This posting features a comprehensive review of the large cap ETF sector. In this category there aren’t many more ETFs than just the 10 we’ve featured given the tsunami of ETF issuance. Further some major issues have been divided into value, growth and blended segments. Nevertheless, to simplify matters for investors, and to be consistent with previous practices, we’re still just highlighting what we feel are reasonable top 10 choices. These may be repetitive but we have also featured the leading “value” ETF, an ETF linked to a popular “enhanced” index and various “all-cap” ETFs.

Remember being the first to market in any sector is most important to issuers and this is much more important in major market sector ETFs like large-caps. In fact, according to Lipper’s Jeff Tjornehoj as of 2012 nearly half of existing ETF assets are found in just two dozen funds with over 1,000 ETFs now issued. The following top 10 issues hold an outsized percentage of these assets.

The issues chosen represent a broad cross section of domestic issues from a variety of sponsors. Most issues are seasoned being issued long ago with substantial assets under management and good liquidity. We’re not necessarily recommending one issue over another; rather we’re just trying to feature those issues that aren’t repetitive. If other choices are available these are mentioned where applicable.

Within this sector we have combined choices for growth, value and a blend of these styles. There are occasional periods when value outperforms growth and vice versa; but, even over even intermediate periods they tend to achieve the same total return. Others may disagree about this conclusion citing studies demonstrating superior returns of one to the other. However, most of these experiences are transitory and are driven by various economic conditions including monetary policies and the overall market environment. But, some investors wish to pursue what they believe is a more conservative value approach while others prefer growth both choices are understandable. Again, you are free to choose what suits your own style and objectives best.

For those wishing to hedge or speculate ProShares and DirexionShares offer inverse short and leveraged long/short issues.

