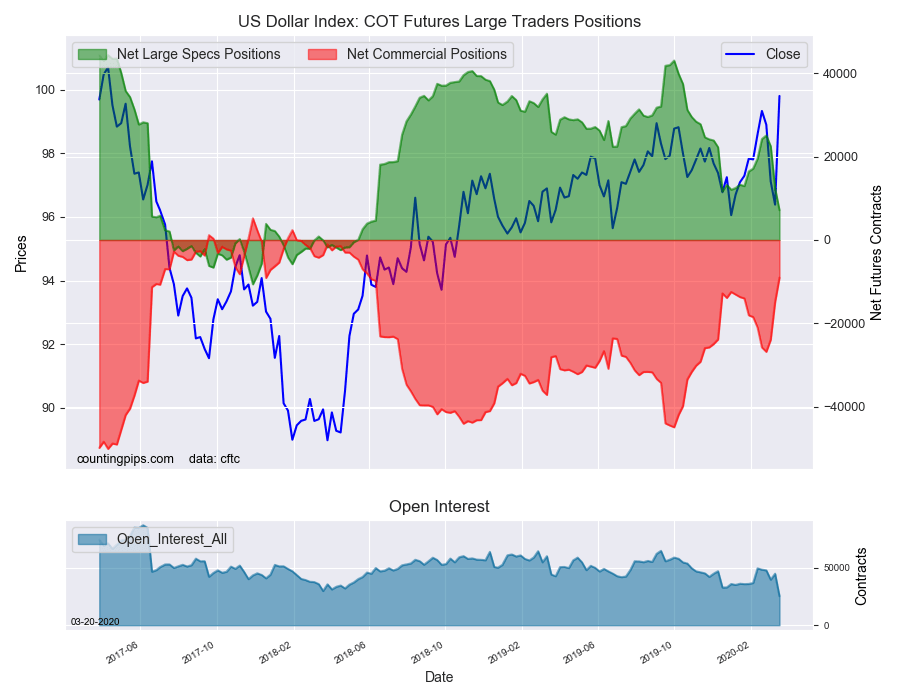

US Dollar Index Speculator Positions

Large currency speculators decreased their net bullish positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of US Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 7,152 contracts in the data reported through Tuesday, March 17th. This was a weekly lowering of -5,260 contracts from the previous week which had a total of 12,412 net contracts.

This week’s net position was the result of the gross bullish position (longs) lowering by -6,060 contracts (to a weekly total of 19,542 contracts) compared to the gross bearish position (shorts) which saw a decrease by just -800 contracts on the week (to a total of 12,390 contracts).

US Dollar Index speculators reduced their dollar bets for a third straight week this week despite the dollar strength being shown in the markets. Speculators have trimmed a total of -17,925 contracts off the bullish position in the past three weeks and the current position is now at the lowest level in ninety-two weeks at just +7,152 contracts. Despite these speculator selloffs, the markets strongly bid the dollar as most desired safe-haven currency and pushed the Dollar Index above the 101 level and to its highest level since January 2017. The dollar has even been stronger than the Japanese yen and the Swiss franc (usually the top safe havens) as investors rushed to cash (dollars) in the market turmoil due to the COVID-19 outbreak.

Individual Currencies Data this week: Euro, Yen, AUD bets jumped

In the other major currency contracts data, we saw four substantial changes (+ or – 10,000 contracts) in the speculators category this week.

