Car resale giant CarMax, Inc. (NYSE:KMX) is slightly lower this afternoon, last seen down 0.6% at $83.01. Traders are most likely gearing up for the company's first-quarter earnings report, slated for release before the market opens tomorrow, June 21. Below we will take a look at how KMX has been doing on the charts, and what the options market is pricing in for the stock's post-earnings moves.

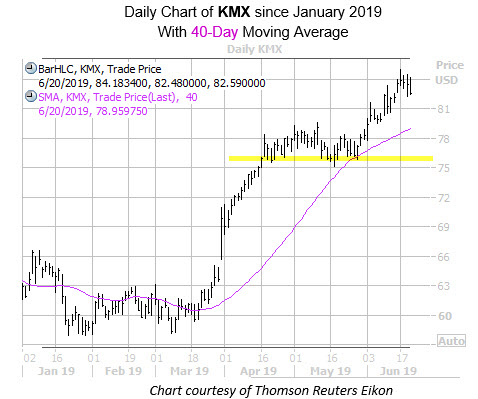

CarMax stock has being climbing the charts since a late-March post-earnings bull gap. Year-to-date, the security has added just over 30%, and after consolidating atop the 40-day moving average and $76 mark, KMX touched a record high of $84.99 this past Monday, June 17.

Digging into CarMax's earnings history, the stock has closed higher the day after earnings in six of the last eight quarters -- including a 9.6% surge in March, as well as a 12.9% gain this time last year. Over the past two years, the shares have swung an average of 5.6% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 8.7% swing for Friday's trading.

Looking toward analyst sentiment, CarMax stock has scored several bull notes ahead of earnings. Just this week, KMX saw price-target hikes from both Credit Suisse (SIX:CSGN) and RBC -- to $90 and $92, respectively. Likewise, the security hosts 10 "buy" or better ratings, just one "hold," and zero "sells." However, the consensus 12-month price target of $85.46 is just a hair's breadth from current levels. Should the company once again report stronger-than-expected earnings, there's room for additional price-target increases.

A strong earnings showing could also shake loose some shorts. Short interest surged more than 30% in the most recent reporting period, and now accounts for nearly 13% of KMX's total available float. At the stock's average pace of trading, it would take more than 12 sessions to buy back these bearish bets -- ample fuel for a potential short squeeze to drive the shares to new heights.