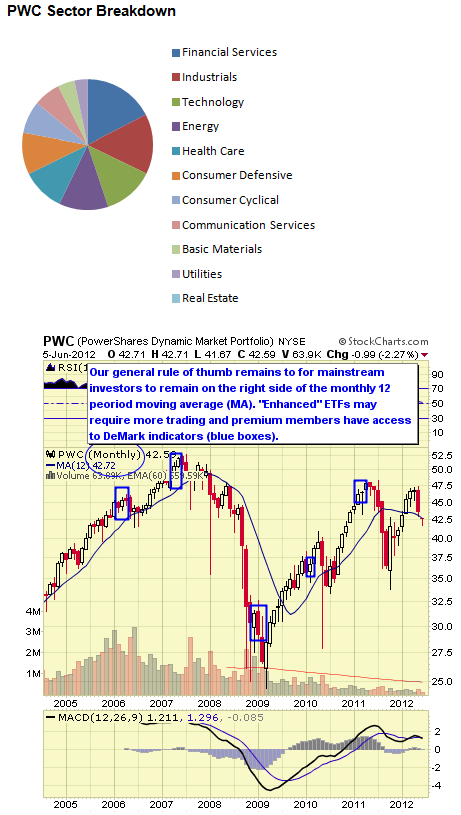

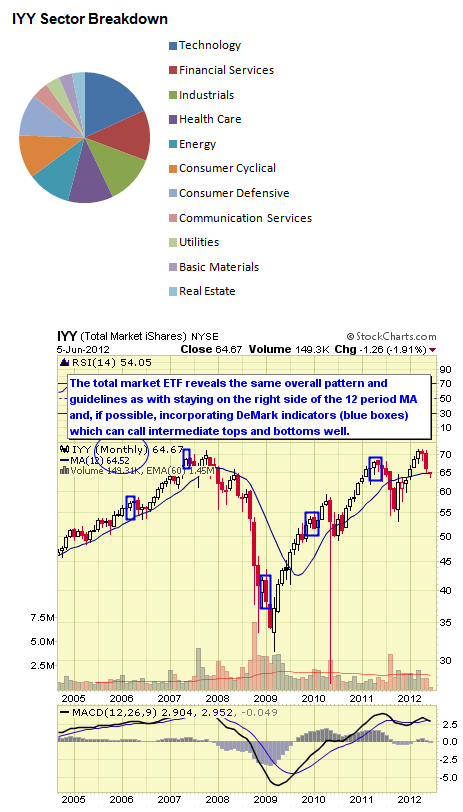

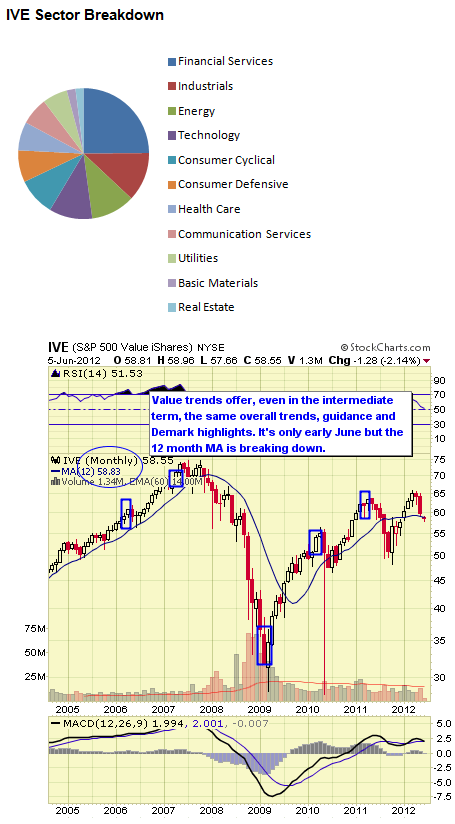

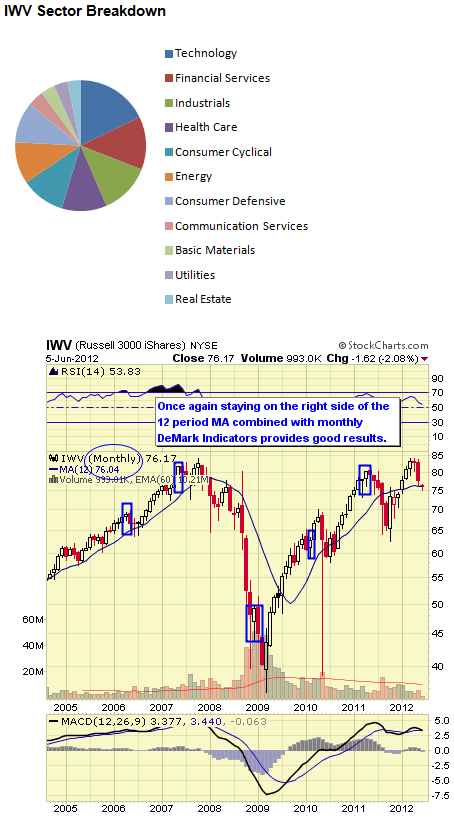

We feature a technical view of conditions from monthly chart views. Simplistically, we recommend longer-term investors stay on the right side of the 12 month simple moving average. When prices are above the moving average, stay long, and when below remain in cash or short. Some more interested in a fundamental approach may not care so much about technical issues preferring instead to buy when prices are perceived as low and sell for other reasons when high; but, this is not our approach. Premium members to the ETF Digest receive added signals when markets become extended such as DeMark triggers to exit overbought/oversold conditions.

For traders and investors wishing to hedge, leveraged and inverse issues are available to utilize from ProShares and Direxion and where available these are noted.![]()

PWC follows the Dynamic Market Intellidex Index which is and “enhanced” index comprised of U.S. stocks from each sector identified as having the greatest capital appreciation potential pursuant to a proprietary Amex Intellidex quantitative methodology. These characteristics include lower price to book, higher dividends and lower PE ratios among other considerations. The fund was launched in May 2003. The expense ratio is 0.59%. AUM equal $116M and average daily trading volume less than 8K shares. As of June 2012 the annual dividend yield was 0.95% and YTD return 2.66%. The 1 YR return was -8.18%.

Remember enhanced indexes can substantially outperform on the upside but underperform on the downside. PWC has been around for quite some time and has been a good performer overall in this regard.

