The October ’22 highs for the 10-year Treasury yield were 4.22% – 4.25% those are closing highs. There is a 4.33% tick that might be a futures tick (after hours or pre-market trading) that’s also showing up, with the point being that readers should be watching these technical levels for a breakout in the 10-year Treasury yield. The last time the 10-year Treasury yield was around 3.40% – 3.50% – before moving much lower – was December ’07.

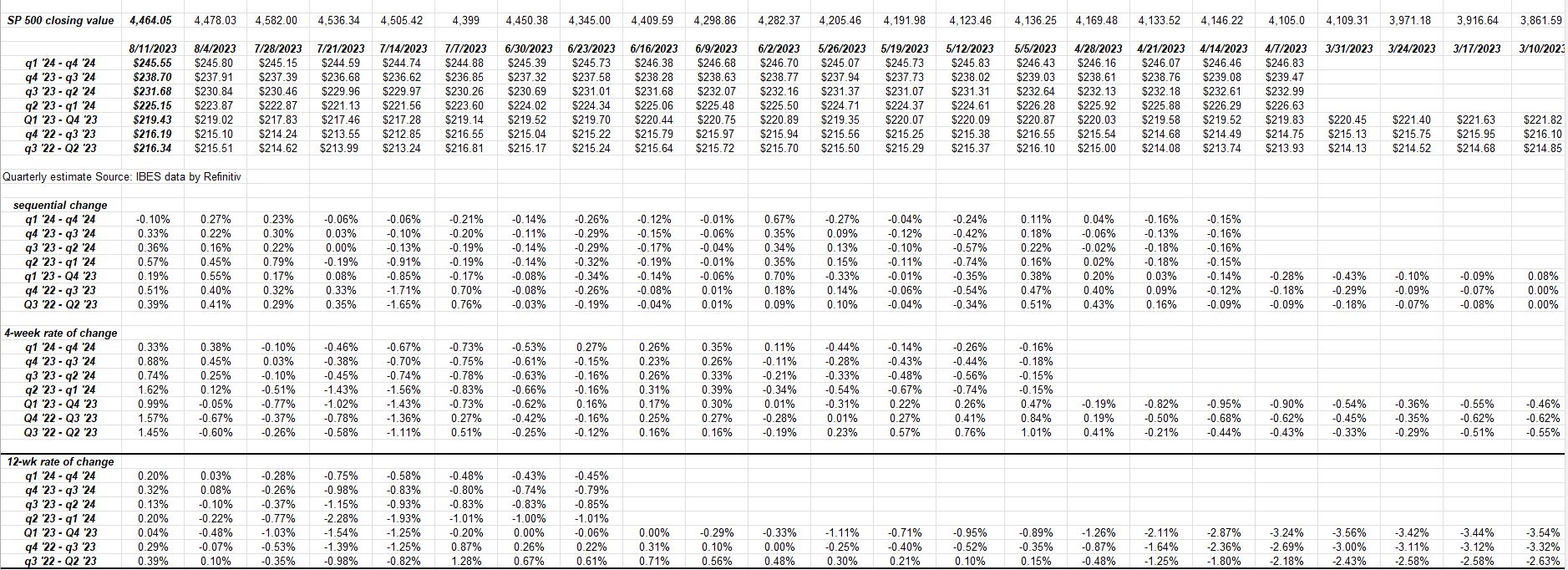

Data source: IBES data by Refinitiv

The above spreadsheet shows the “rate-of-change” of the S&P 500's forward EPS curve.

Note the bottom, black-bordered area, or the 12-week rate of change.

It’s improved materially since the end of March ’23.

S&P 500 Data:

- The forward 4-quarter estimate (FFQE) for the SP 500 increased this week to $231.67 versus last week’s $230.84, and the early January ’23 print of $228.38;

- The PE ratio on the estimate is 19.3x versus last week’s 19.4x;

- The SP 500 earnings yield increased to 5.19% versus last week’s 5.15%;

- The Q2 ’23 bottom-up estimate improved to $54.09 from last week’s $53.26;

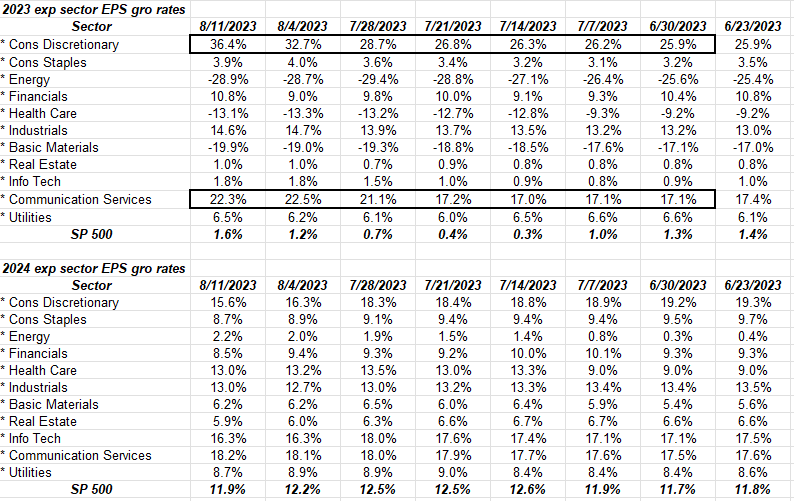

Expected Sector Growth Rates:

Data source: IBES data by Refinitiv

Again, the black-bordered areas show the improvement in SP 500 earnings coming from two sectors: consumer discretionary and communication services. Despite technology’s outperformance this year, the sector shows little improvement in 2023 earnings, and while 2024 is looking for better EPS growth for tech, the rate of change is minimal.

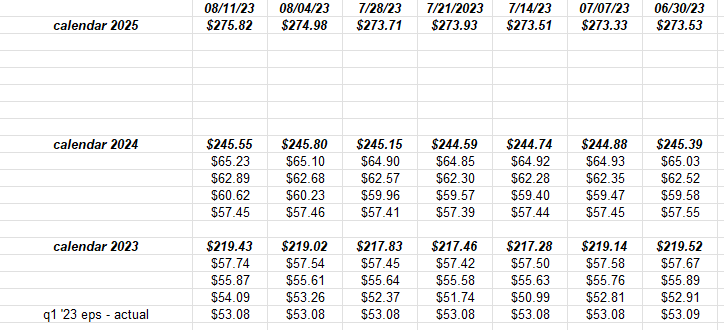

S&P 500 Forward Estimates Are Moving Higher:

Note the gradual increases in 2024 and 2025 SP 500 EPS estimates.

The normal pattern is typically gradual erosion.

Summary / Conclusion:

America’s largest retailer reports this week – Walmart (NYSE:WMT) – and readers also get a look at retail sales, too.

Growth stocks look to have a wet blanket thrown on top of them thanks to worries over higher interest rates, but the fact is technology sector earnings look unremarkable at best. Tech sector’s PE expansion is all about the AI excitement, and you have to think that has a few years to play out yet. I still have to read the conference call notes from the mage-caps and the tech sector earnings, but has one company quantified what AI might mean to either productivity savings or EPS gains.

Take all this with substantial skepticism and a considerable grain of salt. Past performance is no guarantee or predictor of future results. All SP 500 earnings data sourced within is from IBES data by Refinitiv. None of this information may be updated and if it is updated, may not be done in a timely fashion.