I'll leave the chat on the daily time frames for later this week, but last Friday's damage has left markets struggling on a weekly time frame. It's not all doom and gloom, but come this week's Friday, there will need to be some buying flourish if we are not to start looking for support dating back to the end of 2022 (or worse for the Russell 2000).

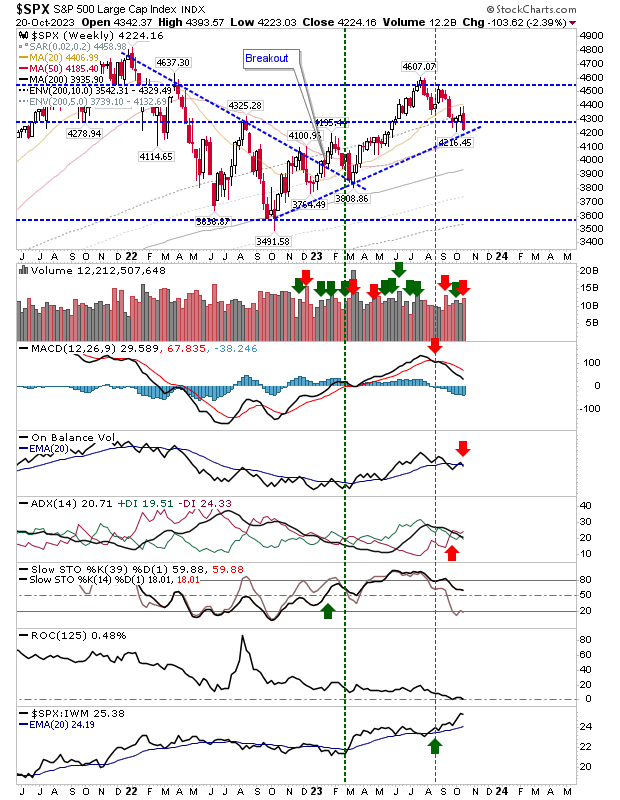

The S&P 500 is in the process of testing rising support connecting swing lows of October 2022 and May 2023. Last week's volume ranked as distribution with a new 'sell' trigger in On-Balance-Volume to go with earlier 'sell' triggers in ADX and MACD. Stochastics are still well above the mid-line, which is perhaps the best sign that the bullish shift triggered in January of this year can continue.

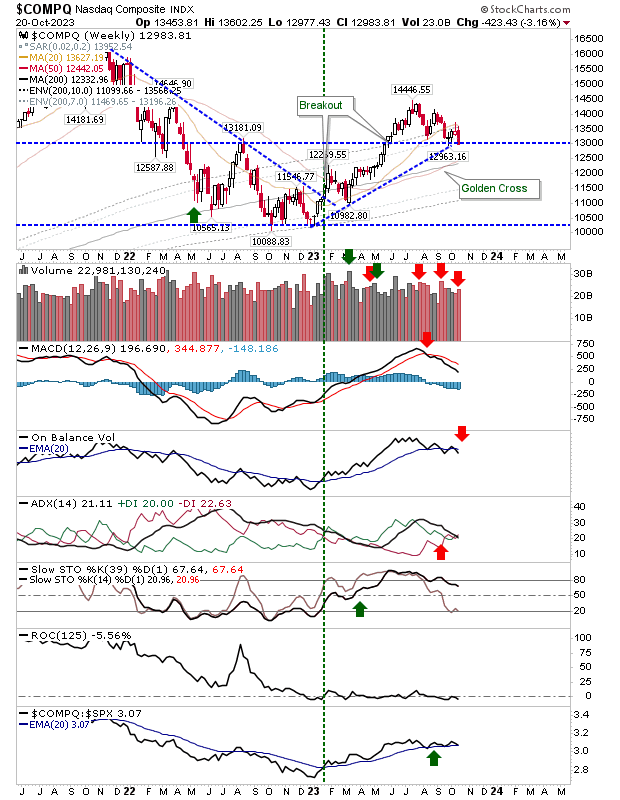

The Nasdaq weekly chart has reached swing high support from August 2022 and converged rising support from the late 2022 low. Technically it has broken trendline support, but I would look to current support (also near psychological support of 13,000) as more important. This week will be decisive; last week's volume ranks as distribution, what will this week bring?

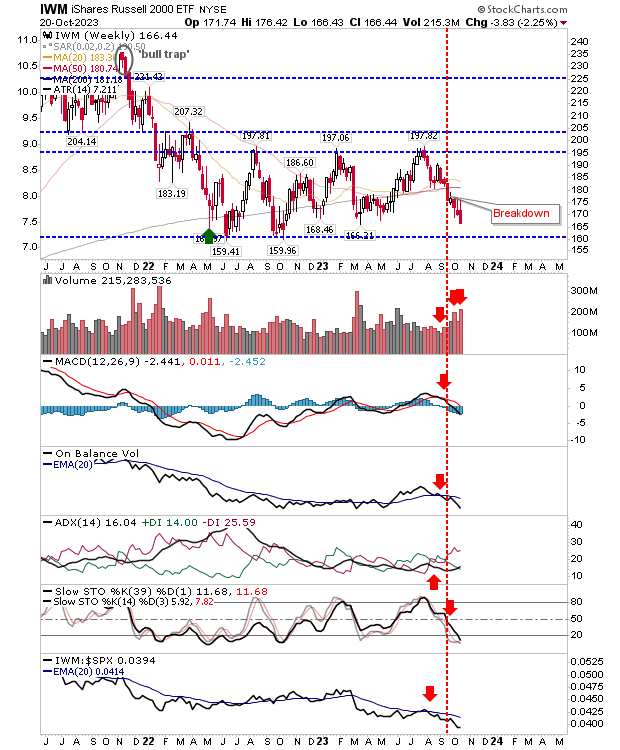

The Russell 2000 (IWM) is in freefall on the weekly time frame as it failed to hold 200-week MA support, but not after bouncing off it five times in failed rallies. The last support is to be found at the 2022 swing low, but it has already endured two tests, I suspect a third will be one too many (particularly given the time that has past between these tests).

The crash warning for the Russell 2000 ($IWM) is in play following Friday's close. Given the index is already well off its 2021 peak I would see any such crash as something short and sweet, perhaps bottoming in early 2024. It's by no means certain that a crash will happen and if you are an investor you shouldn't be waiting for any further discount but instead be buying with a 5-year+ time horizon. If you are a trader, these are dangerous times.