With cash in hand and a goal of doubling gold output in the next five years, Japanese heavyweight Sumitomo is looking to acquire gold assets—and Viscount Mining Corp. (TO:VML) could be a prime target. In this article for The Gold Report, Resource Maven Gwen Preston explores the Viscount proposition, including the historic potential of its Cherry Creek land package and its potential to produce Carlin-type gold.

Sumitomo is on the hunt.

Fresh off spending $1 billion to boost its stake in the massive Morenci copper mine in Arizona from 15% to 28%, Sumitomo President Yoshiaki Nakazato has turned his attention to gold.

Nakazato wants to double Sumitomo's gold output by 2021. The major currently owns two gold mines—the Hishikari mine in Japan and the Pogo mine in Alaska—that together produce just under half a million ounces of gold annually. By buying existing mines and through exploration success, Nakazato wants to lift that to 1 million ounces.

The company has the cash to put this plan into action. The company closed out fiscal 2015 with $7.5 billion in the bank (its fiscal year end is March 31, almost a year ago), a marked contrast with the debt-burdened balance sheets of most North American mining majors.

Cash means Sumitomo can act now. And it likely will, in the knowledge that other miners will move to buy assets as soon as their balance sheets let them.

For the investor, it all suggests positioning in companies that are set up to be on the receiving end of a Sumitomo cheque.

It is impossible to know what the Japanese major will do, but it is possible to trace where its money is already going. And it turns out Sumitomo currently only has one joint venture with an exploration company.

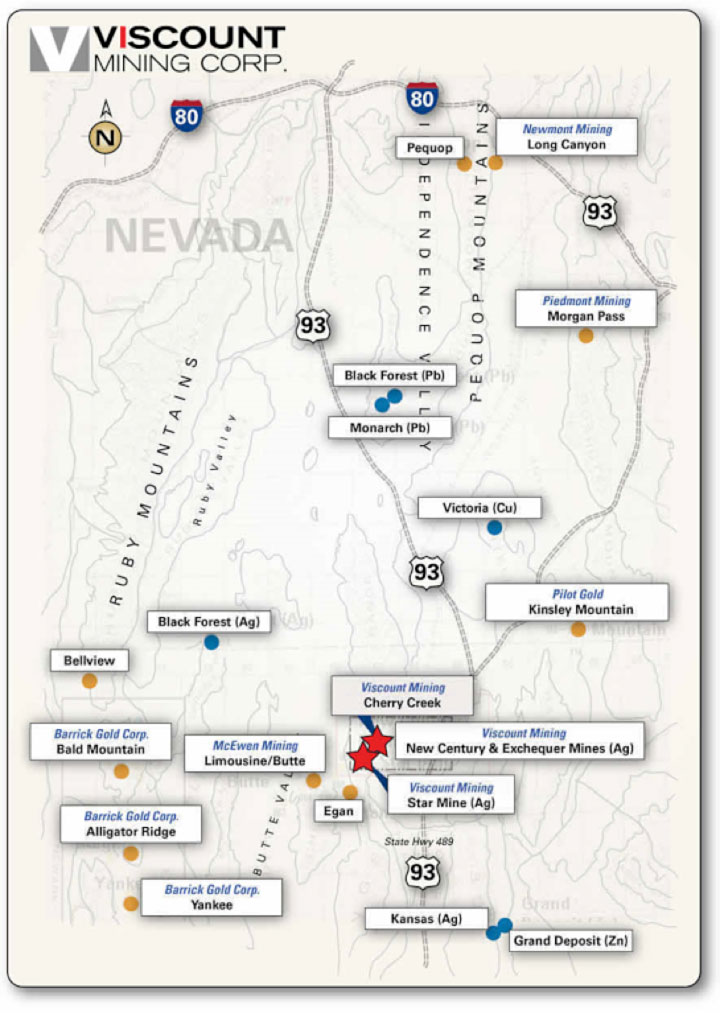

That company is Viscount Mining Corp.. Viscount's flagship asset is the Cherry Creek project in Nevada. And last February Sumitomo, through its subsidiary Summit Mining, signed on to earn 75% ownership by spending $10 million on the project over eight years, in addition to producing a bankable feasibility study at an estimated cost of between $30 million and $40 million.