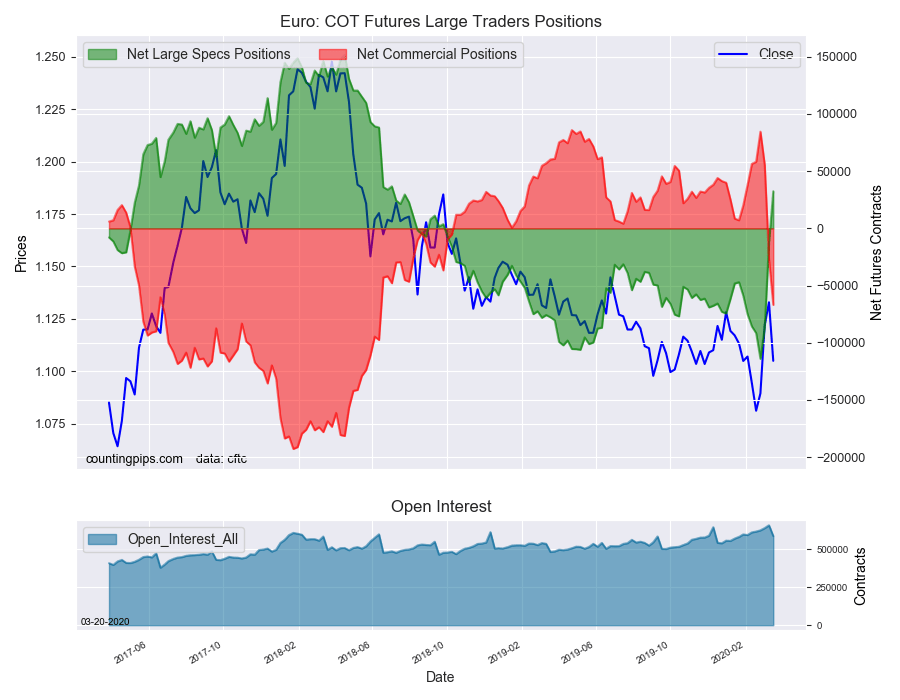

Euro bets surged higher once again this week as speculators pushed the overall standing into a bullish stance (+32,495 contracts) for the first time since September of 2018. Euro bets rose by over +45,000 contracts this week following gains by +74,036 contracts and by +27,318 contracts in the previous two weeks, respectively. Despite these speculator bets, the euro was on the defensive and the EUR/USD closed the week under the 1.07 level.

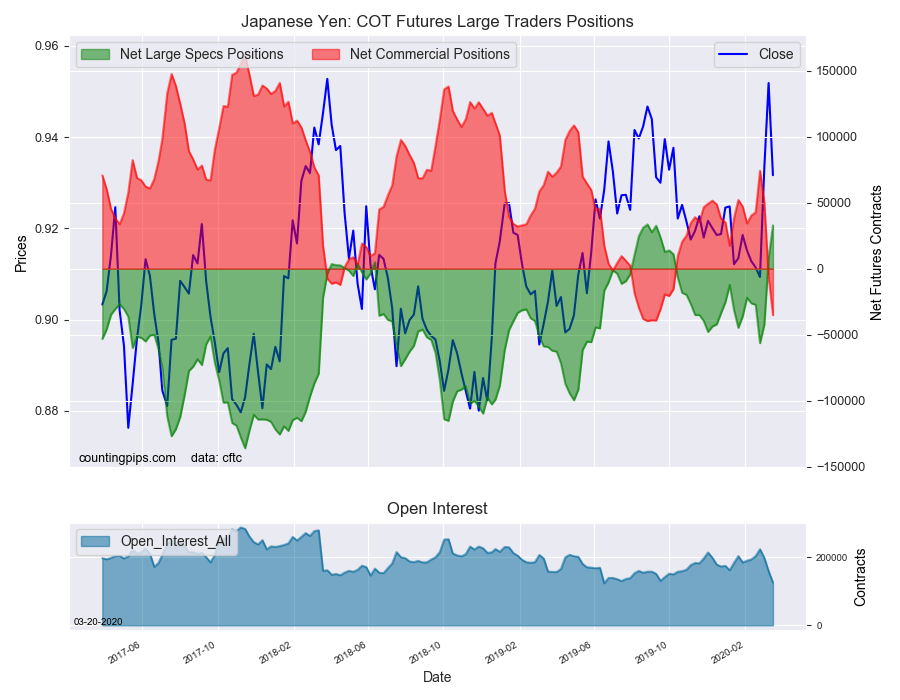

Japanese yen bets jumped for a third straight week this week by over +24,000 contracts. The yen contracts have now risen by +89,324 contracts over the past three weeks and overall back into bullish territory. Despite these rises, the yen actually fell to the dollar this week and the USD/JPY currency pair ended the week over the 110.70 level.

Australian dollar positions rose sharply this week by over +25,000 contracts. Previously, AUD positions had declined for six out of the past seven weeks and dropped to the most bearish level in twenty-seven weeks. Despite the weekly gain, AUD speculator contracts remain in bearish territory for the 103rd straight week.

