The struggles of the Sports Goods industry, be it Sports Gear Retailers or Producers of Sportswear brands, are far from over. Among the various factors plaguing the Sporting Goods Retailers, the prominent ones are changing consumer habits, Sportswear brands turning to direct selling channels and increased competition. Additionally, the general retailing backdrop has turned highly promotional, creating pressure on margins and the bottom line.

Notably, the general trend suggests customers are becoming more dependent on digital devices and mobile phones for their buying habits. Responding to this trend, sportswear brands are building up their online presence by teaming up with e-retailers as well as improving their website for a chic e-commerce experience. Though sportswear brands still value and recognize sporting goods retailers as an important sales channel, these companies have reduced their inventory with retailers to combat the soft traffic at stores.

Citing an example from the sportswear brands, NIKE Inc. (NYSE:NKE) recently took to selling directly to consumers on social media and e-commerce platforms, as evident from its recent deal with Amazon.com Inc. (NASDAQ:AMZN) . NIKE is executing a pilot program with Amazon in the United States, where it will sell limited product assortments on the latter’s website. Earlier, the company sold on Amazon through unlicensed third-party resellers. Under this partnership, NIKE will look to improve the NIKE brand experience on Amazon by improvising the presentation and increasing the quality of storytelling. It also announced plans to sell products directly to consumers through Facebook’s (NASDAQ:FB) Instagram.

Why Sportswear Brands Are Suffering?

The concerns for the sportswear brands mainly stems from to foreign currency headwinds, intense competition, higher costs to develop omni-channel capabilities and inventory management, challenging retail environment and aggressive promotions. Notably, the revenues for these brands remain strong due to growth in the sports participation rate owing to increased health and fitness consciousness. However, the margins and bottom line have been hurt by the aforementioned factors.

How Are These Industries Placed?

While retailers selling sports gear are a part of the Zacks Retail-Miscellaneous space, sellers of sports footwear retailers belong to the Zacks Retail-Apparel and Shoes industry - both forming a part of the Retail-Wholesale sector. Notably, the Retail-Miscellaneous industry is placed at the bottom 9% (232 of 256) of the Zacks classified industries, while the Retail-Apparel and Shoes space is at the top 36% with a Zacks Industry Rank of #91. Further, the respective industries have slumped 16.1% and 23.3% year to date, compared with the S&P 500 market’s 13.8% growth.

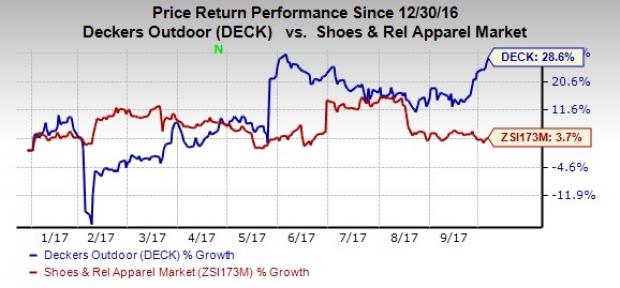

Moreover, the sportswear brands come under the Zacks Shoes and Related Apparel industry, which is a part of the Consumer Discretionary sector. This industry is placed at the top 30% (77 of 256) of Zacks industries and has gained 3.7% year to date. However, it has underperformed the S&P 500 market’s growth.

That said, we bring to you some stocks that are trending well despite the industry challenges and can be banked upon. Further, we present to you few stocks that have fallen prey to the turmoil and should be avoided currently.

Stocks Trending Up

We have hand-picked some industry outperformers with Zacks Rank #1 (Strong Buy) or #2 (Buy), VGM Score of A or B, robust earnings surprise trend and strong fundamentals.

First on the list is Caleres, Inc. (NYSE:CL) , a footwear retailer and wholesaler offering licensed, branded, and private-label casual, dress, and athletic footwear products to women, men, and children. The company currently has a VGM Score of A and carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has delivered positive earnings surprise in the last two quarters. The long-term expected earnings growth rate for Caleres is 11%. Moreover, the stock has gained 13.8% in the last three months, against the industry’s 8.7% decline.

Another lucrative option is Goleta, CA-based Deckers Outdoor Corporation (NYSE:DECK) . The company is a leading designer, producer, and brand manager of innovative, niche footwear and accessories developed for outdoor sports, and other lifestyle-related activities. It has a VGM Score of A and carries a Zacks Rank #2. Moreover, the company has recorded an average positive earnings surprise of 76.7% in the preceding four quarters. Further, the company has a long-term expected earnings growth rate of 9.8%. The stock grew 28.6% year to date, outperforming the industry’s 3.7% upside.

Last but not the least, investors may consider Steven Madden, Ltd. (NASDAQ:SHOO) that designs, sources, markets, and sells fashionable brands and private label footwear for women, men, and children globally. The company currently carries a Zacks Rank #2 and a VGM Score of A. The company has delivered positive earnings surprises with an average beat of 7.1% in the trailing four quarters. The long-term expected earnings growth rate for Steven Madden is 12.3%. The stock has gained 19.5% year to date, outperforming the industry’s 3.7% growth.

Stocks to Avoid

While some stocks have made their way out of the woods, there are ones that have succumbed to the hardships in the sports goods space. So, it is advisable to avoid these stocks with Zacks Rank #4 (Sell) or #5 (Strong Sell), dismal stock performance and an unfavorable outlook.

We suggest keeping away from Hibbett Sports Inc. (NASDAQ:HIBB) , which operates sporting goods stores in small to mid-sized markets in the South, Southwest, Mid-Atlantic and lower Midwest regions of the United States. The company currently carries a Zacks Rank #5 and a VGM Score of C. Moreover, the stock has declined a substantial 61.2% year to date, wider than the industry’s 16.1% dip. The decrease can be attributed to the company’s dismal sales surprise history, reflecting a top line miss in nine of the last 10 quarters. Further, Hibbett trimmed guidance for fiscal 2018 due to soft second-quarter fiscal 2018 results and expectations of the persistence of a tough retail environment.

Also avoid, New York-based Foot Locker Inc. (NYSE:FL) . This retailer of athletic shoes and apparel operates through the Athletic Stores and Direct-to-Customers segments. This Zacks Rank #5 company has delivered negative earnings in the preceding two quarters, with an average miss of 6.6% for the trailing four quarters. The company’s results in the last reported quarter were impacted by soft performance of “some recent top styles” and lack of innovative fresh products in the market. Moreover, the company provided a bleak outlook as it expects the challenging retail landscape and changing consumer spending pattern to make the operating environment tough. Consequently, the stock has declined a substantial 51.4% year to date, wider than the industry’s slump of 23.2%.

Finally, we suggest getting rid of Skechers U.S.A., Inc. (NYSE:SKX) , which designs, develops, markets, and distributes footwear for men, women, and children in the United States and overseas under the SKECHERS name, as well as under several uniquely branded names. This Zacks Rank #4 company has delivered an average negative earnings surprise of 19.2% in the trailing four quarters. Moreover, investors remain apprehensive about Skechers’ bottom line performance that has been declining for the past five straight quarters due to rise in selling and general & administrative expenses. The stock has dropped 11.9% in the last three months, wider than the industry’s decline of 8.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Foot Locker, Inc. (FL): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Nike, Inc. (NKE): Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX): Free Stock Analysis Report

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Steven Madden, Ltd. (SHOO): Free Stock Analysis Report

Colgate-Palmolive Company (CL): Free Stock Analysis Report

Original post

Zacks Investment Research