Stocks extended their consolidation yesterday as the index gained over 1%. But today they are expected to lower again. Is this a bottoming pattern?

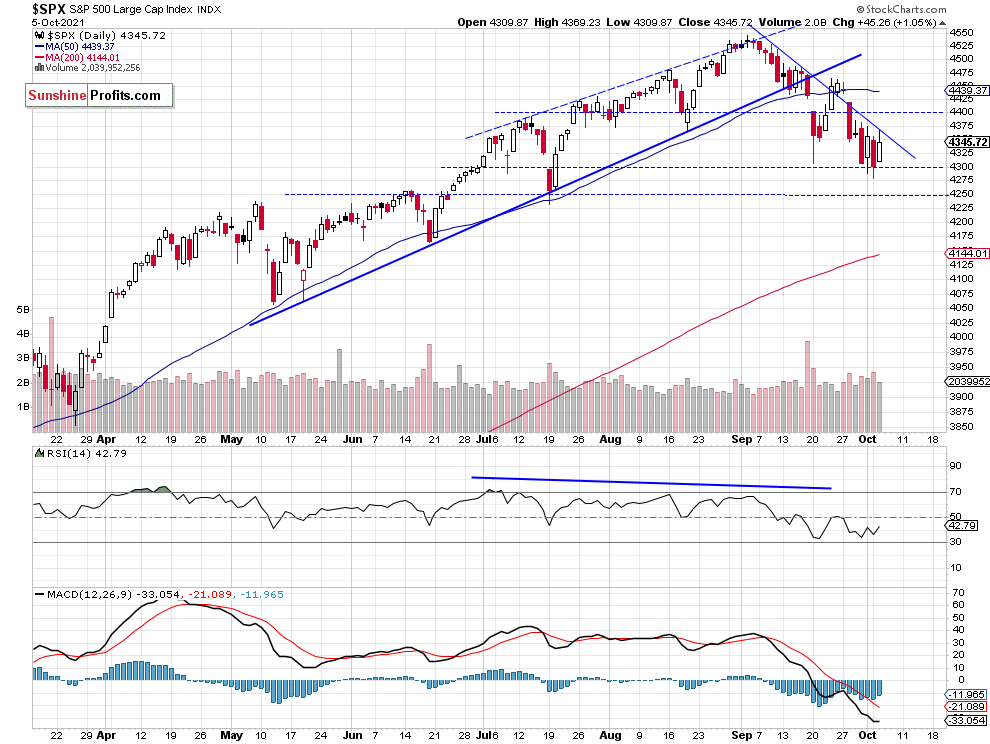

The S&P 500 index gained 1.05% on Tuesday, as it bounced from the 4,300 level again. For now, it looks like a consolidation following a month-long decline. The market will be waiting for Friday’s Nonfarm Payrolls number release and the coming quarterly corporate earnings season. Today’s ADP Non-Farm Employment Change release has been better than expected at +568,000, but it only brought more uncertainty ahead of the Friday’s data. And we will likely see some further short-term fluctuations.

The support level remains at 4,290-4,300. On the other hand, the resistance level is at 4,375-4,400, marked by the recent local highs. The S&P 500 continues to trade below its month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Dow Jones Is Also Going Sideways

Let’s take a look at the Dow Jones Industrial Average chart. In early September the blue-chip index broke below a two-month-long rising wedge downward reversal pattern. Last week, it got back closer to the mid-September local low. However, unlike the broad stock market’s gauge, it managed to stay above that support level. The nearest important resistance level remains at around 34,500, as we can see on the daily chart:

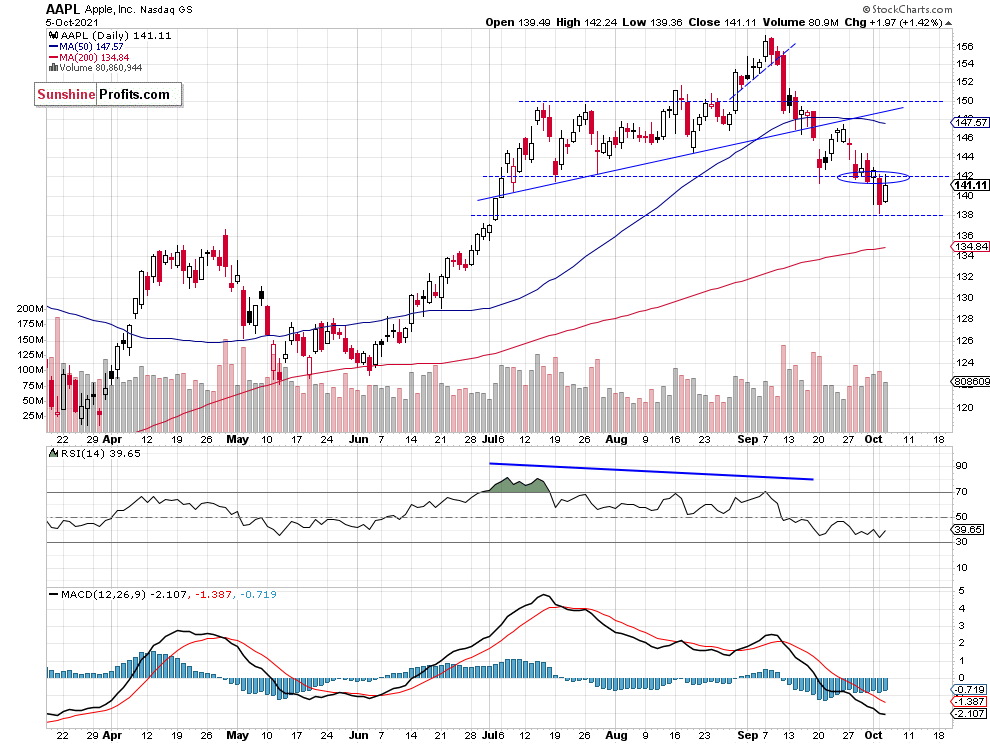

Apple Broke Below Its Support Level

Apple (NASDAQ:AAPL) stock weighs around 6.1% in the S&P 500 index, so it is important for the whole broad stock market picture. Since early September it has been declining from the record high. Recently, the stock broke below the support level of around $142, marked by the previous local lows. The $142 price level is acting as a resistance level right now.

Conclusion

The S&P 500 index has been trading within a short-term consolidation since last Thursday. On Monday, the broad stock market retraced its Friday’s advance and the S&P 500 index fell to the 4,300 level again, but yesterday it came back higher. There have been no confirmed positive signals so far. However, the risk/reward perspective seems less favorable right now and no positions are currently justified.

Here’s the breakdown:

- The S&P 500 trades within a short-term consolidation that looks like a flat correction within a month-long downtrend.

- Our speculative short position has been closed right before the opening of Friday’s cash market’s trading session.

- However, we are still expecting more downward pressure and a correction to 4,200-4,250 level.