by Adam Button

The third week of September keeps up with its negative seasonality as one of the worst weeks of the year amid surging fears of Fed taper and Evergrande. Equity indices are down nearly 2%, VIX hit 26 to show its fourth biggest increase of the year, while falling yields are helping metals over energy. JPY and CHF are the strongest currencies of the day (not the USD), while CAD and GBP are the weakest. The word on everyone's lips on the weekend was 'Evergrande' as the Chinese property giant stumbles towards a seemingly-inevitable bankruptcy. The EUR/USD short hit the stop, while the SPX short hit its final target. More ahead.

China's second-largest property developer remains in dire straights as the company's bonds trade at extremely distressed levels. There were weekend reports of offers to give investors property in exchange for debt and that employees were told to help fund the company or forfeit bonuses.

The company is undoubtedly in a death spiral. Even if it can find a way out of this, its brand is forever tarnished and that will make raising further funds impossible.

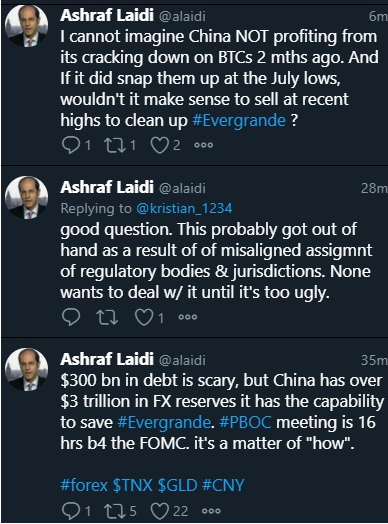

The question everyone is asking is whether this will be China's Lehman Brothers moment; a large firm failing and threatening to bring down the financial system.

That's the wrong question because there's ample evidence that Evergrande isn't the problem, but rather a symptom of a change in philosophy in Chinese leadership. There was a time in China's recent development it would never have let the problems get anywhere near as bad as they are. More importantly, it comes at the same time as cultural crackdowns, censorship, seemingly-targeted attacks on rich tycoons like Jack Ma and official talk of a fresh policy on 'common prosperity'.

So while some well-informed people have convincingly argued that Evergrande doesn't pose systemic risks alone, we fear that China is showing signs of a shift to a new paradigm; one where GDP growth isn't its north star. The inevitable conclusion is slower growth domestically and globally.

Of course, it's all still in flux but we note that all three of the most-read stories on Bloomberg this weekend were about Evergrande. We've been writing about Chinese risks for a month but they're finally now on top of the market's consciousness. Expect it to remain that way through year end.