US futures are pointing to a marginally lower open on Monday, as traders eye tonight’s speech from Donald Trump as well as a few other from policy makers from the Federal Reserve, Bank of England and ECB.

It’s looking a little quiet on the economic data side today but speeches from policy makers from three major central banks and the President of the US should keep things interesting. All three central banks have been erring on the hawkish side recently, with the Fed raising interest rates last week, one BoE policy maker dissenting on leaving rates unchanged – preferring instead to hike – and the ECB having recently cut its asset purchases and suggested it could raise rates before it ends QE.

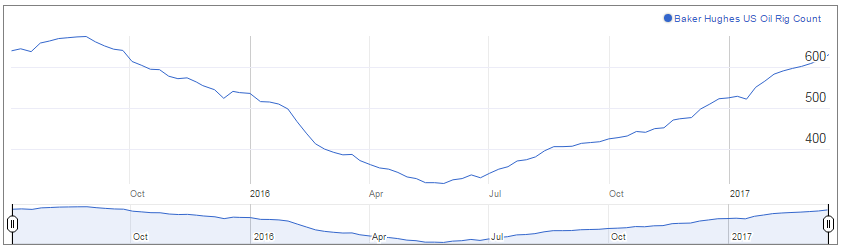

Oil is trading down around 1% today after oil rig data from Baker Hughes on Friday reported another increase, this time of 14 bringing the total to 631. The US shale industry has been quick to respond to last year’s rebound in oil prices which was largely driven by an agreement between OPEC and some non-OPEC producers to cut output.

While producers remain confident that the measures taken and high level of compliance will bring the market into balance, price action would suggest traders are not buying it. The resurgence in US shale is overshadowing the efforts of other producers for now and while US stockpiles continue to build, the cuts still far outweigh the gains in the US. Still, an extension to the cuts may be necessary before the market will rebalance, which may be easier said than done as that would involve conceding further market share to the US.

Gold is currently trading higher again on the day but the rally appears to be losing some steam. While the gains since the start of the year were being spurred on by growing political risks, with the gains in February having coincided with a rally in the dollar which is unusual, the recent moves appear to be being driven purely by the softness we’ve seen in the greenback since last week’s rate hike. To the downside, Gold could face a test around $1,220, with $1,200 below being a potentially important level. To the upside, $1,236-1,237 should be an interesting test of resistance.