Data as of May 2012

PWC Top Ten Holdings and Weightings

· Marathon Petroleum Corp (MPC): 4.43%

· Exxon Mobil Corporation (XOM): 4.35%

· Altria Group Inc. (MO): 3.47%

· CVS Caremark Corp (CVS): 3.43%

· Apple, Inc. (AAPL): 3.11%

· CF Industries Holdings Inc (CF): 2.86%

· Alliance Data Systems Corporation (ADS): 2.80%

· MasterCard Incorporated Class A (MA): 2.74%

· Visa, Inc. (V): 2.72%

· Delta Air Lines Inc (DAL): 2.68%

![]()

IYY follows the Dow Jones U.S. Index which measures the performance of the U.S. equity broad markets making it an All Cap Index. The fund was launched in June 2000. The expense ratio is 0.20%. AUM equal $581M and average daily trading volume is 61K shares.

As of early June 2012 the annual dividend yield is 1.41% and YTD return 1.92%. The 1 YR return was -1.40%.

Data as of May 2012

IYY Top Ten Holdings and Weightings

· Apple, Inc. (AAPL): 3.69%

· Exxon Mobil Corporation (XOM): 2.82%

· Microsoft Corporation (MSFT): 1.63%

· International Business Machines Corp (IBM): 1.55%

· Chevron Corp (CVX): 1.45%

· General Electric Co (GE): 1.41%

· AT&T Inc (T): 1.33%

· Johnson & Johnson (JNJ): 1.21%

· Pfizer Inc (PFE): 1.20%

· Procter & Gamble Co (PG): 1.19%

![]()

IVE follows the S&P 500/Citigroup Value Index which carves out those securities with value characteristics from the S&P 500 index. The fund was launched in May 2000. The expense ratio is .0.19%. AUM equals $3.8B and average daily trading volume exceeds 437K shares. As of June 2012 the annual dividend yield is 1.79% and YTD return 0.38%.

The 1 YR return was -3.90%. IVE trades commission free at Fidelity and TD Ameritrade.

Data as of May 2012

IVE Top Ten Holdings and Weightings

· General Electric Co (GE): 3.60%

· AT&T Inc (T): 3.39%

· Wells Fargo & Co (WFC): 3.06%

· Pfizer Inc (PFE): 3.00%

· JPMorgan Chase & Co (JPM): 2.85%

· Exxon Mobil Corporation (XOM): 2.55%

· Berkshire Hathaway Inc Class B (BRK.B): 2.46%

· Cisco Systems Inc (CSCO): 1.89%

· Microsoft Corporation (MSFT): 1.79%

· Chevron Corp (CVX): 1.68%

![]()

IWV follows the Russell 3000 Index which is capitalization-weighted and consists of the 3000 largest companies domiciled in the U.S. and its territories. The fund was launched in May 2000. The expense ratio is 0.21%. AUM equal $3.1B and average daily trading volume is 217K shares. As of June 2012 the annual dividend yield is 1.39% and YTD return is 1.93%.

The 1YR return was -1.65%. IWV trades commission free at Fidelity and TD Ameritrade.

Data as of May 2012

IWV Top Ten Holdings and Weightings

· Apple, Inc. (AAPL): 3.47%

· Exxon Mobil Corporation (XOM): 2.73%

· International Business Machines Corp (IBM): 1.61%

· Microsoft Corporation (MSFT): 1.53%

· Chevron Corp (CVX): 1.38%

· General Electric Co (GE): 1.33%

· AT&T Inc (T): 1.25%

· Pfizer Inc (PFE): 1.16%

· Johnson & Johnson (JNJ): 1.15%

· Procter & Gamble Co (PG): 1.14%

![]()

