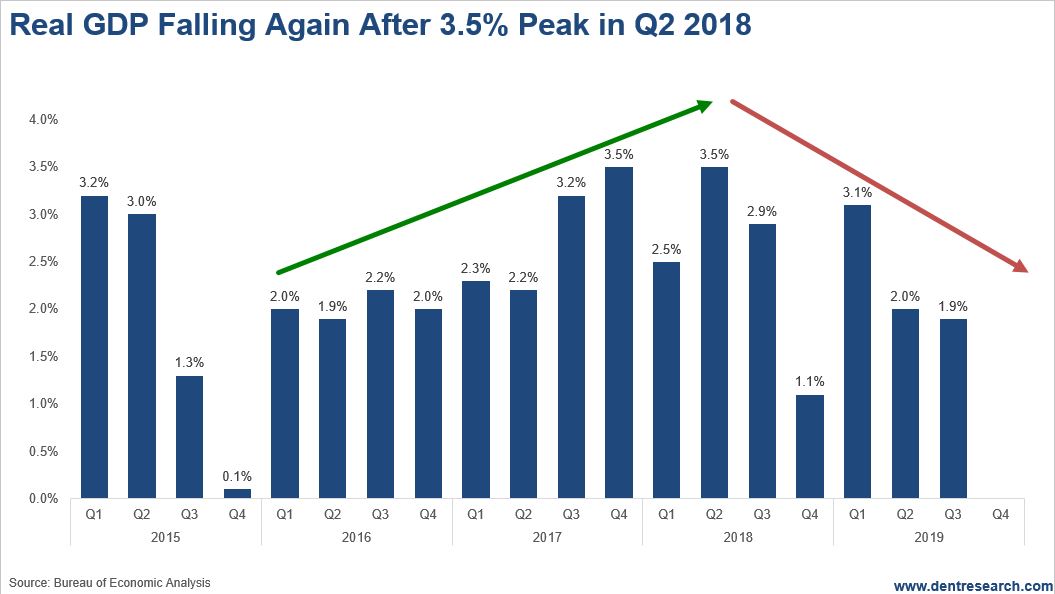

Somehow the stock market is expecting growth to re-accelerate after a disappointing 2.0% GDP growth in Q2. The only sign of such growth in the stock market is central banks lowering rates and expanding their balance sheets again.

Q3 just came in at 1.9%, just below the 2.0% last quarter. And that covers over the bigger decline in consumer spending down from 3.03% in Q2 to 1.93% in Q3. Business investment continues to trickle down as did last quarter.

Don’t be Fooled by Stock Buybacks

As David Stockman and I both noted at our October IES conference, the tax cuts did not contribute to a higher rate of capital investment: only more stock buybacks. Nonresidential fixed investment surged briefly to 8.8% in Q1 2018, but has been falling ever since and was down 3% in Q3 2019. Companies don’t need more capacity after the greatest debt bubble and over expansion in history. They just keep putting their excess cash and/or cheap borrowing into buying back their overvalued stock, which will make them look like the dumbest money in history at this bubble.

And more important, a good leading index of corporate earnings is the ISM. That has been declining since Q2 2018 and suggest earnings that have been falling since Q3 2018 will continue to decline ahead and potentially go negative .

What’s in Store for Stocks?

So, how are stocks going to break up and out to major new highs? Looks unlikely unless we get stronger signs of stimulus from the Fed, or a more substantial trade agreement with the Chinese.

If we don’t see a break up in the coming weeks, then a sharper breakdown like late 2018 is the more likely course . That could wake up the Fed and get a balls-out stimulus program that will ignite a final, failing rally…

As the truth is that you can only overstimulate, an already overstimulated economy so long before no one needs a bigger house or factory or car – or another refinance!