Trillions of dollars have been lost and gained over the last five years. The extreme volatility strangled investment portfolios, and as a result millions of investors capitulated by throwing in the towel and locking in losses. Melted 401ks, shrunken IRAs, and beat-up retirement accounts bruised the overarching psyche of Americans to the point they questioned whether the stock market is a shrewd bet or stupid gamble?

The warmth and safety of bonds provided some temporary relief in subsequent years, but the explosive rebound in stock prices to new record highs in 2013 coupled with the worst year in a decade for bonds still have many on the sidelines asking whether they should get back in?

As I’ve written many times in the past (see Timing Treadmill), timing the market is a fruitless effort. Elementary statistics, including the “Law of Large Numbers” will demonstrate that blind squirrels can and will beat the market on occasion, but very few can consistently beat the stock market indices for sustained periods (see Dart-Throwing Chimps).

However, there have been some gun-slinging hedge fund managers who have accumulated some impressive track records. Because of insanely high management fees, many overpaid hedge fund managers will swing for the fences by using a combination of excessive leverage and/or concentration. If the hedge funds connect with lucky returns, the managers can take the money and run. If they swing and miss…no problem. Close shop, hang out a shingle across the street, change the hedge fund’s name, and try again. Of course there are those successful hedge fund managers who have learned how to manipulate the system and exploit information to their advantage, but many of those managers like Raj Rajaratnam and Steven Cohen are either behind bars or dealing with the Feds (see fantastic Frontline piece on Cohen).

But not everyone cheats. There actually are a minority of managers who consistently beat the market by taking a long-term approach like Warren Buffett. Long-term outperforming managers are like lifetime .300 hitters in Major League Baseball – the outperformers exist, but they are rare. In 2007, AssociatedContent.com did a study that showed there were only 12 active career .300 hitters in Major League Baseball.

Another legend in the investment industry is John Bogle, the founder of the Vanguard Group, a firm primarily focused on passive, index-based investment strategies. Although it is counter-intuitive to most, just matching the market (or index) will put you in the top-quartile over the long-run (see Darts, Monkeys & Pros). There’s a reason Vanguard manages more than $2,000,000,000,000+ (yes…trillion) of investors’ money. Even at this gargantuan size, Vanguard remains a fraction of the overall industry. Regardless, the gospel of low-cost, tax-efficient, long-term horizons is slowly leaking out to the masse.

(Disclosure: Sidoxia is a devoted user of Vanguard and other providers’ low-cost Exchange Traded Funds [ETFs]).

Rolling the Dice?

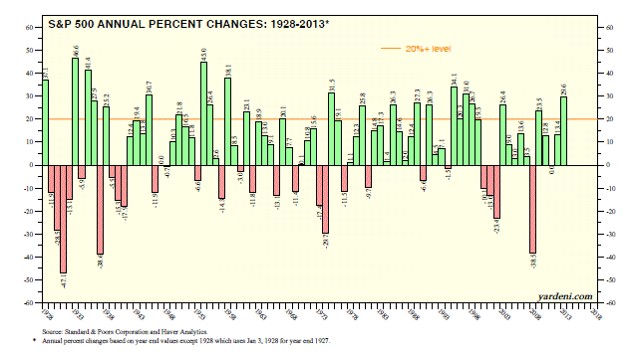

Unlike Las Vegas, where the odds are stacked against you, in the stock market the odds are stacked in your favor if you stay in the game long enough and don’t chase performance. Dr. Ed Yardeni has a great chart (below) summarizing stock market returns over the last 85 years, and what the data highlights is that the market is up (or flat) 69% of the time (59/86 years). The probabilities are so favorable that if I got comparable odds in Vegas, I’d probably live there!

Unfortunately, rather than using this time arbitrage in conjunction with the incredible power of compounding, many individuals look at the stock market like a casino – similarly to betting on black or red at a roulette wheel. Speculating about the direction of the market can be fun, and I’ve been known to guess on occasion, but it’s a complete waste of time. Creating a long-term plan of reaching or maintaining your retirement goals through a diversified portfolio is the way to go – not bobbing in out of the market with cash and bonds.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.