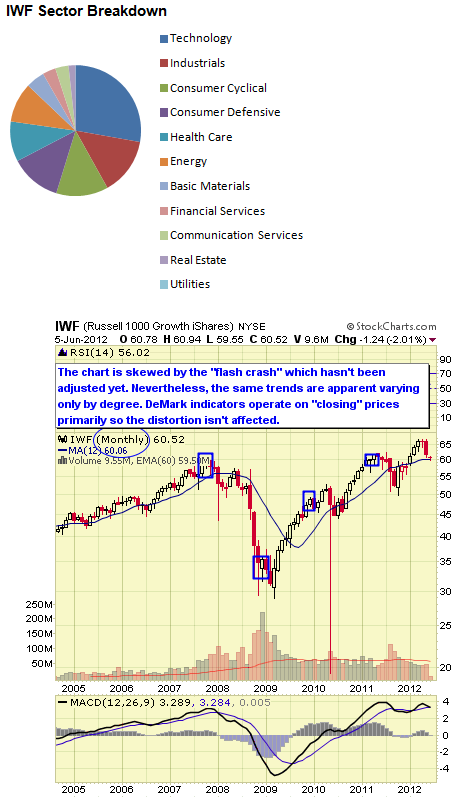

IWF follows the top 1000 growth stocks within the Russell 3000 Index. The fund was launched in May 2000. The expense ratio is 0.20%. AUM equal $15B with average daily trading volume 2.2M shares. As of June 2012 the annual dividend yield was 1.03% and YTD return 4.19%. The 1 YR return was 1.80%. IWF trades commission free at TD Ameritrade and Fidelity.

Note this is a “growth” oriented index structure and the holdings very much reflect this.

Data as of May 2012

IWF Top Ten Holdings and Weightings

· Apple, Inc. (AAPL): 7.38%

· Exxon Mobil Corporation (XOM): 4.29%

· International Business Machines Corp (IBM): 3.43%

· Microsoft Corporation (MSFT): 3.24%

· Google, Inc. Class A (GOOG): 2.08%

· Coca-Cola Co (KO): 2.06%

· Philip Morris International, Inc. (PM): 1.97%

· Oracle Corporation (ORCL): 1.54%

· Qualcomm, Inc. (QCOM): 1.46%

· PepsiCo Inc (PEP): 1.42%

![]()

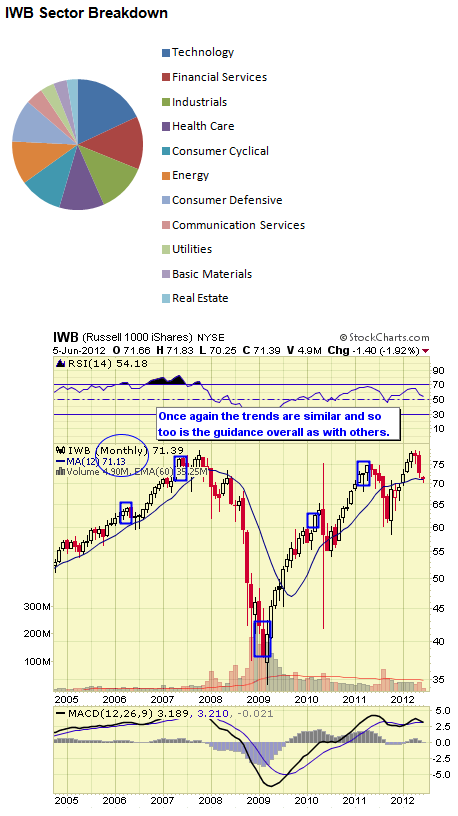

IWB tracks the largest 1000 stocks within the Russell Index. The fund was launched in May 2000. The expense ratio is 0.15%. AUM equals $6.6B and daily trading volume is roughly 1.1M shares. As of June 2012 the annual dividend yield is 1.48% and YTD return 2.09%.

The 1 YR return was -1.11%. IWB trades commission free at TD Ameritrade and Fidelity.

Note: This is a Large Cap index clearly.

Data as of May 2012

IWB Top Ten Holdings and Weightings

· Apple, Inc. (AAPL): 3.76%

· Exxon Mobil Corporation (XOM): 2.96%

· International Business Machines Corp (IBM): 1.75%

· Microsoft Corporation (MSFT): 1.66%

· Chevron Corp (CVX): 1.49%

· General Electric Co (GE): 1.45%

· AT&T Inc (T): 1.36%

· Pfizer Inc (PFE): 1.26%

· Johnson & Johnson (JNJ): 1.24%

· Procter & Gamble Co (PG): 1.24%

![]()

