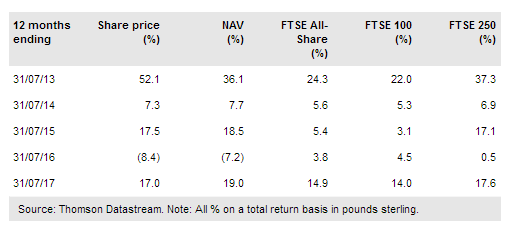

Standard Life (LON:SL) Equity Income Tst (LON:SLET) aims to generate above-average income and real capital and income growth from a relatively concentrated portfolio of c 50-70 UK equities. Since 2011, SLET has been managed by Thomas Moore, who says that the trust’s strong revenue growth is leading to higher dividend growth. The board has indicated that the FY17 annual dividend will be at least 9.1% higher than in FY16. Following a tough period of relative performance surrounding the Brexit vote, as companies with domestic businesses underperformed those with overseas operations, the manager is now more positive on the outlook. SLET’s performance is improving versus both the FTSE All-Share benchmark and its peer group. Moore is placing greater emphasis on higher-growth smaller companies that are reasonably valued and have faster-than-average dividend growth.

Investment strategy: Across the cap spectrum

Moore employs Standard Life Investments’ Focus on Change investment process, selecting stocks on a bottom-up basis that have favourable cash flow and dividend characteristics and are reasonably valued. The investment approach is index- agnostic and the manager invests across the capitalisation spectrum, meaning that sector weightings and performance may vary significantly from the benchmark. At end-June 2017, more than 60% of the portfolio was invested outside of the top 100 UK companies. Net gearing at end-June 2017 was 11.6%.

To read the entire report Please click on the pdf File Below: