S&P 500 retraced its recent advances – is the uptrend over?

The S&P 500 index lost 0.81% on Thursday as it bounced from 4,400 level. Stocks retraced some of their recent advances following 30y bond auction results, Jerome Powell’s speech, among other factors. Yesterday’s daily low was at 4,343.94 and earlier in the day the S&P 500 reached new local high of 4,393.40. It was very close to mid-October high of 4,393.57. Investors’ sentiment remains positive despite a lot of uncertainty about monetary policy, economic growth and geopolitics. Last week the index rallied from October 27 local low of 4,103.78.

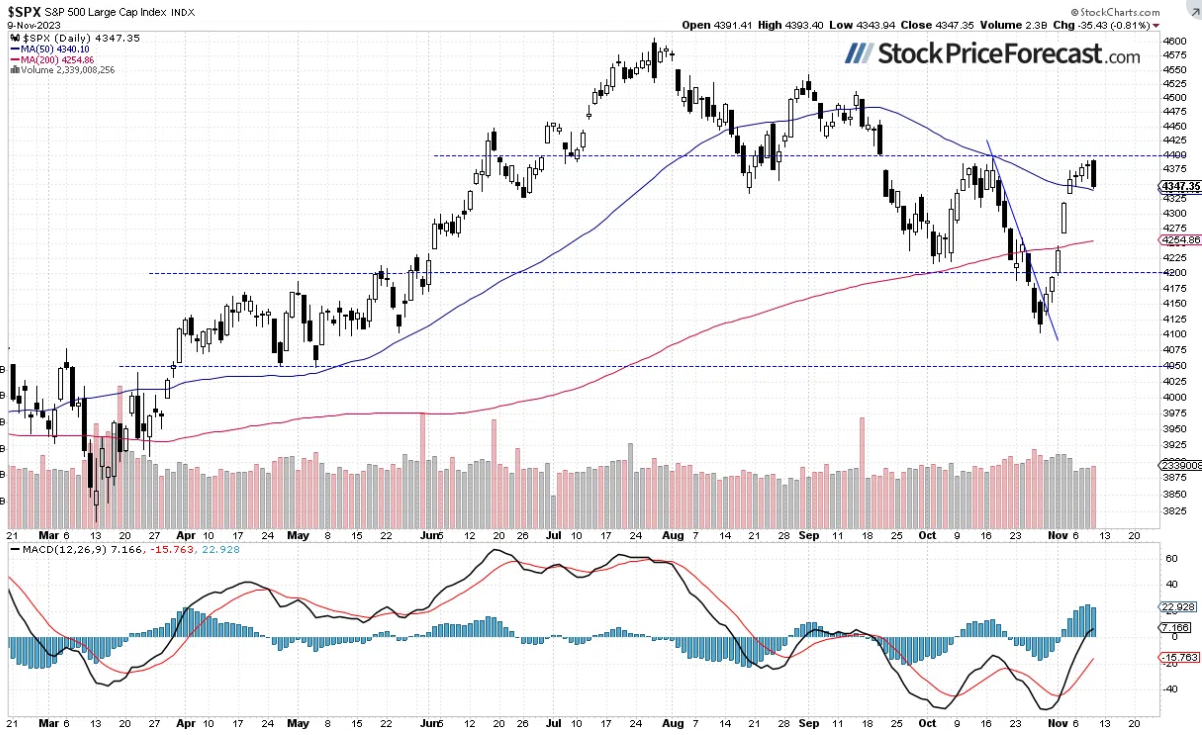

Stocks are expected to open 0.4% higher today. So the S&P 500 will likely extend a short-term consolidation below the resistance level of 4,400 as we can see on the daily chart:

Futures Contract Trades Below 4,400

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it was as high as 4,413 and this morning it’s trading slightly below 4,380. The resistance level is at 4,400-4,420 and support level is at 4,350, among others.

Conclusion

The S&P 500 index will likely extend its fluctuations following last week’s rally. Overall, the market went sideways this week. For now it looks like a consolidation or relatively flat correction within an uptrend. The resistance level is still at 4,400, marked by the previous local highs and the technically important September 21 daily gap down of around 4,376-4,401.

Here’s the breakdown:

- The S&P 500 retraced its recent advances yesterday, but it remained within a week-long consolidation.

- For now it looks like a flat correction of an uptrend.

- In my opinion, the short-term outlook is still bullish.