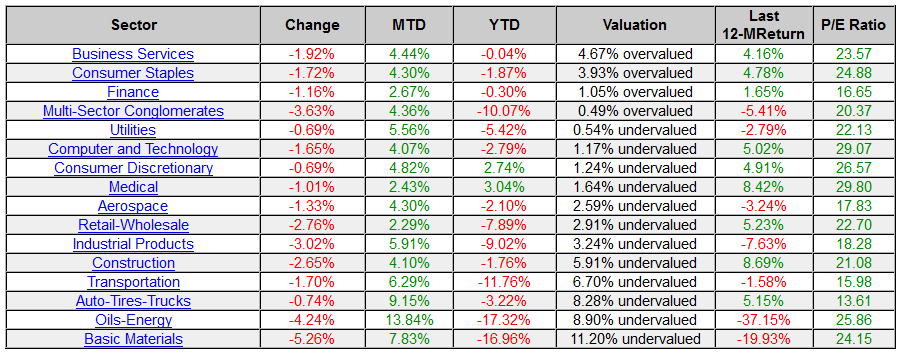

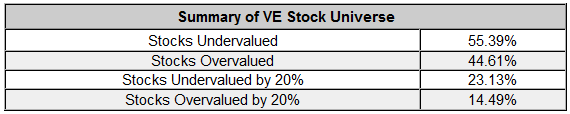

VALUATION WATCH: Overvalued stocks now make up 44.61% of our stocks assigned a valuation and 14.49% of those equities are calculated to be overvalued by 20% or more. Four sectors are calculated to be overvalued.

Time To Pop A Cold One?

--SABMiller PLC (L:SAB) Accepts Anheuser-Busch Inbev SA (N:BUD) Offer, Approved Deal Would Create Beer Giant

It took some extra cash and effort, but the long-proposed merger deal between SAB Miller and AB InBev is now a reality with the news today that SAB Miller accepted a sweetened offer from AB InBev totaling at $104 billion.

The resultant firm would dominate every beer market across the globe and big macro brewers are already facing scrutiny for anti-competitive practices related to their purchase of distributors. That sort of vertical integration sets off alarm bells for smaller competitors and craft brews.

And, is bigger always better? While the merged companies would own almost 30% of the global market, macro players still have no answer for the craft juggernaut, and acquiring a ton of other large macro brews hardly seems like an effective strategy for satisfying the tastes of the world's increasingly demanding--and fickle--craft drinkers.

But that problem exists in developed markets--where overall beer consumption is flat/shrinking. In emerging markets such as Africa--where SAB Miller is a the big player, there may still be room for growth in the macro portion of the market. And, SAB Miller also brings a strong soft-drink business the table. That should help AB InBev as sales of Budweiser and Bud Light continue to plummet.

Of course the real question now is whether or not regulators will allow this behemoth to occur. And SAB Miller certainly is aware that the deal may get shot down, they asked for--and received--a $3 billion payment if regulators refuse to green light the massive merger.

Details still need to be worked out here. The companies will have to divest themselves of certain brands to avoid even more antitrust scrutiny, undoubtedly jobs will be cut on both sides, and some beers will be phased out in an effort to force macro consumers into flagship products such as Budweiser.

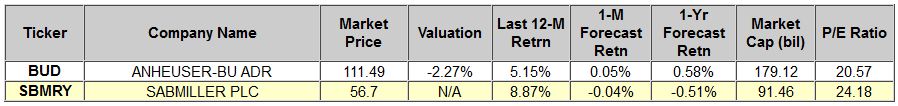

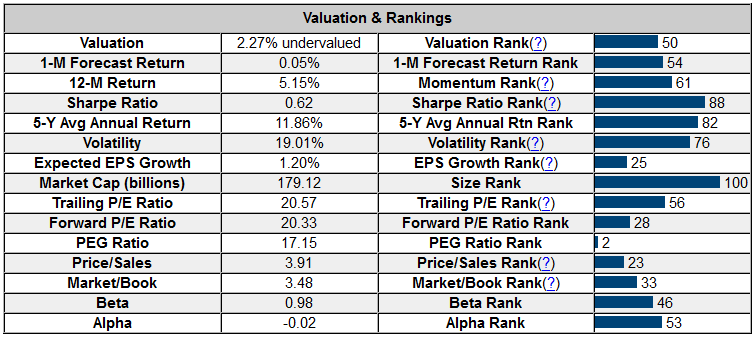

Below, we present the latest data on the two beverage giants. First some key metrics compared, then the more extensive data from our systems. Neither of the stocks is currently rated a BUY.

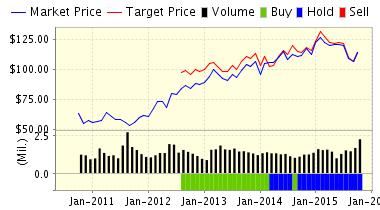

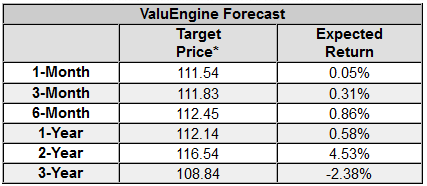

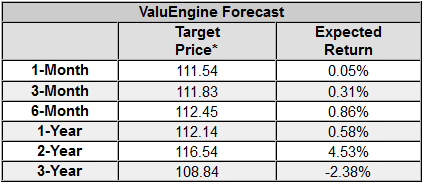

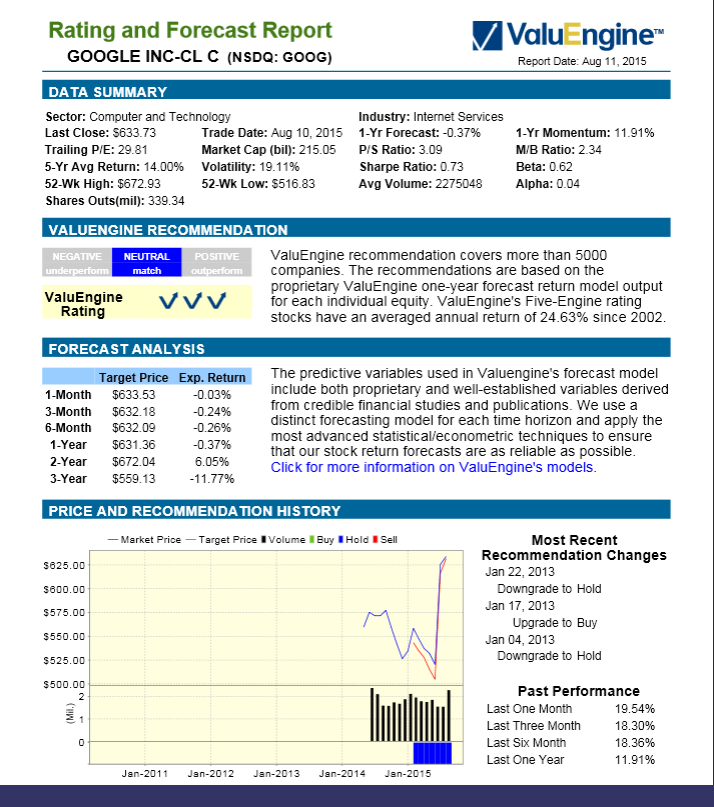

Below is today's data on ABInBev:

