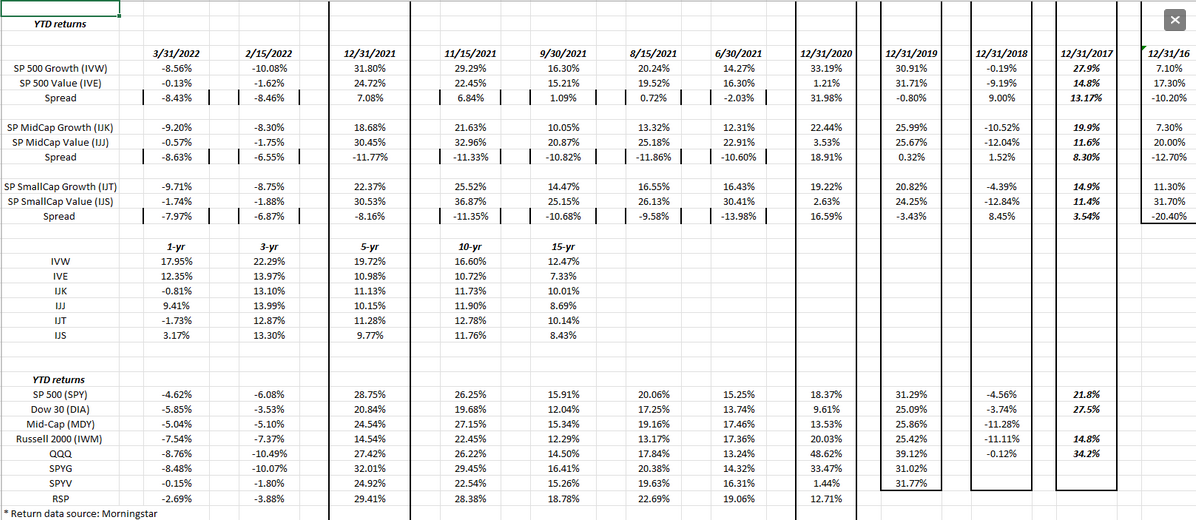

Updating style-box returns as of 3/31/22, using the iShares growth and value ETFs. “Value” continues to outperform growth this calendar year (probably not a surprise given the Energy sector’s performance) but growth did narrow the differential after the Feb. 15, update.

Near the S&P 500 lows of early March and just prior to the start of the nice March rally, S&P 500 growth was down 12%, while value was down 2% and I suspect that was the peak of the performance differential. By 3/31/22, the S&PYG—SPDR® Portfolio S&P 500 Growth ETF (NYSE:SPYG)—was down 8.48%, while the SPDR® Portfolio S&P 500 Value ETF (NYSE:SPYV) was down just 15 basis points or almost flat at the end of the quarter.

Looking at the above spreadsheet (and like all my spreadsheets, this one is taking on a life of it’s own) readers can see how in the mid-cap and small-cap asset classes, value started to outperform growth in 2021, but the large-cap growth asset class continued to show outperformance vs large-cap value, and that is mostly due to the mega-cap space or top 10 names in the S&P 500.

Starting in 2022 though, value has clearly outperformed across all market-cap asset classes.

Q1 ’22 was the biggest performance differential between large-cap value and growth since 2016, with large-cap value outperforming l/c growth by over 800 bps this quarter.

The rolling multi-year returns are still pretty elevated. If 2022 gives us nothing more than a flat equity market across the board, it would go a long way in taking the steam out of the all market caps. Looking at the rolling returns, large-cap growth is still showing much healthier average, annual returns than it’s smaller asset classes.

Numbers and markets change quickly. Take all this with a healthy skepticism. I do this update just to stay abreast of the numbers and rolling returns in areas where clients may not be invested.