between the major indices, clear follow-through in either direction usually does not come easily.

The second (and more important) point is that the head and shoulders pattern, like all technical chart patterns, obviously does NOT work 100% of the time. In fact, far from it. This means that blindly selling short QQQ (or buying an inversely correlated “short ETF”) at the current price level of QQQ is risky and not advisable.

Instead of entering this swing trade setup based purely on anticipation of the pattern working, our technical trading system mandates that we first wait for price confirmation that indicates momentum has shifted back in favor of the bears. At a minimum, we would NOT enter a short position unless/until QQQ breaks down below last week’s low, which we now know is a key level of price support. Jumping the gun by trying to get an “early” entry point is never advisable in swing trading.

Will the head and shoulders pattern in QQQ eventually follow-through to the downside? Drop us your thoughts in the comment box below.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Trading The Head And Shoulders Pattern Now In QQQ

Published 03/25/2013, 02:51 AM

Updated 07/09/2023, 06:31 AM

Trading The Head And Shoulders Pattern Now In QQQ

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Indeed, the Fed will try to hold things up, as they always do. However, natural forces of supply and demand eventually come into play to, at the very least, cause corrections.

Certainly not predicting the end of the bull market here; rather, just highlighting a potential actionable trade to take advantage of a near to intermediate-term correction.

Lets not forget "THE FED" !

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.