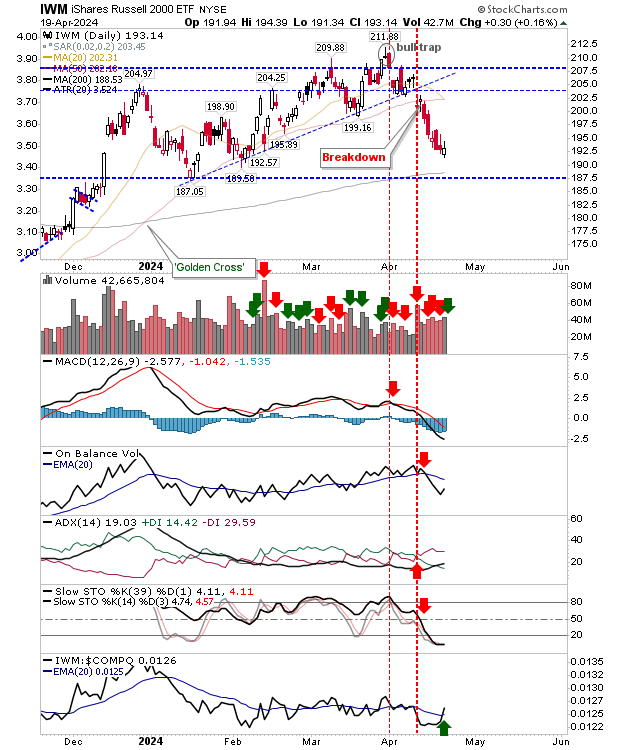

The divergence in the action between the Russell 2000 (IWM), and the S&P 500 and Nasdaq continues. If the Russell 2000 could go on to tag its 200-day MA, particularly if it's done on a bullish reversal candlestick, then there would be a good trade opportunity on offer here. Even a rally from here might be enough if there is a tight stop.

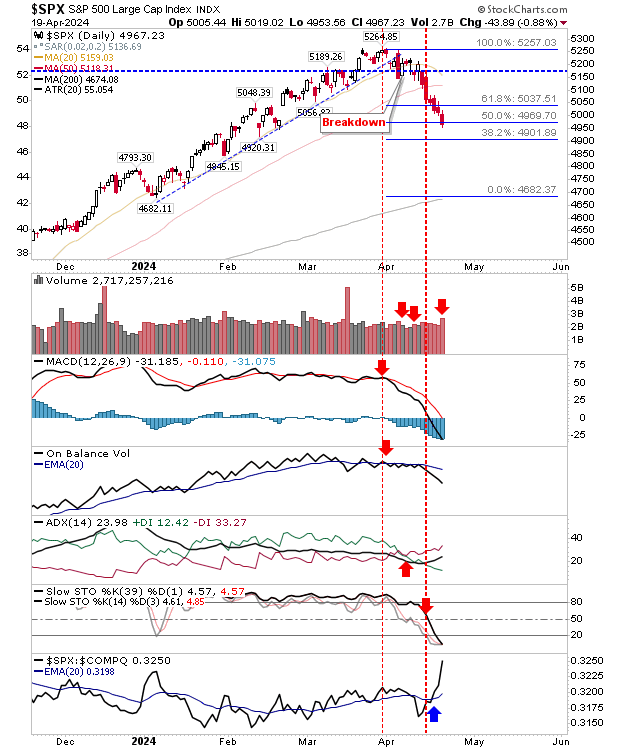

There is less joy to be found in the S&P 500. Fibonacci retracement levels haven't offered much support yet and the 200-day MA is a long, long way away. Despite that, the index has still managed to surge in relative performance against the Nasdaq.

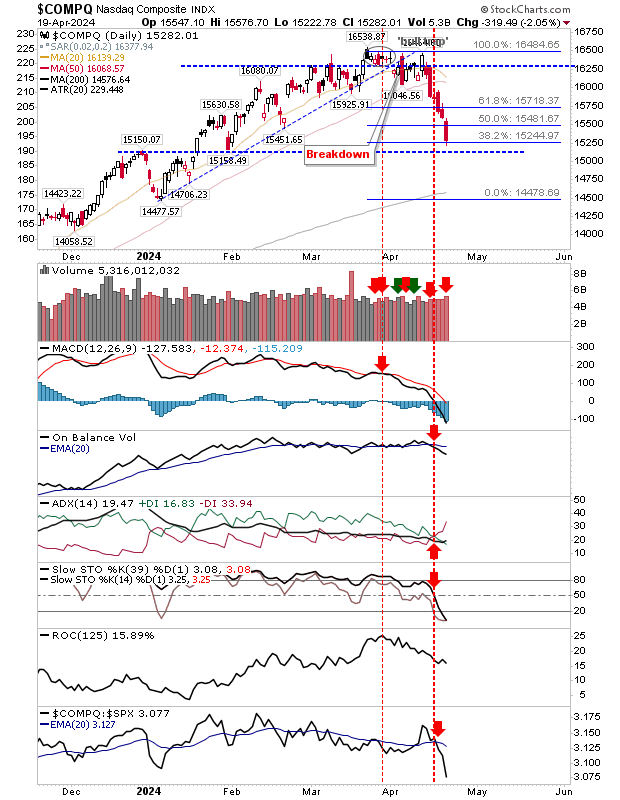

The Nasdaq accelerated its losses with a 2% loss. Support at 15,150 may offer a respite, but bulls would need to bid this up early in the week if this was to play as support.

There isn't a whole lot on offer for optimists, but if the Russell 2000 can stick around current levels there may be a trade opportunity.

It will probably take some stop-gap candlestick in the S&P 500 and Nasdaq to offer the incentive for the Small Cap trade. When this time comes, lows for new trading ranges will be established across these lead indexes.