Investors enjoyed gains right after the release of the September Unemployment Rate which dropped to 7.8% vs. 8.1% previously. Most of these gains were reversed later in the day as research notes tempered the strong number. Analysts believe the number is a blip and that next month the rate will move back towards 8.0%. The actually nonfarm Payrolls change was at 114k vs. 113k previously with large revision. Looking ahead, Holiday in US for Columbus Day.

The Euro (EUR)

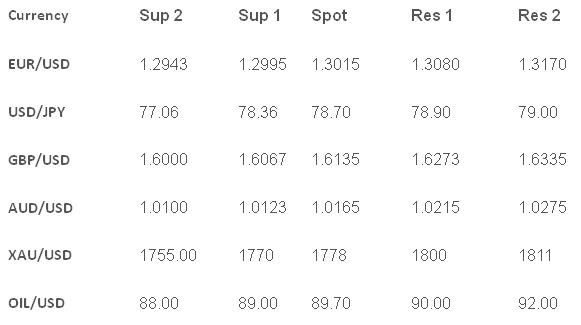

The EUR/USD was strong hitting day highs at 1.3070 after finding support sub 1.3000 on multiple occasions. EUR/JPY reacted sharply higher with the US jobs and we are well supported ahead of a big week from the Eurozone. Spain and Greece are still in the headlines with some concerns that Spain is in no rush to ask for a bailout.

The Sterling (GBP)

The GBP/USD ended lower on the day after failing to hold onto gains and the USD pushed back into the weekend. The positive risk appetite is letting the GBP/USD remain above 1.6000 but we are in no hurry to push to higher levels with sellers in control above 1.6200. Looking ahead, Eurogroup Meeting. Also August German Industrial Production forecast at -0.7% vs. 1.3% previously.

The Japanese Yen (JPY)

The USD/JPY was already on the front foot going into the NFP numbers and was unable to break past the Y79 resistance as we closed well supported near Y77.70. The outlook is for more Yen weakness as stocks and the Euro continue to recover. The BOJ held at 0.1% disappointing some of the yen Sellers.

Australian Dollar (AUD)

The AUD/USD is struggling to keep up with the Euro and we had another round of selling on Friday. The market hit highs at 1.0270 and after a few failed attempts reversed direction. The sellers took the pair all the way down to fresh lows under 1.0160. The bears are being fueled by increasing focus on the slowdown in China and RBA cutting rates and being more vocal on the AUD exchange rate. The bulls are supported by Australia’s AAA rating and higher yield.

Oil and Gold (XAU)

Gold fell sharply from the $1800 level after the better than expected US jobs dampened demand for the precious metal. Oil couldn’t hold on to the $90 level and we fell back with US stocks late on Friday night. The outlook for oil is mixed with Middle Eastern tensions being countered by slowing global demand.

Pairs To Watch

EUR/USD: Strong enough to push higher?

USD/JPY: US Jobs to help spark uptrend?

TECHNICAL COMMENTARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Surprise Drop In US Unemployment Rate

Published 10/08/2012, 07:58 AM

Updated 03/09/2019, 08:30 AM

Surprise Drop In US Unemployment Rate

U.S. Dollar Trading (USD)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.