One of investors’ biggest fears over the Fed’s monetary stimulus (QE3) is that it will cause runaway inflation. While there are reasons for believing this fear could come to pass in the years following the upcoming 120-year cycle bottom in late 2014, the evidence suggests that inflation is not a concern in the 1-2 years ahead.

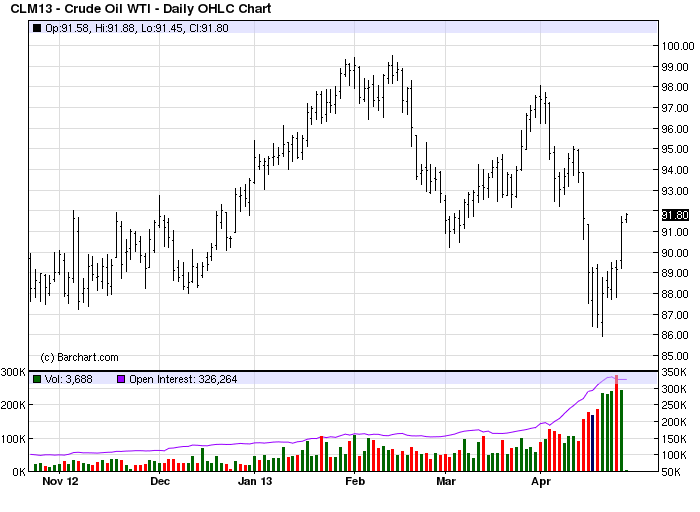

It’s remarkable just how quickly those fears over inflation getting out of hand can change into fears over deflation. Just in the last few weeks we’ve seen substantial declines in commodity prices, from corn to oil to gold, and economic forecasters have changed their tune from inflation to deflation. The reason for this is because the 120-year Kress cycle is in its final deflationary phase and is defeating the central banks’ strongest attempts at creating inflation.

Take for instance the featured editorial in the latest issue of Barron’s. Randall Forsyth’s column, entitled “A Deflationary Wave,” says it all. Forsyth described the recent commodities rout as being part of a “global deflationary wave” that has yet to run its course. While I agree with this statement from a longer-term (1-2 year) standpoint, the technical indicators suggest a bottom is nigh at hand for this mini-deflationary wave in the near term.

“The message seems to be,” writes Forsyth, “that there are limits to central banks’ ability to keep boosting commodities, which are barometers of the real economy. And the rocky performance of stocks doesn’t inspire confidence that they can keep the bull market running indefinitely.” Again, this statement may be true in the longer term, but the evidence strongly suggests the Fed’s efforts will prove sufficient to boost equities in the near term.

Besides providing the market with a much needed correction, another thing the commodities sell-off succeeded in doing was relieving the retail economy of some of the excesses from QE3. The recent drop in oil, food and base metals prices will, in the words of one economist, “give consumers more spending power and let central bankers keep at their game longer.” In other words, the mini-deflationary wave that Forsyth wrote about will actually prove beneficial for both consumers and investors as long as the Fed is going hard and heavy with its $85 billion-a-month asset purchases.

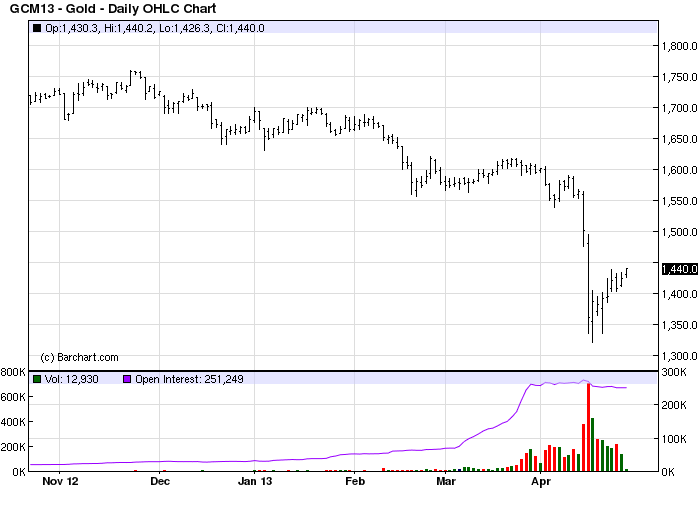

Gold

In the previous commentary we discussed the historical accuracy of investment bank Goldman Sachs when it comes to making commodity price predictions, particularly oil and gold. Goldman made a high profile bearish call on gold a few weeks ago, a prediction which proved to be spot on. On Tuesday, Goldman reversed its bearish gold stance in the short term. That’s potentially good news for the gold market, at least in the near term.

According to CNBC, the firm’s commodities research team said the decline in gold was “more rapid than it expected,” and it exited the trade with a potential gain of 10.4 percent, below its original target price of $1,450.

Goldman had previously forecast that gold would close out 2013 at $1,450 per ounce, then take a hit in 2014 with a predicted close of $1,270. Within days of that call, gold fell almost 16 percent to a low of $1,321 an ounce. As CNBC pointed out, “While the bailout of Cyprus did not send gold higher, reports that Cyprus would sell gold to cover its shortfall sent the metal tumbling, as traders bet other European countries might also sell gold to raise cash.”

Goldman said the surprisingly rapid decline was probably accelerated by breaks in “well-flagged technical support levels.” With the investment bank no longer on the short side of gold, the yellow metal has another reason for establishing a low in the coming days and weeks.

Momentum Strategies Report

The stock market recovery is nearly four years old, and investors wonder if it will continue. While many experts have made forecasts for the coming year, few have been as impressive as the Kress cycles in projecting the market’s year-ahead performance since the recovery began.

Each year I publish a forecast for the coming year based on a series of historical rhythms known within Kress cycle theory. Last year’s forecast was remarkably accurate in predicting the pivotal market turns, including the June 1 bottom in the S&P.

Here’s a sampling from last year’s forecast:

“The first five months of 2012 will likely be characterized by greater than average volatility....This will create a level of choppiness to coincide, if not exacerbate, the market’s underlying predisposition to volatility owing to the euro zone debt crisis…the May-June 2006 stock market slide could be repeated in May-June 2012. Our short-term trading discipline should allow us to navigate this volatility and there should be at least two worthwhile trading opportunities between [January] and the scheduled major weekly cycle around the start of June 2012. From there, the stock market should experience what amounts to the final bull market leg of the current 120-year cycle, which is scheduled to bottom in October 2014.

“Keeping in mind that like snowflakes, no two markets are exactly alike, the Kress cycle echo analysis for 2012 tells us to expect a final upswing for stocks in the second half of the year with the first half of 2012 likely to be more favorably to the bears, especially if events in Europe are allowed to get out of hand.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Helping Hand Of Deflation

Published 04/25/2013, 07:57 AM

Updated 07/09/2023, 06:31 AM

The Helping Hand Of Deflation

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.