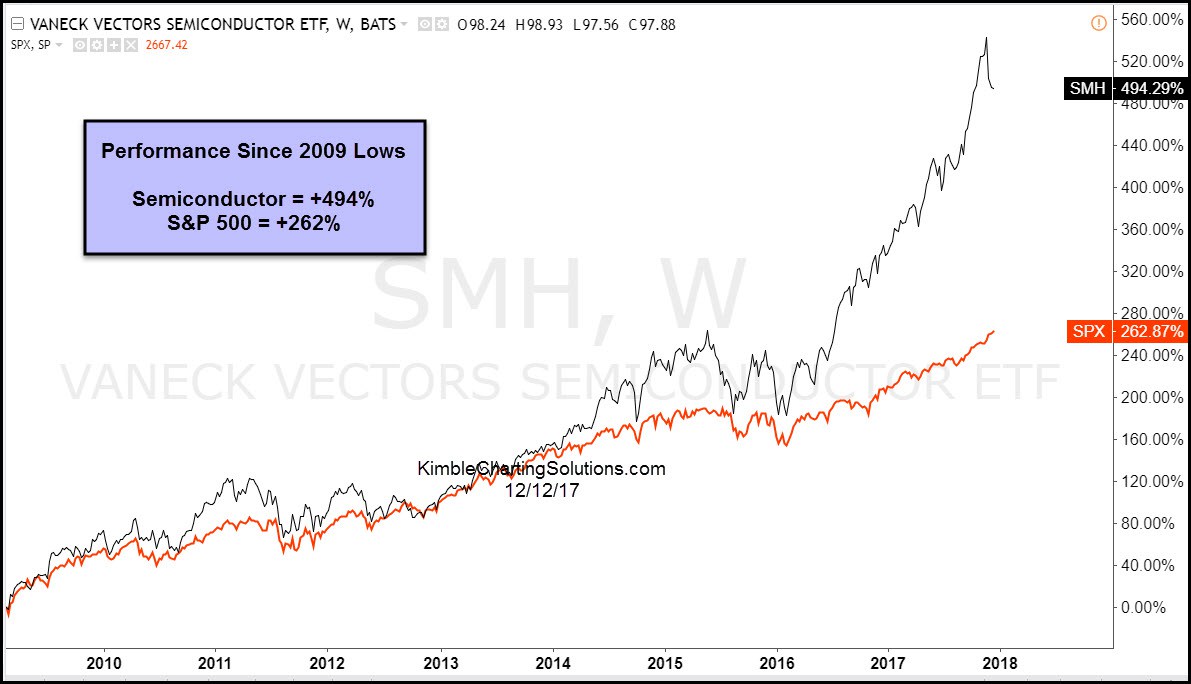

Since the 2009 stock-market lows, investors have looked to the Semiconductor sector for strong returns and market leadership.

Just check out its performance vs. the broader stock market: Semiconductor ETF SMH +494% vs S&P 500 +262%.

With numbers that double those of the S&P 500, it’s fair to say that the Semiconductors have provided important leadership for this bull market.

And that leadership has become much more apparent (and “visual”) in the past 18-24 months. Just look at the Semiconductor rally and outperformance! See chart below.

If you look closely at the chart above, you’ll note the recent downturn/pullback for SMH. That brings us to the importance of our next chart – a “monthly” bar chart that highlights why the Semiconductors have pulled back here.

Semiconductors Testing 2000 Highs

SMH recently tested its 2000 price highs (see points 1 & 2 on the chart below), before reversing lower to test uptrend price support (point 3). This action created a bearish reversal pattern and gave market bulls a strong reason to put SMH on their radar.

One thing is certain: Bullish investors don’t want to see this market leader break down!