As professional traders, we spend a lot of resources determining whether we are in a bull-up market or a bear-down market. The follow-up to this is our additional efforts in finding the right places to buy or sell in either of these scenarios.

As traders, we also have different styles or time frames that we trade. For instance, longer-term trend traders may utilize the daily, weekly or even monthly charts. In comparison, shorter-term swing traders may utilize the 4-hour or 1-hour charts.

Much emphasis and resources are committed to these efforts. However, we have learned that going to cash or having a cash position is just as important, if not more important, than having an actual position in the market.

The beautiful thing about trading is that the trader is in control. We do our research, and then after weighing the evidence, we have the edge in that we have complete flexibility in determining whether we buy, sell, or do nothing.

Cash Position Versus Invested In The Markets

Taking a position and making +20, +30 or +40% is great. But going to cash and avoiding a 20, 30 or 40% drawdown is just as important. We could even say that having the ability to go to cash is even more important, as it protects our attitude and our health. There is nothing enjoyable about worrying about a position 24 hours a day, seven days a week.

A trader should ask themselves: Is holding onto this position worth the stress and worry about whether the market is going to rally? Or, will the market give me back a small portion of my hard money losses? Or, will the bottom completely fall out of the market, which will destroy my account?

Age is a defining factor in answering this question. Depending on our age, do we have the time or the energy to make back losses if the unthinkable happens? Successful traders have learned the hard way that retreating (going to cash) may be the best option, as you live to fight another day.

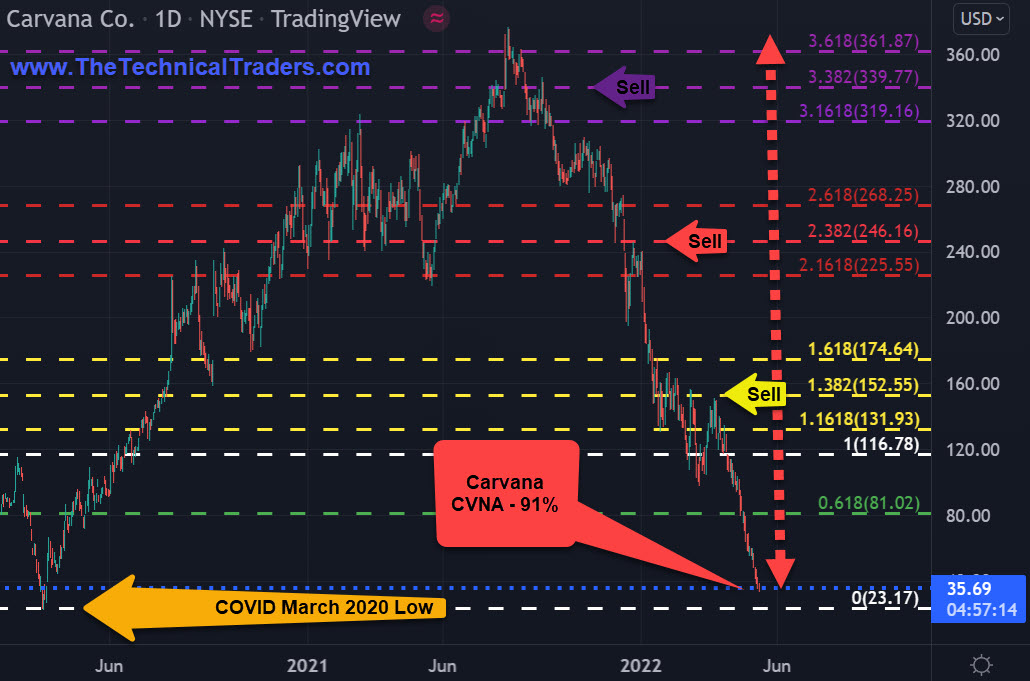

Carvana -91%

Carvana (NYSE:CVNA) is the perfect example of the bottom falling out unexpectedly. The rallies were short-lived, ranging from four to 14 days. After CVNA had dropped about 25%, it only rallied back about 14 days before it started a steep but steady decline. CVNA is a textbook example of the importance of accepting a loss and going to cash.

As technical traders, we exclusively follow price. This, too, is an important concept to grasp. Following and trading price simply means that the market tells the trader what to do, and not the other way around. Being one with price will deposit money into your trading account. Fighting price will withdraw money out of your trading account. The market (or price) does not care what a trader’s opinion or bias is.

Managing and protecting our hard-earned capital is our individual responsibility and should be the top priority.

