Last week’s review of the macro market indicators suggested, heading into next week there was continued weakness. Gold (GLD) and Crude Oil (USO) looked better to the downside while the US Dollar Index (UUP) seemed to be turning up and US Treasurys (TLT) were biased lower within the Uptrend. The Shanghai Composite (SSEC) and Emerging Markets (EEM) were poised to continue consolidation, Chinese markets within the downtrend.

Volatility (VIX) looked to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ, despite the Dollar Index and Treasurys undercutting it. The Indexes themselves all looked biased to the downside with a chance of consolidation within the longer term uptrends.

The election was the pivot point for the week. It played out with Gold ripping higher while Crude Oil jumped only to fall back at resistance. The US dollar broke higher and Treasurys followed along after the election. The Shanghai Composite rolled back lower while Emerging Markets remained in their recent range. Volatility remained subdued but an uptrend is building. The Equity Index ETF’s SPY, IWM and QQQ held early in the week but dumped hard after the election results. What does this mean for the coming week? Let's look at some charts.

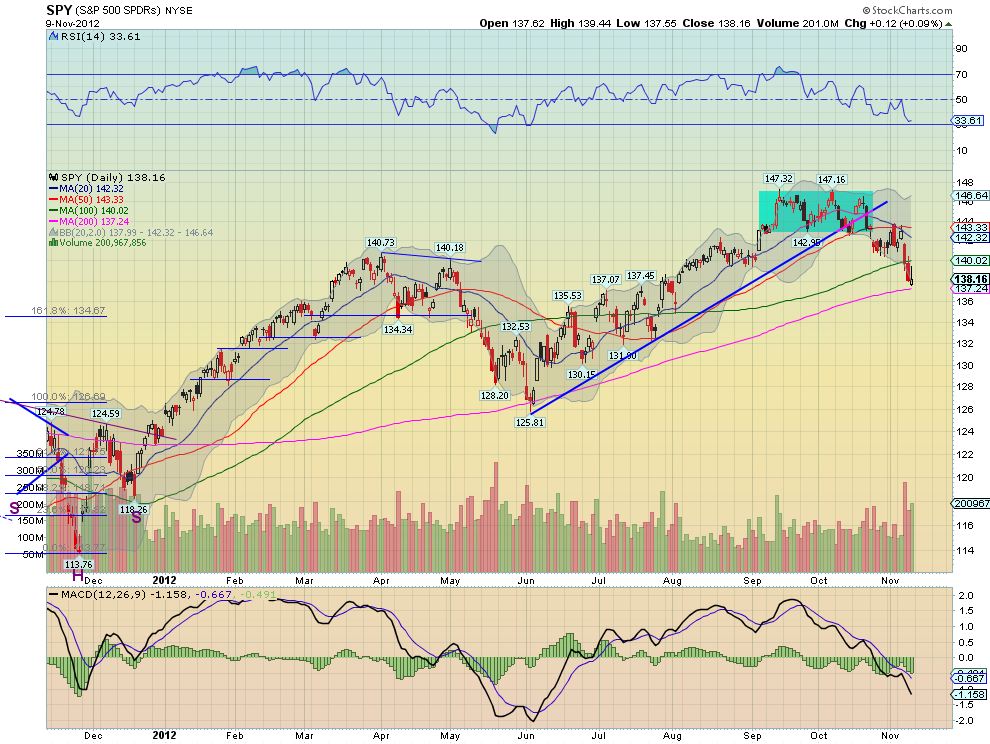

SPY Daily (SPY)

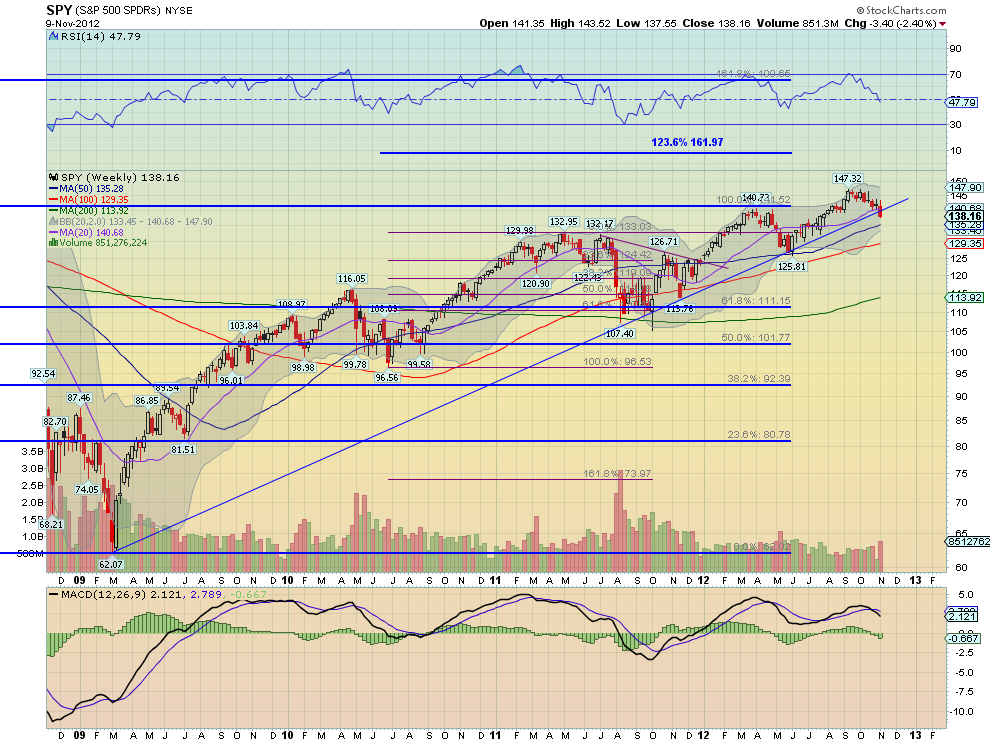

SPY Weekly (SPY)

The SPY continued lower out of a bear flag once the election results were known. The week ended with an Inverted Hammer, a possible reversal, which would be a shallow 6% correction if it confirms higher. The Relative Strength Index (RSI) is trending lower and in bearish territory near being technically oversold. The Moving Average Convergence Divergence indicator (MACD) is negative and continues to grow, also supporting more downside and the increasing volume on the selloff reinforces the trend lower.

Moving out to the weekly chart shows a crack of the rising uptrend. The RSI on this timeframe is trending lower as well with a negative MACD, both supporting more downside. There is support lower at 137.30 and 135.10 followed by 132.40. It will take a move under 125.81 to turn bearish long-term. Resistance higher is found at 138.60 and 140.10 followed by 142 and 144.44. Over that and the repair of the upward bias begins. Continued Short Term Downward Bias in the Uptrend.

As we shift focus from the election to the fiscal cliff the market is revolting. Look for Gold to continue in its uptrend while Crude Oil consolidates with a bias lower. The US Dollar Index and US Treasurys are set to move higher. The Shanghai Composite and Emerging Markets look to consolidate, with the Shanghai Composite doing so in a downtrend. Volatility looks to remain low but slowly trending higher making a hard way for the equity index ETF’s SPY, IWM and QQQ, which all look better to the downside, despite some signs of possible reversals. Use this information as you prepare for the coming week and trade’m well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

SPY Trends And Influencers: November 10, 2012

Published 11/11/2012, 01:00 AM

Updated 05/14/2017, 06:45 AM

SPY Trends And Influencers: November 10, 2012

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.