Most tech stocks – and I’d put AI darling Nvidia (NASDAQ:NVDA), with its pathetic 0.02% yield, at the top of the list here – don’t pay dividends when they’re growing quickly. Only later, when growth slows, do they “find religion” and return cash to shareholders as dividends and buybacks. That’s too bad for those of us who like to have more than one way – price gains – to book returns on our stocks.

That said, during the gold rush of the 1840s, hordes flocked to California to get rich mining for gold. But the guys who made the real money didn’t actually mine anything. They were the entrepreneurs who sold the picks and shovels (as well as booze and lodging) to the hapless speculators.

SRE is an ideal pick and shovel play on the AI boom. It’s a California- (and Texas-) based utility set to profit as AI drives power demand through the roof—to 85 terawatts a year by 2027, according to Scientific American. That’s more power than many small countries use.

Let’s start with California, where Sempra has 25 million customers in the southern and central parts of the state. Despite recent tech layoffs, California created 260,000 jobs in 2023, according to the Public Policy Institute of California, a rate that matched pre-pandemic levels.

But Texas, where Sempra has 13 million customers and operates 143,000 miles of transmission lines, is the real growth driver here.

The state’s tech sector is en fuego. According to the Texas Economic Development Corporation, 17,600 tech firms now call Texas home, and they employ some 203,700 workers there. In Austin alone, the number of tech jobs jumped 9.8% in 2022, according to the city’s chamber of commerce.

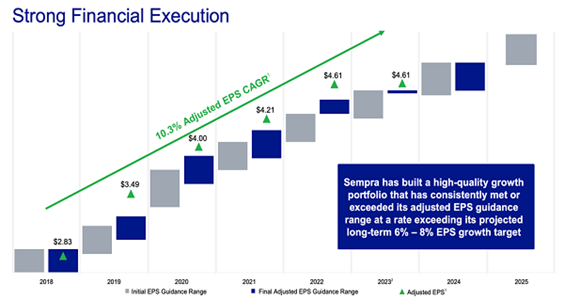

All of this builds a strong case for Sempra, and its stellar earnings history drives the point home. Management continuously sets a 6% to 8% EPS growth target…and continuously crushes it.

Source: Sempra fourth-quarter investor presentation

No wonder the payout (recent yield: 3.5%) is on a growth tear and it has pulled up the share price with it, too. That connection is a phenomenon I call the “Dividend Magnet” – and we’ve seen it in dividend stock after dividend stock.

Recommended Action: Buy SRE