One of my favorite data sets is the Commitment of Traders figures that the CFTC released each week. It shows us how various types of traders are positioned within various futures markets such as corn, Treasury’s, copper, and multiple currencies. A growing theme recently has been selling of certain major foreign currencies by the Large Trader category, which is often made up of hedge funds.

When studying COT data I primarily look at the Commercial Traders (‘smart money’) and the Large Traders (large hedge funds and institutions). The Small Trader category can be useful when at extreme reads but most of the time it just sits near the zero line so we don’t glean very much from these odd-lot traders.

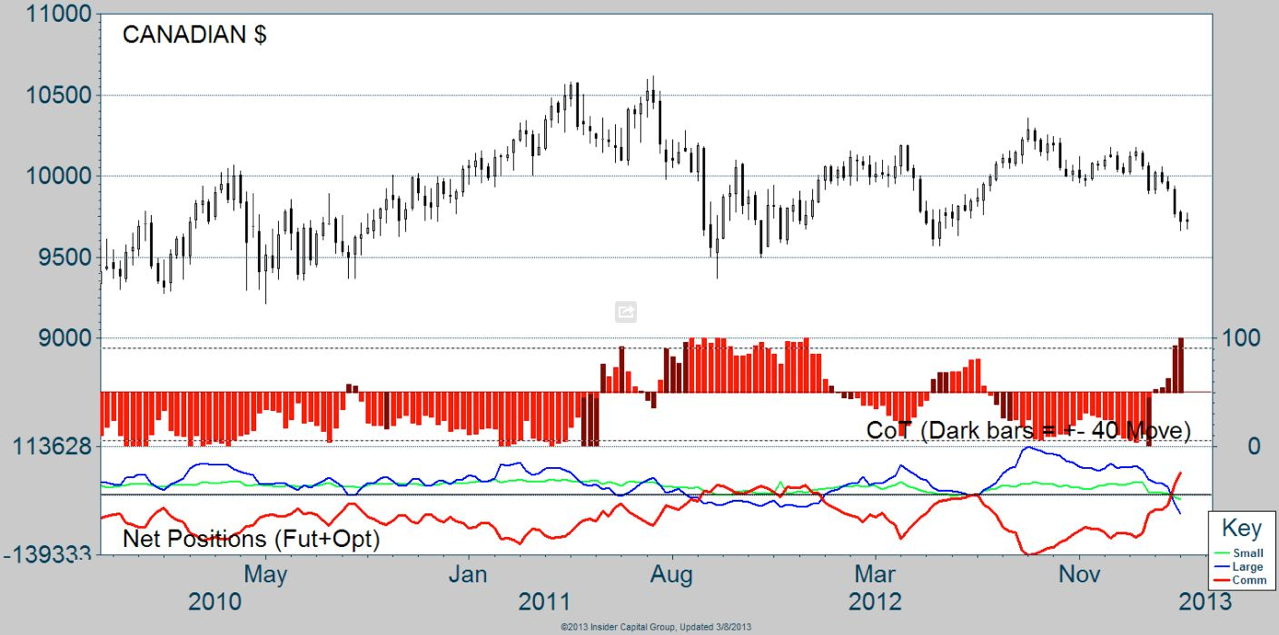

First up we have the Canadian dollar (FXC). Since mid-2009 Large Traders haven’t spent much time net-short the loonie and typically when they are we have seen the loonie eventually bottom out. Currently we can see that the Commercial Traders are the most net-long they have been in three years while hedge funds and Small Traders are historically extremely net-short.

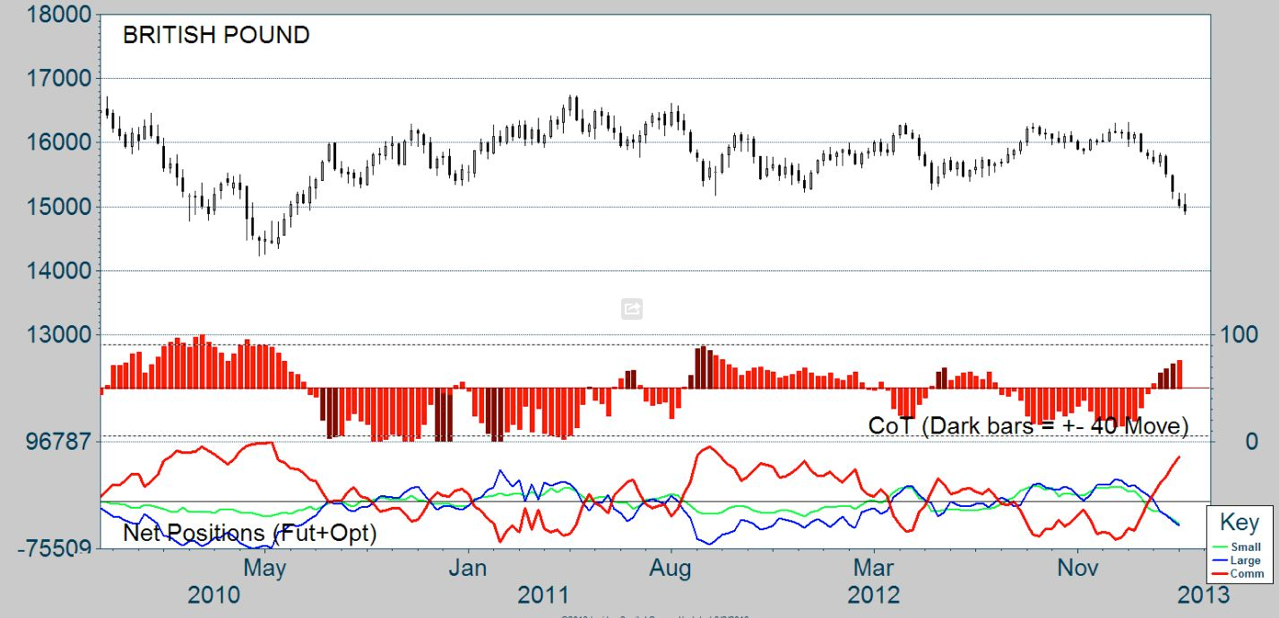

Second up is the British pound (FXB). Over the last few years it hasn’t been unusual to see Large Traders go back and forward between being net-long and short the Pound. What I find interesting is the magnitude that the Commercial Trades have taken a net-long position, almost to the previous high from mid-2011. Hedge funds are currently net short but not yet to the same degree as in 2011.

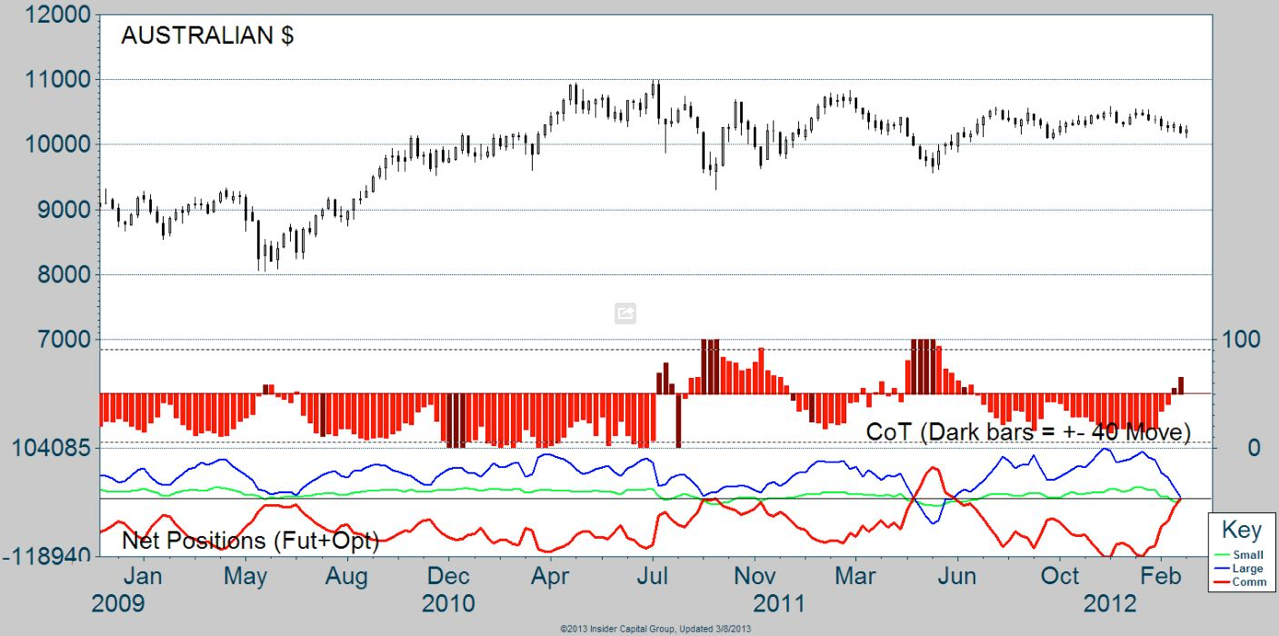

The Australian dollar (FXA) is another market that we typically see Large Traders stay net-long. And as of last week they still were but are very close to flipping shorting. We looked at the uptrend in the Australian equities last week, although a shift in the Aussie dollar could create some headwinds for equity bulls.

Risk On

So there they are -- the three currencies that large traders don’t seem to like much right now. However, typically when this rubber band is expanded, in some cases to the current level, we see it relax/consolidate or snap back. This could have been created as part of the risk-on nature the market has adapted. This would make sense considering two of the currencies hedge funds have befriended are the Mexican Peso and the ever-so-popular Japanese Yen. Going forward, if we begin to see strength in the Aussie dollar, the pound or the loonie, we may see a short-squeeze that sends the large traders for the exits.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer. Connect with Andrew on Google+.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Currencies Hedge Funds Hate

Published 03/12/2013, 10:56 AM

Updated 07/09/2023, 06:31 AM

The Currencies Hedge Funds Hate

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.