Why is Sumitomo interested in Cherry Creek? For its multi-faceted potential.

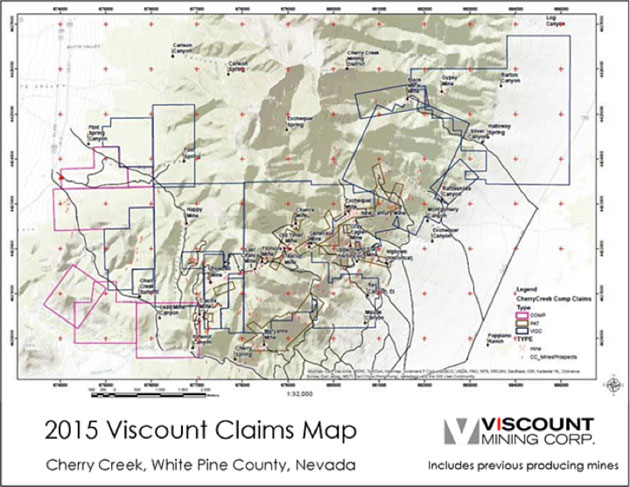

Cherry Creek is a land package that for many years was divided up amongst a list of owners, most of whom were not inclined to work together. Viscount's first feat was negotiating with each of these owners and assembling the property for the first time.

History speaks to part of its potential: Cherry Creek hosts 20 historic mines that produced silver, gold and tungsten between 1872 and 1940. The mines tapped into vein mineralization, the extent and sources of which have never been explored with modern techniques. The possibility of finding more high-grade silver and tungsten is pretty high.

That's interesting, but the really enticing aspect of Cherry Creek is the possibility of Carlin-type gold.

The Flint Canyon area of Cherry Creek comprises dissected blocks of the Dunderberg Shale, with Marjum Limestone underneath and Notch Peak Limestone and Pogonip Formation on top.

At nearby deposits the Dunderberg, Notch Peak and Pogonip units are important Carlin gold hosts. At Flint Canyon not only are all three units present, but a second key characteristic also prevails: jasperoid outcrops.

Many Carlin-type gold deposits have been found because jasperoid outcrops along the bedding contacts of mineralization carbonate rocks. At Flint Canyon, the jasperoids appear to lie along the base of the Dunderberg shale and along the Pogonip-Notch Peak contact.

At this point Flint Canyon has only seen mapping, which determined the jasperoid and carbonate bedding relationships just described, and rock chip sampling, which returned gold in 138 of 203 samples.

"Last year, near the end of the season in October, Summit specifically focused on Flint Canyon and its Carlin-type gold characteristics," said Jim MacKenzie, CEO of Viscount Mining. "Based on that work, they are going to make Flint Canyon a very high priority target in 2016. What got them really excited were all the jasperoid occurrences."

MacKenzie couldn't provide any details on Summit's plans for the year because they have not yet been announced, but he did say there's "going to be a significant amount of money put into Flint Canyon this year." The work will start with building roads—and that in itself is notable, as Summit had previously planned to do helicopter work and the decision to build roads suggests the company plans to be there for a while.

Flint won't be the only part of the project getting attention. MacKenzie says Summit will be mapping, sampling and drilling other targets as well. A detailed exploration plan should be announced shortly.

"What they originally liked about the property: they referred to it as a 'candy store' because of all the targets and the potential for gold, silver, lead, zinc and tungsten," said MacKenzie.

Sumitomo is publicly going after gold. Cherry Creek is the only exploration project it is advancing. Viscount is its partner. The market has already noticed the significance of the relationship: Viscount's shares are up 160% since last summer.

If exploration goes well this year and it starts to look like Sumitomo will move on Viscount to get all of Cherry Creek, there will be more where that came from.

With almost a decade of junior resource-focused journalism under her belt, Gwen Preston launched Resource Maven. Preston watches the wires, talks to her network and analyzes economics to identify resource news that matters and figure out how to profit. She focuses on early-stage exploration and development stories. Preston has been interviewed on CBC and in Financial Post.

Disclosure:

1) The following companies mentioned in the article are sponsors of Streetwise Reports: Viscount Mining Corp. Streetwise Reports does not accept stock in exchange for its services.

2) Gwen Preston: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for writing this article.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.