There’s a quiet shift happening in closed-end funds (CEFs)—and it’s primed to give those who buy now some very nice upside in 2023.

And that’s in addition to the rich 7%+ dividends CEFs hand us.

That trend is a shift toward share buybacks, which you likely know about from the stock world. Buybacks work similarly with CEFs, but with an extra punch: they keep CEFs’ discounts to net asset value (NAV) from getting too broad—and they can even narrow those discounts, slingshotting the share price higher as they do.

In other words, by helping close CEFs’ discounts, managers have some control over the fund’s market price in a pullback, and they can amplify its gains when the market turns higher.

BlackRock’s Aggressive Buyback Move a Positive Sign for ’23

As I write this, BlackRock (NYSE:BLK) is leading the way on the buyback front, snapping up over $100 million in shares across 15 of its CEFs in the last quarter of 2022.

When a company with the size and expertise of BlackRock makes a move like this, it pays to take notice because there’s only one reason why they would do it (two, actually):

- They see overlooked value in the funds they’re buying back.

- They see an upside in the CEF market as a whole.

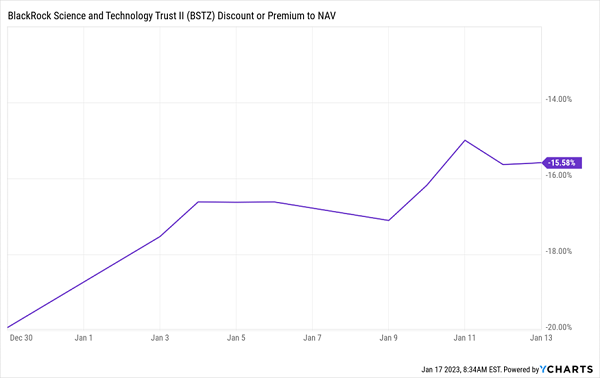

Already, we can see the effect of these moves: check out the discount on the BlackRock Science and Technology Trust II (NYSE:BSTZ), a payer of an outsized 13.5% dividend, this year.

Buybacks Shrink BSTZ’s Discount

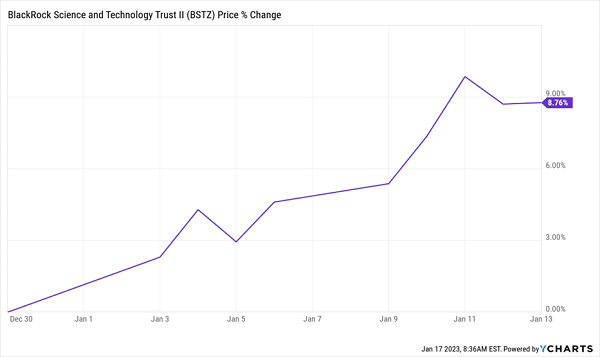

That shrinking discount grabbed investors’ attention, prompting them to buy in and drive a quick 9% gain in the fund’s market price, as of this writing:

Driving a Fast Rise in Its Share Price

How CEF Buybacks Work

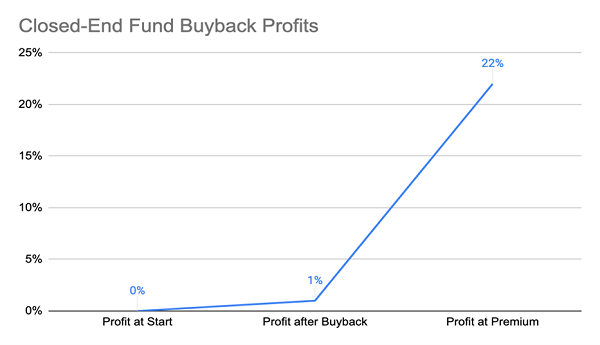

When a fund buys back shares from investors, it can create value when those shares trade at a discount.

To explain this, let’s use a quick example. Imagine a CEF that has $100 worth of shares in total, and each share trades at a dollar each and a 10% discount to NAV. Management realizes this and buys back shares, holding them until the fund returns to a premium—let’s say a 10% premium, for our example.

The potential profits can be significant indeed.

Just by buying the shares at a 10% discount, holding on to those shares, and waiting for the fund to go to a 10% premium, a CEF can earn strong profits without actually investing in the market.

Source: CEF Insider

Of course, this only makes sense when discounts are unusually wide, like in the past year. When funds trade at par, buybacks have little effect, and when a CEF trades at a premium, buybacks destroy shareholder value.

In the case of BSTZ, you can see why BlackRock is engaging in a buyback: the fund started 2022 at par and ended the year at over a 20% discount.

Buybacks on the Rise Across the CEF Space

CEF buybacks are also growing in size and frequency. BlackRock, for example, has authorized buybacks of up to 5% of outstanding shares in many of its CEFs, and managers from other firms have told me that aggressive buybacks are being set up throughout the CEF world.

If you are already invested in CEFs, you’re poised to benefit from this trend in 2023. If not, you still have time to get in. In the case of BSTZ, even if it resells those repurchased shares at par a year from now (a reasonable estimate, given that this is where the fund started in 2022), it would equate to a 20% gain in the market price. And investors who buy the fund now would see the same gain to go along with their 13.5% payouts.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."