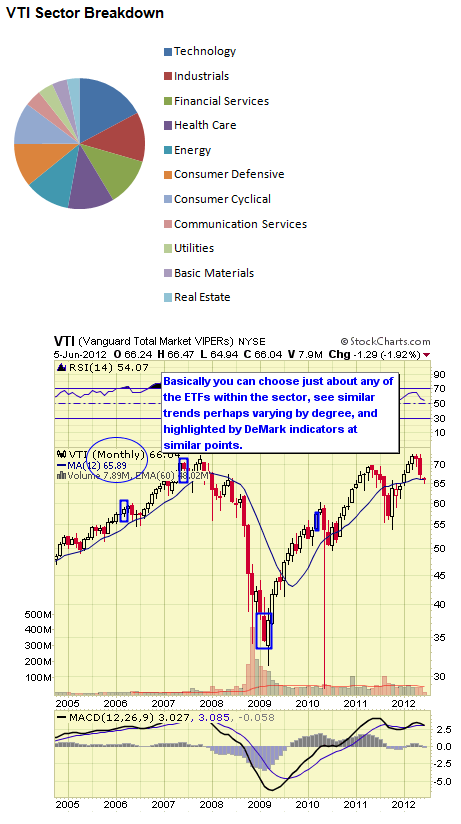

VTI tracks the MSCI U.S. Broad Market Index. The index represents 99.5% of the total market capitalization of the U.S. common stocks traded on the major markets. The fund was launched in May 2001. The expense ratio is only 0.06%. AUM equal $19B and average daily trading volume exceeds 1.8M shares. As of June 2012 the annual dividend yield is 1.92% and YTD return 2.36%.

The 1 YR return was -1.04%. VTI trades commission free at TD Ameritrade and Vanguard.

Data as of May 2012

VTI Top Ten Holdings and Weightings

· Exxon Mobil Corporation (XOM): 2.95%

· Apple, Inc. (AAPL): 2.68%

· International Business Machines Corp (IBM): 1.57%

· Chevron Corp (CVX): 1.52%

· Microsoft Corporation (MSFT): 1.40%

· General Electric Co (GE): 1.36%

· Procter & Gamble Co (PG): 1.31%

· Johnson & Johnson (JNJ): 1.28%

· AT&T Inc (T): 1.28%

· Pfizer Inc (PFE): 1.21%

![]()

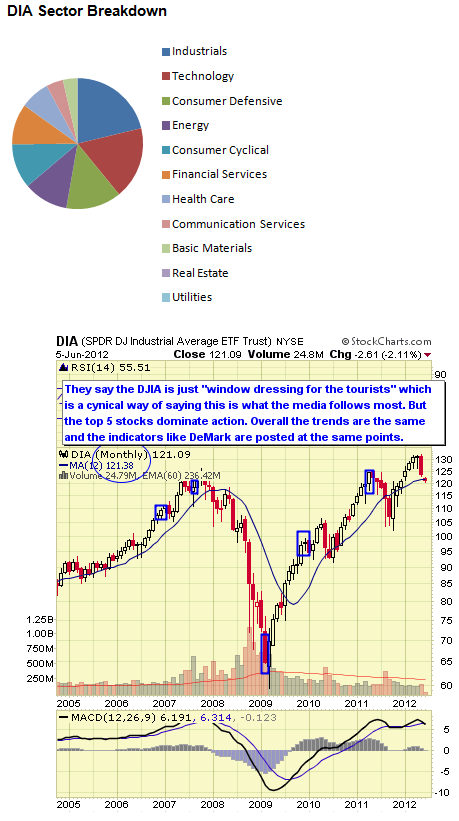

DIA follows the popular Dow Jones Industrial Average Index of 30 stocks which is a “price-weighted” Index meaning the highest priced stocks carry more weight which you can see in the top holdings below. The fund was launched in January 1998. The expense ratio is 0.16%. AUM equal $10B and average daily trading volume is 6.4M shares.

As of June 2012 the annual dividend yield is 1.60% and YTD return -0.75%. The 1 YR return was -0.32%.