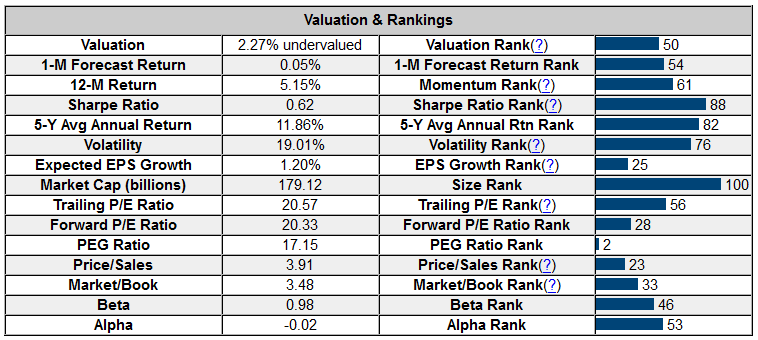

Anheuser-Busch is the leading global brewer and one of the world's top five consumer products companies. Their portfolio of well over 200 beer brands continues to forge strong connections with consumers. They invest the majority of their brand-building resources on their Focus Brands - those with the greatest growth potential such as global brands Budweiser, Stella Artois and Beck's, alongside Leffe, Hoegaarden?, Bud Light, Skol, Brahma, Antarctica, Quilmes, Michelob Ultra, Harbin, Sedrin, Klinskoye, Sibirskaya Korona, Chernigivske, Hasserder and Jupiler. In addition, the company owns a 50 percent equity interest in the operating subsidiary of Grupo Modelo, Mexico's leading brewer and owner of the global Corona brand

VALUENGINE RECOMMENDATION: ValuEngine continues its HOLD recommendation on ANHEUSER-BU ADR for 2015-10-12. Based on the information we have gathered and our resulting research, we feel that ANHEUSER-BU ADR has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Price Sales Ratio.

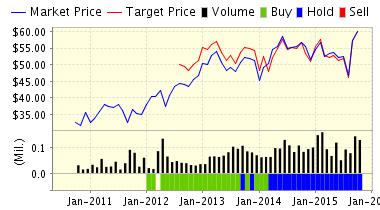

Below is today's data on SABMILLER PLC:

SABMILLER PLC (SBMRY) is one of the world's largest brewers with brewing interests or distribution agreements in over sixty countries across six continents. The principal activities of the Company and its subsidiaries are the manufacture, distribution and sale of beverages. The group's brands include premium international beers such as Grolsch, Miller Genuine Draft, Peroni Nastro Azzurro and Pilsner Urquell, as well as an exceptional range of market leading local brands. Outside the USA, SABMiller (L:SAB) plc is also one of the largest bottlers of Coca-Cola products in the world.

VALUENGINE RECOMMENDATION: ValuEngine continues its HOLD recommendation on SABMILLER PLC for 2015-10-12. Based on the information we have gathered and our resulting research, we feel that SABMILLER PLC has the probability to ROUGHLY MATCH average market performance for the next year. The company exhibits ATTRACTIVE Company Size but UNATTRACTIVE Book Market Ratio.

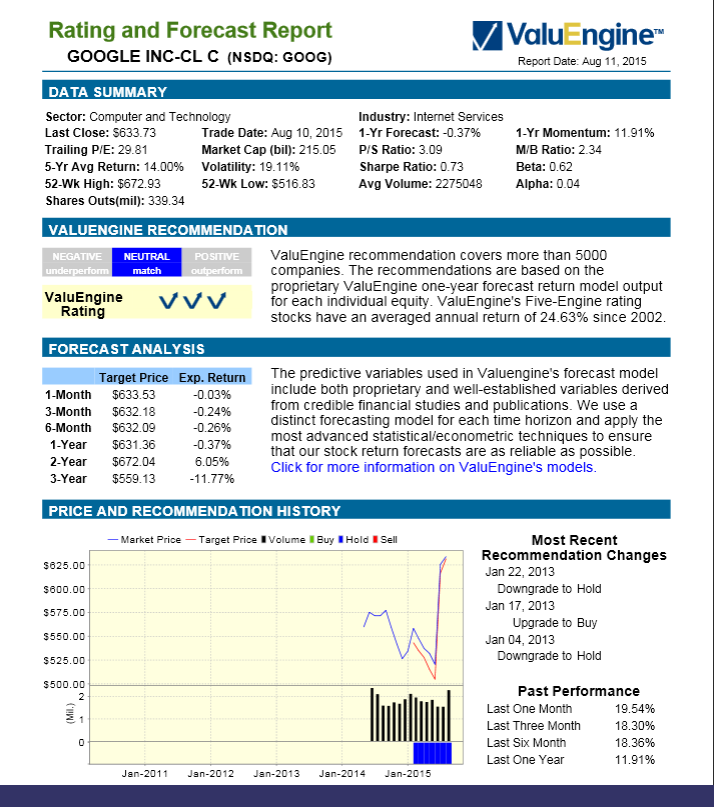

You can download a free copy of detailed report on SBMRY from the link below.

ValuEngine Market Overview

ValuEngine Sector Overview