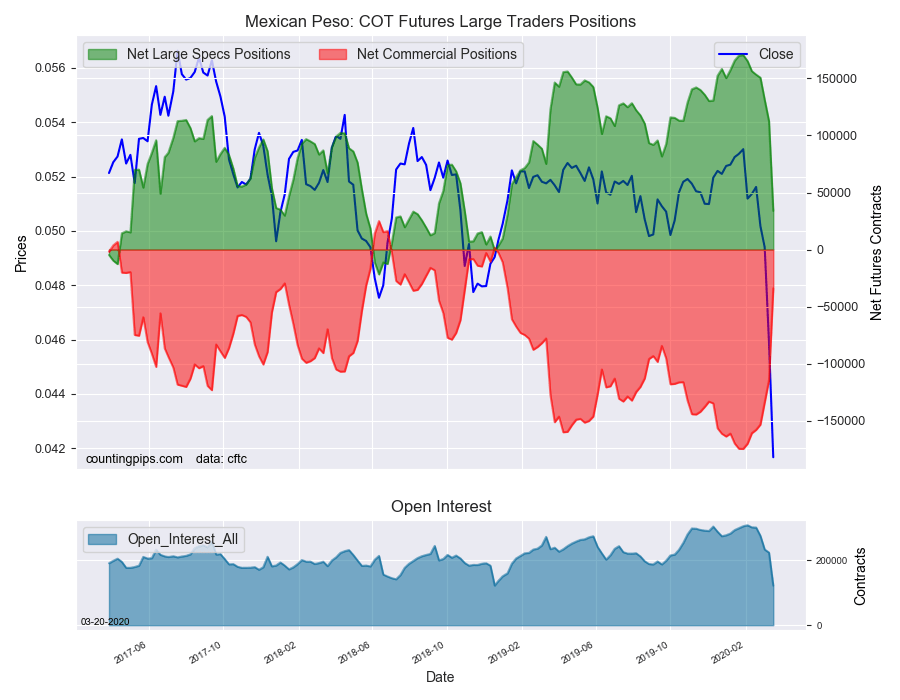

Mexican peso speculator bets dropped sharply as investors strongly sold off the peso in the markets this week. Peso bets fell by more than -78,000 contracts in what was the largest one-week sell-off in history, according to the CFTC data going back to 1995. Peso positions had stayed above the +100,000 net contract level for twenty-four straight weeks before this week’s decline which brings the overall standing down to just +33,845 contracts (the lowest level since January 8th of 2019).

Overall, the major currencies that saw improving speculator positions this week were the euro (45,162 weekly change in contracts), Japanese yen (24,778 contracts), Swiss franc (6,779 contracts) and the Australian dollar (25,280 contracts).

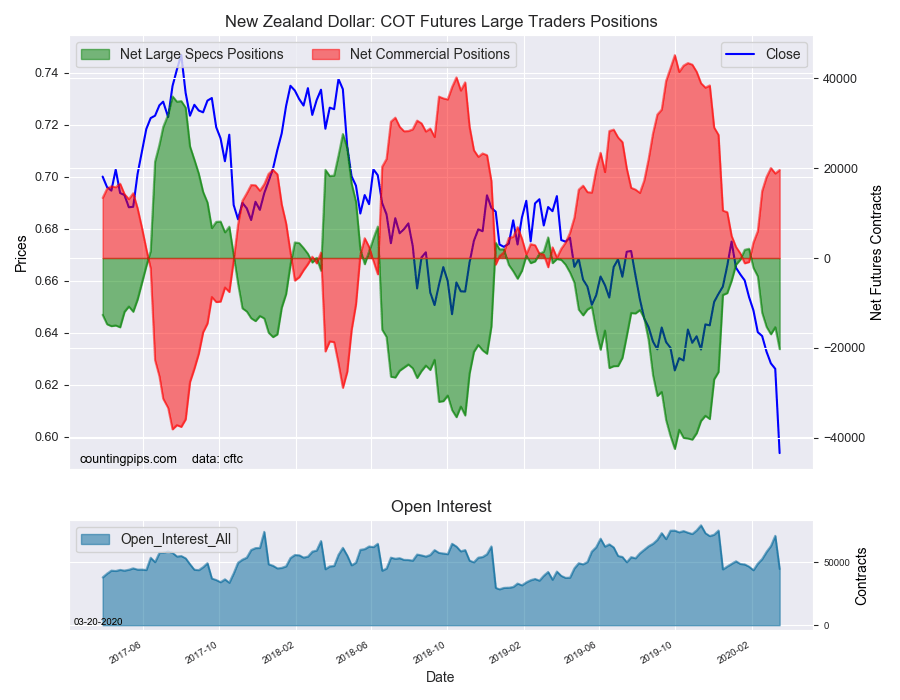

The currencies whose speculative bets declined this week were the US dollar index (-5,260 weekly change in contracts), British pound sterling (-7,688 contracts), New Zealand dollar (-4,899 contracts), Canadian dollar (-7,633 contracts) and the Mexican peso (-78,702 contracts).