Data as of May 2012

DIA Top Ten Holdings and Weightings

· International Business Machines Corp (IBM): 11.85%

· Chevron Corp (CVX): 6.10%

· Caterpillar Inc (CAT): 5.88%

· McDonald's Corporation (MCD): 5.58%

· 3M Co (MMM): 5.11%

· Exxon Mobil Corporation (XOM): 4.94%

· United Technologies Corp (UTX): 4.67%

· Boeing Co (BA): 4.39%

· Coca-Cola Co (KO): 4.37%

· Johnson & Johnson (JNJ): 3.72%

![]()

RSP also follows the S&P 500 Index but breaks the index up into equal weights vs weighted like SPY and IVV. Generally, we prefer using RSP for some of our portfolios when long given upside returns have been marginally superior. RSP was launched in April 2003. The expense ratio is 0.40%. AUM equal $2.6B and average daily trading volume is 696KM shares.

As June 2012 the annual dividend yield is 1.50% and YTD return 1.71%. The 1 YR return was -3.21%.

Data as of May 2012

RSP Top Ten Holdings and Weightings

· Expedia, Inc. (EXPE): 0.27%

· Watson Pharmaceuticals Inc. (WPI): 0.25%

· Amazon.com Inc (AMZN): 0.25%

· Sunoco, Inc. (SUN): 0.24%

· TripAdvisor Inc (TRIP): 0.24%

· American International Group Inc (AIG): 0.24%

· Edwards Lifesciences Corporation (EW): 0.24%

· Red Hat, Inc. (RHT): 0.23%

· Priceline.com, Inc. (PCLN): 0.23%

· Family Dollar Stores, Inc. (FDO): 0.23%

![]()

SPY tracks the S&P 500 Index. It holds the distinction of being the original ETF created by Nate Most for the AMEX in January 1993. (Nate passed away at the age of 90 in 2004 a few months after we had a wonderful lunch with him.) The expense ratio is only 0.09%. AUM equal $93B and average daily trading volume is over 160M shares.

As of June 2012 the annual dividend yield is 1.58% and YTD return 2.84%. The 1 YR return was 1.67%.

Data as of May 2012

SPY Top Ten Holdings and Weightings

· Apple, Inc. (AAPL): 4.31%

· Exxon Mobil Corporation (XOM): 3.21%

· International Business Machines Corp (IBM): 1.90%

· Microsoft Corporation (MSFT): 1.89%

· Chevron Corp (CVX): 1.67%

· General Electric Co (GE): 1.64%

· AT&T Inc (T): 1.54%

· Johnson & Johnson (JNJ): 1.41%

· Wells Fargo & Co (WFC): 1.39%

· Procter & Gamble Co (PG): 1.39%

Rankings Explained

We rank the top 10 ETF by our proprietary stars system as outlined below. However, given that we’re sorting these by both short and intermediate issues we have split the rankings as we move from one classification to another.

Strong established linked index

Excellent consistent performance and index tracking

Low fee structure

Strong portfolio suitability

Excellent liquidity![]()

Established linked index even if “enhanced”

Good performance or more volatile if “enhanced” index

Average to higher fee structure

Good portfolio suitability or more active management if “enhanced” index

Decent liquidity![]()

Enhanced or seasoned index

Less consistent performance and more volatile

Fees higher than average

Portfolio suitability would need more active trading

Average to below average liquidity![]()

Index is new

Issue is new and needs seasoning

Fees are high

Portfolio suitability also needs seasoning

Liquidity below average

The above list of ETFs combined contains most of the AUM (Assets under Management) in the domestic U.S. ETF space. Add in a half dozen or so overseas sectors (EFA, EEM, VWO and so forth) and you’ll quickly get to half the overall AUM in the ETF space. There isn’t much to parse in this regard.

It’s also important to remember that ETF sponsors have their own competitive business interests when issuing products which may not necessarily align with your investment needs. New ETFs from highly regarded and substantial new providers are also being issued. These may include Charles Schwab’s ETFs and Scottrade’s Focus Shares which both are issuing new ETFs with low expense ratios and commission free trading at their respective firms. These may also become popular as they become seasoned.

Disclosure: Author has no current positions in any of the featured ETFs.

Source for data is from ETF sponsors and various ETF data providers.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Top 10 U.S. Large And All Cap Sector ETFs

Published 06/10/2012, 11:56 PM

Updated 05/14/2017, 06:45 AM

Top 10 U.S. Large And All Cap Sector ETFs

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.