Cybersecurity provider SentinelOne Inc (NYSE:S) has fallen 44% year-to-date in the technology bear market despite its triple digit growth.

The cloud-based cybersecurity provider provides artificial intelligence (AI) based protection for endpoints, cloud, and identity, which are areas offering significant growth opportunities. Revenues rose 109% and non-GAAP gross margins hit a high of 68% in its fiscal Q1 2023 as customer count rose 55%. Annual recurring revenue (ARR) rose 110% to $339 and customers with ARR over $100,000 rose 113% to 591. The Company has over $1.5 billion in cash and raised its forward guidance.

Despite the economic slowdown amidst rising interest rates, cybersecurity remains a top IT spending priority indicating recession proof resilience. This is driven by secular trends including digital transformation, expanding attacks and data proliferation. Headlines have shown how costly it can be by not having a cybersecurity solution. SentinelOne delivers continuous autonomous protection through AI and machine learning and represents one of the largest operational implementation of AI in the world. The Company is still in its hypergrowth stage with a path to profitability driven by the scalability of its solutions and high margins. Prudent investors looking for growth in the cybersecurity segment can watch for opportunistic pullbacks in shares of SentinelOne.

Q1 Fiscal 2023 Earnings Release

On June 1, 2022, SentinelOne released its fiscal first-quarter 2023 earnings report for the quarter ending in April 2022. The Company saw an earnings-per-share (EPS) loss of (-$0.21), excluding non-recurring items, beating consensus analyst estimates for a loss of (-$0.24) by $0.03. Revenues rose 109.4% year-over-year (YoY) to $78.3 million, beating analyst estimates for $74.64 million. Annualized recurring revenue (ARR) rose 110% to $339 million. SentinelOne CEO Tomer Weingarten commented:

“Our Q1 results demonstrate the combination of a robust demand environment for our leading cybersecurity platform and impressive execution across the board. We once again sustained triple-digit growth with significant margin expansion, added a record number of new customers, and exited the quarter with an extremely strong pipeline. We’re raising our revenue guidance to nearly triple-digit growth again this fiscal year, which now includes our acquisition of Attivo Networks.”

Upside Revenue Guidance

SentinelOne raised guidance for fiscal Q2 2023 for revenues to come in between $95 million to $96 million compared to $84.83 million consensus analyst estimates. The Company sees fiscal full-year 2022 revenues to come in between $403 million to $407 million versus $371.03 million consensus analyst estimates.

Conference Call Takeaways

CEO Weingarten (NYSE:WRI) mentioned some highlights of the quarter including Q1 2023 as its fifth consecutive quarter of triple-digit ARR growth, which it expects to repeat next quarter. Cybersecurity outlook looks bright prompting the Company to raise its guidance. He emphasized the success of its land and expand strategy as evidenced by the record number of new clients growing even more than the seasonally strong fourth quarter. He hinted at some of the notable wins which included a one of the country’s largest telecoms, a major U.S. agency, and a global media conglomerate. It’s net retention rate rose toa record 131%.

They also closed on its Attivo acquisition, making its footprint in the identity security segment. Cloud security continued to be its fast growing segment. Demand for mission-critical cybersecurity has never been stronger and is a top IT spending priority. The patented technology core Singularity XDR platform is the largest operation implementation of AI in the world as its delivers autonomous protection. CEO Weingarten summed it up:

“Our XDR platform addresses the major attack surfaces that enterprises need. In addition to endpoint, these emerging capabilities like cloud, Ranger, data, and vigilance are delivering growth. Cloud grew to nearly 10% of our Q1 ACV.”

Opportunistic Pullback Levels

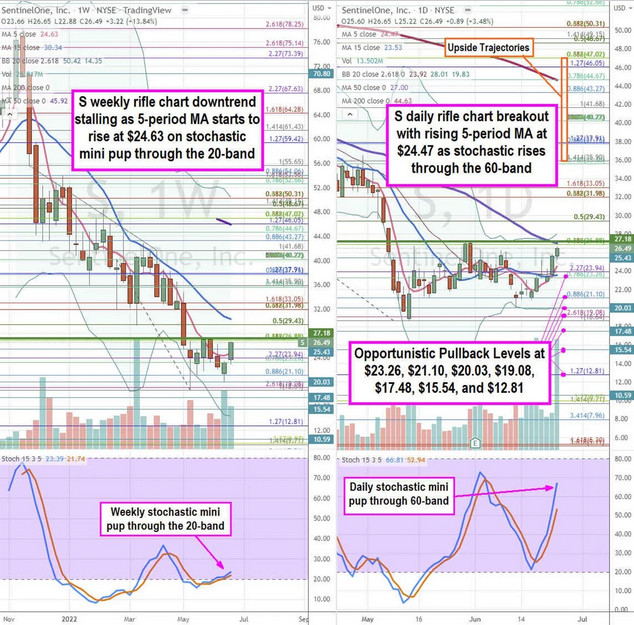

Using the rifle charts on the weekly and daily time frames enables a precision view of the price action playing field for S stock. The weekly rifle chart formed an inverse pup breakdown when it cracked the $37.91 Fibonacci (fib) level. The downtrend put in a bottom neat the $19.08 fib before staging a rally back up through the weekly 5-period moving average (MA) resistance at $24.63 towards the 15-period MA resistance at $30.34. The weekly lower Bollinger Bands (BBs) sit at $14.36 and daily 50-period MA sits near the $46.05 fib. The weekly stochastic is forming a stairstep mini pup through the 20-band. The weekly market structure low (MSL) buy triggers on a breakout through $27.18 which also nearly overlaps with the daily 50-period MA at $27.00. The daily rifle chart breakout has a rising 5-period MA support at $24.47 followed by the 15-period MA at $23.53 as the stochastic rises through the 60-band. The daily upper BBs sit at $28.01. Prudent investors should avoid chasing and patiently watch for opportunistic pullback levels at the $23.26 fib, $21.10 fib, $20.03 , $19.08 fib, $17.48, $15.54, and the $12.81 fib. Upside trajectories range from the $35.90 fib level up towards the $47.02 fib level.