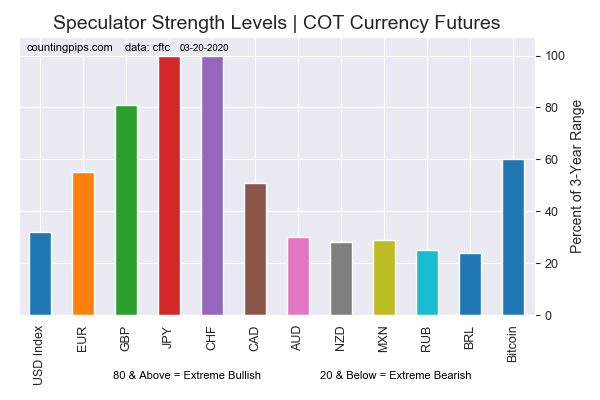

Chart: Current Strength of Each Currency compared to their 3-Year Range

The above chart depicts each currency’s current speculator strength level compared to data of the past 3 years. A score of 0 percent would mean speculator bets are currently at the lowest level of the past three years. A 100 percent score would be at the highest level while a 50 percent score would mean speculator bets are right in the middle of the data (a neutral score). We use above 80 percent (extreme bullish) and below 20 percent (extreme bearish) as extreme score measurements.

Please see the data table and individual currency charts below.

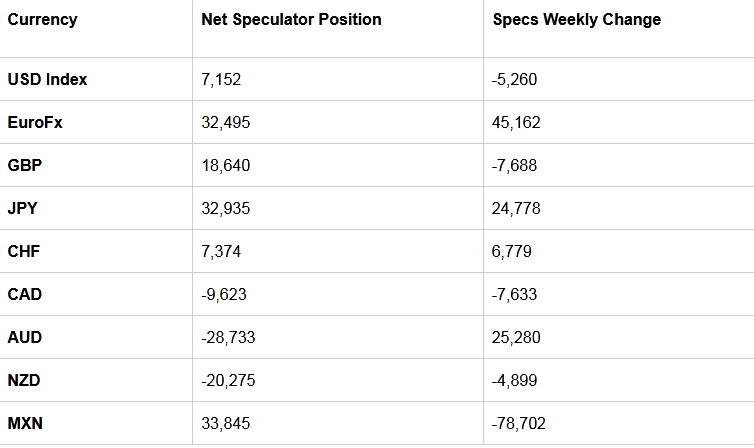

Table of Large Speculator Levels & Weekly Changes:

This latest COT data is through Tuesday and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar while a bet against the euro will be a bet that the dollar will gain versus the euro.

Weekly Charts: Large Trader Weekly Positions vs Price

EuroFX:

The euro large speculator standing this week was a net position of 32,495 contracts in the data reported through Tuesday. This was a weekly gain of 45,162 contracts from the previous week which had a total of -12,667 net contracts.

