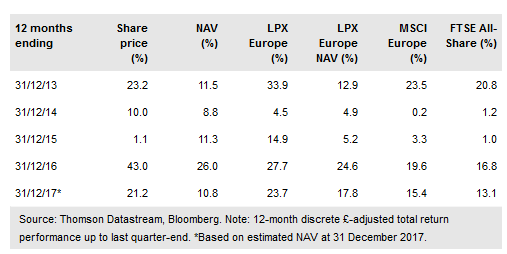

Standard Life (LON:SLA) takes a long-term, conviction approach to fund selection, evidenced by its new primary commitments in FY17 being made to private equity managers where there was a strong existing relationship. NAV total returns have been ahead of peers over three and five years, and share price returns have noticeably outpaced NAV returns over one year. The share price discount to NAV has narrowed markedly from c 36% in early 2016 to c 14% currently, arguably due in part to the strength of SLPET’s underlying performance, as well as its revised dividend policy, with improved and more frequent payouts scheduled. The manager sees portfolio companies’ earnings growth continuing to drive value creation, with the maturity profile of SLPET’s portfolio suggesting further near-term upside potential from prospective realisations.

Investment strategy: Systematic, disciplined approach

SLPET aims to achieve long-term total returns through investing in a portfolio of 35-40 funds run by experienced private equity managers with strong track records of generating attractive investment returns, giving exposure to an underlying portfolio of c 350 private companies. Funds are selected that invest in mature businesses, primarily via buyout transactions. A systematic, disciplined approach is followed, involving detailed and rigorous screening and due diligence to identify and evaluate primary fund offerings as well as secondary market transactions, which are used to adjust portfolio exposures and to maintain SLPET’s capital efficiency.

To read the entire report Please click on the pdf File Below: