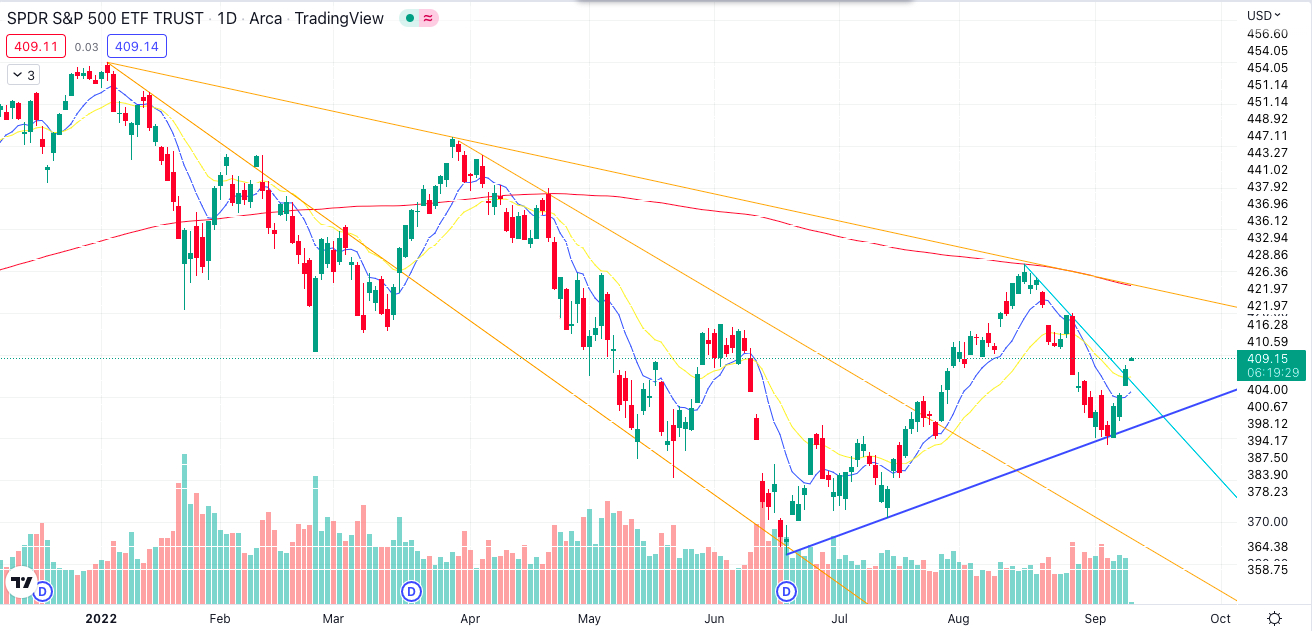

Today is a pivotal day for the SPY.

On Sept. 7, we bounced right off the up-trend line formed from Jun. 17 to Jul. 14. We can see that on Friday, Sept. 9, we came up with that blue downtrend line from the previous push down (after we rejected the major downtrend line on Aug. 16).

As of this morning at 9:45a EST, we have gapped above that minor downtrend line. If we get a backtest and bounce on the top side of this downtrend line, that's a good sign for continuation to the upside.

If that happens, I expect a continuation to the major downtrend line (overhead on the chart in orange) and 200 SMA (in red on the chart). The fact that both the 200 SMA and the major downtrend line are near each other means there will be a strong level of resistance as we test it.

The selling volume that we experienced over the last two weeks implies that sellers are still interested at these levels. However, we still had decent buying volume over the last few days, which gives little confidence for this push-up.

There is a volume battle going on here as the market tries to determine whether the sellers or buyers will win for either the next leg down or continuation to the upside.

If sellers can push us below the minor blue downtrend line, I expect to see a continuation of the downtrend back down to the pivot low on Sept. 6. We are seeing this morning, though, that the bulls are in control.

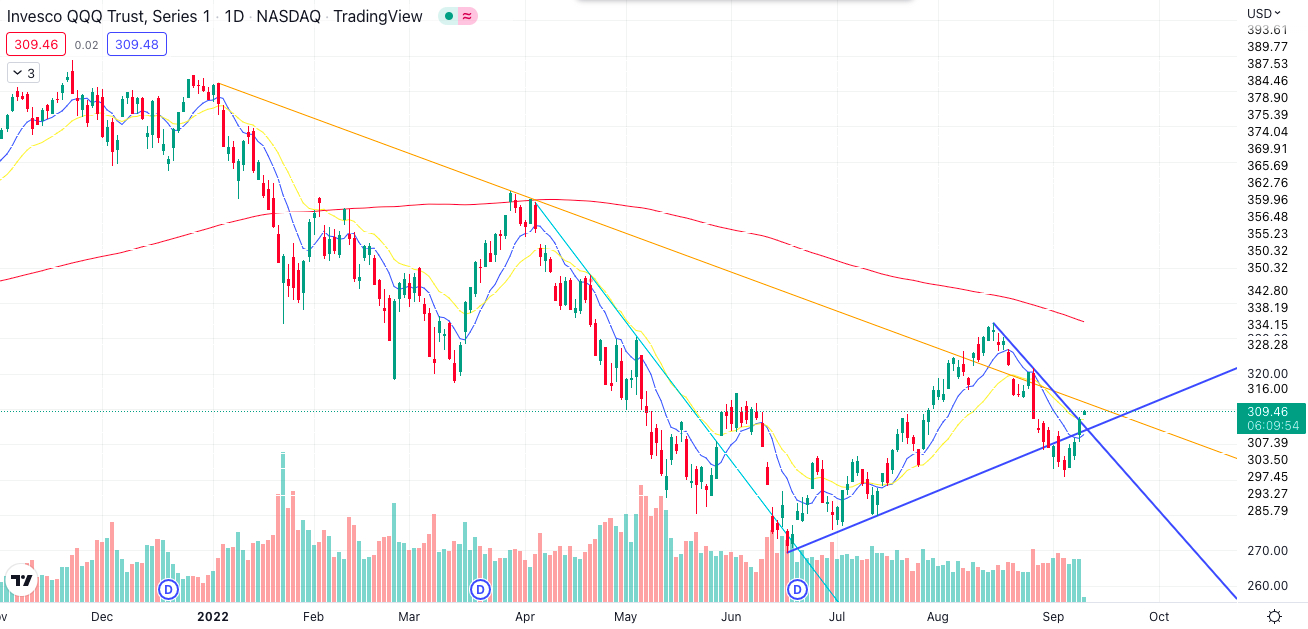

The QQQ has been less reliable with its trendlines and has been chopping around them much more these past few months.

If QQQ can get above its major downtrend line (yellow line), and we see a backtest with continuation up on good volume, then that is a strong sign that the bulls have taken back control, and it would also bode well for the SPY experiencing more upside as well.

The key levels to watch on QQQ are the major downtrend line in yellow and the 200 SMA in red.

With both the SPY and QQQ getting higher pivot lows over the past week, we can expect more buyers to become interested in participating in this rally.

The key is to watch your levels, trade your plan, and let the market tell you what it wants to do.