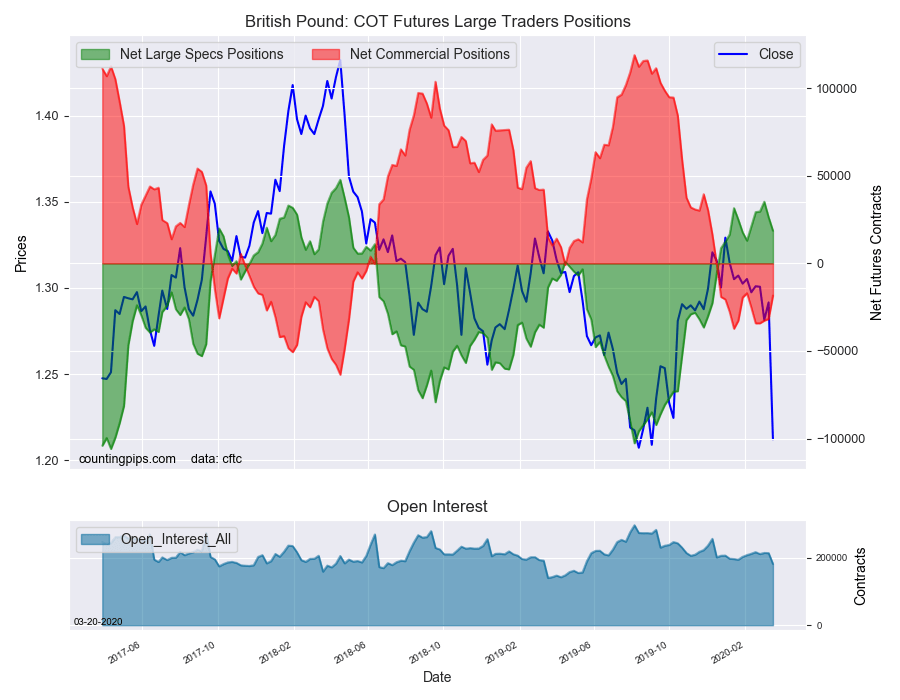

British Pound Sterling:

The large British pound sterling speculator level reached a net position of 18,640 contracts in the data reported this week. This was a weekly decrease of -7,688 contracts from the previous week which had a total of 26,328 net contracts.

Japanese Yen:

Large Japanese yen speculators reached a net position of 32,935 contracts in this week’s data. This was a weekly increase of 24,778 contracts from the previous week which had a total of 8,157 net contracts.

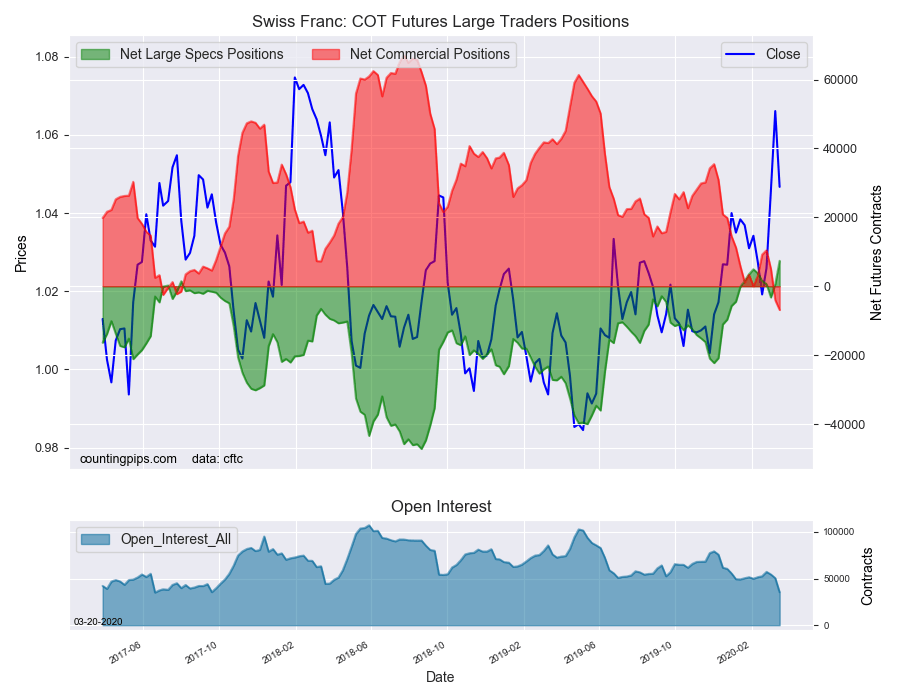

Swiss Franc:

The Swiss franc speculator standing this week reached a net position of 7,374 contracts in the data through Tuesday. This was a weekly boost of 6,779 contracts from the previous week which had a total of 595 net contracts.