CARVANA CO. • CVNA • NYSE • DAILY

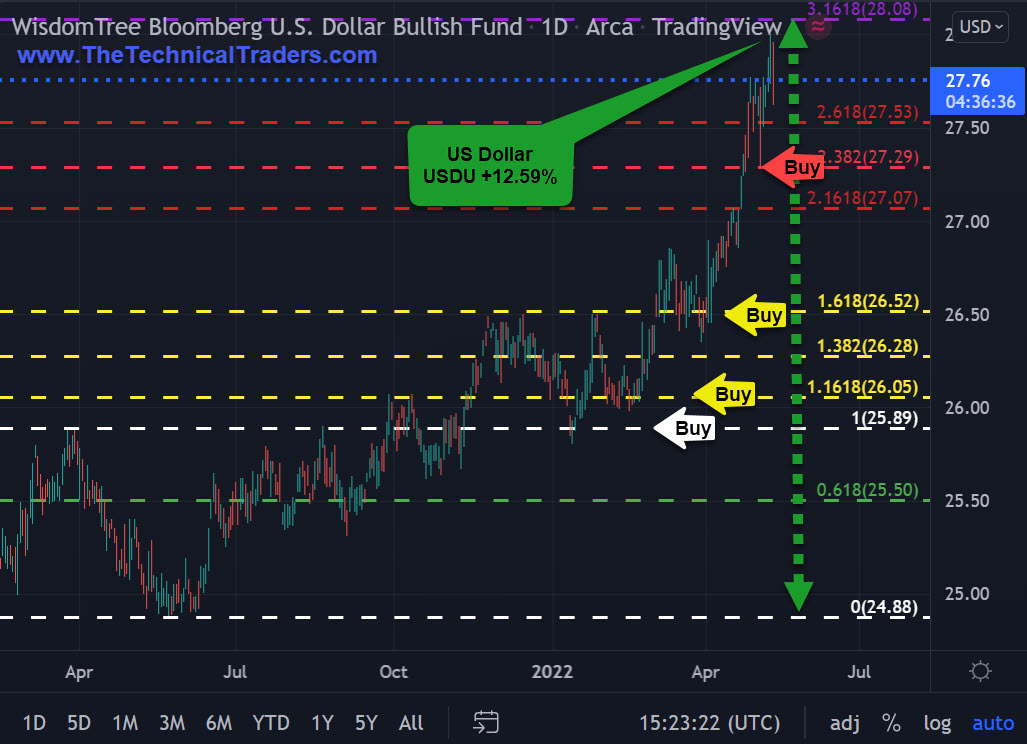

U.S. Dollar – A Strong Buy

If a trader doesn’t trade currencies, why should they even care about what is happening to the USD?

Think about the world economy. Whether a stock, ETF, bond or commodity, everything is affected by the currency it is traded in. Currency is part of the fundamental make-up of each market. Tracking and understanding global money flows provides us with the big picture.

Armed with that information, a trader can make better decisions about the markets they trade or how they manage their cash position. In other terms: risk-on, risk-off, trade-on, trade-off, capital invested, capital not-invested, etc.

The U.S. Dollar continues to attract capital from investors all over the world. But could this be a double-edged sword for U.S. stocks? As capital flocks to the USD, this, in turn, hurts U.S. multinationals, as they need to convert their weak foreign currency profits back into USD.

The USD safe-haven trade may eventually trigger a broad and deep selloff in U.S. stocks. As the USD continues to strengthen, corporate profits for U.S. multinationals will shrink or disappear.

U.S. Multinational $1-Billion Revenue Example:

- $1 billion in revenue-generating a 15% net profit with a net neutral 0% currency translation equals a $150 million profit.

- $1 billion in revenue-generating a 15% net profit with a negative -15% unfavorable currency translation expense equals a $0 profit!

In addition, the impact of inflation on the global consumer will lead to a pullback in consumer spending, which will further reduce corporate revenues and profits. Combining the global currency dislocation and the economic cool off will bring on a global recession.

Wisodom Tree Bloomberg – U.S. Dollar Bullish Fund ETF • USDU • ARCA • DAILY

RUSSELL 2000 SMALL CAPS -29.96%

The Russell 2000 stock index is considered the bellwether of the U.S. economy. The index measures the performance of 2,000 smaller companies whose focus is on the U.S. market. Tracking this index gives us a broad overview of the health of the overall stock market.

Since bottoming in March of 2020, the iShares Russell 2000 ETF (NYSE:IWM) has more than doubled. But in November 2021, the IWM put in its final top. Upon completing and then breaking out of a distribution wedge, the IWM is now solidly in a bear market.

Knowing this information tells us that we should seriously consider we are in a period of risk-off, no-trade and cash as a position.

For experienced traders, they may consider buying non-leveraged inverse index ETFs on days when the market has a sharp spike rally up.

ISHARES • RUSSELL 2000 ETF • IWM • ARCA • DAILY