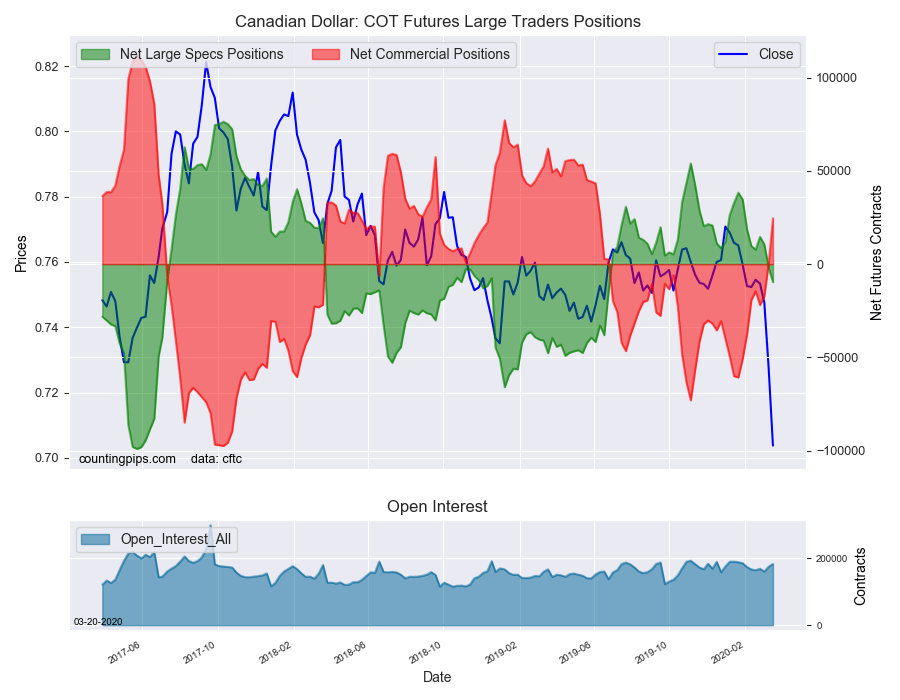

Canadian Dollar:

Canadian dollar speculators were a net position of -9,623 contracts this week. This was a decline of -7,633 contracts from the previous week which had a total of -1,990 net contracts.

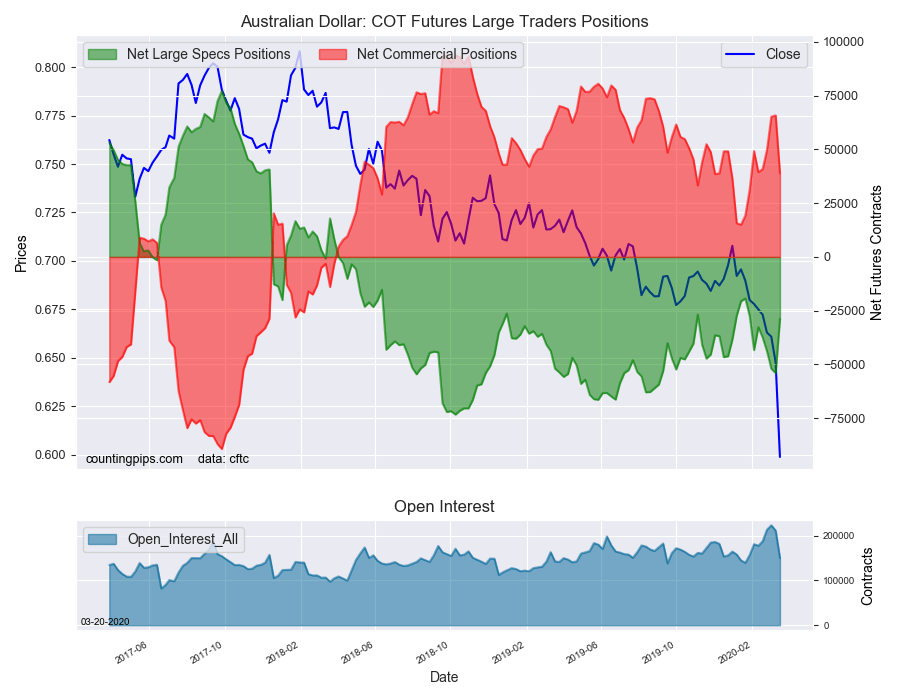

Australian Dollar:

The large speculator positions in Australian dollar totaled a net position of -28,733 contracts this week in the data ending Tuesday. This was a weekly increase of 25,280 contracts from the previous week which had a total of -54,013 net contracts.

New Zealand Dollar:

The New Zealand dollar speculative standing was a net position of -20,275 contracts this week in the latest COT data. This was a weekly reduction of -4,899 contracts from the previous week which had a total of -15,376 net contracts.

Mexican Peso:

Mexican peso speculators were a net position of 33,845 contracts this week. This was a weekly decrease of -78,702 contracts from the previous week which had a total of 112,547 net contracts.