I predict a decline for the S&P 500 (SPY) on Thursday, because I am “selling the news.” I have been wrong every day this week so far. Yesterday, the S&P 500 went against me with a 1.38% gain on the hopes that Congress would come up with a deal, and thankfully they did. The Dow Jones Industrial Average (DIA) rose 1.36% and the NASDAQ 100 (QQQ) rose 1.29%.

Hindsight is always correct, but part of me really felt the US could have defaulted last night (again, thankfully not). Stock markets did not feel that way however, as it is clear from yesterday’s gains that investors were driven by hope and absolute certainty that the US would not default. Now that a deal is made, the government is re-opening, and the bills will be paid, I predict the classic “sell the news” kind of day, because underneath all of this we are still looking at a fundamentally and technically weak market.

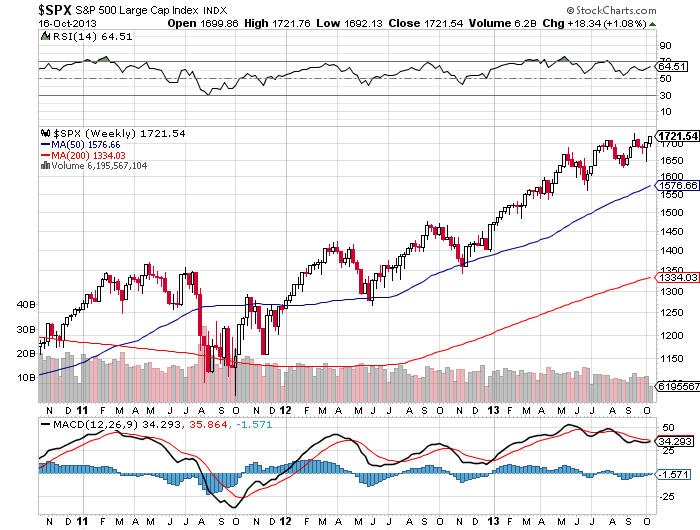

From a technical perspective, the only major S&P 500 indicator that supports my forecast is the RSI, which is just ten points off from overbought levels (60.60). The S&P 500′s MACD is robustly situated at 2.43 and looks poised to keep going up. From a weekly perspective, however, we are in negative territory with the MACD and RSI, which is why I am in part selling the news for tomorrow:

chart courtesy of stockcharts.com

International markets are all in the green at the time of this writing. I guess I shouldn’t be surprised here because we skated through a potential world-wide soup kitchen.

US Futures Markets are trading in the red at the time of this writing, which does not really mean anything except for the fact that perhaps investors are feeling slightly jittery from the past days’ roller coaster ride.

Speaking of roller coaster rides, the VIX Index (NYSEARCA:VXX) should feel ready to vomit as it dropped 21.17% yesterday in a huge sigh of relief. Does this mean a relief rally for Thursday in equity markets? Perhaps, but I feel that investors have already partied hard for the week without a nice floor beneath them.

Yesterday we were supposed to get Consumer Price Index and Core Consumer Price Index reports, but the government was shut down so we didn’t. We did however get a Home Builder’s Index report, which declined 2 points, not good. Tomorrow, outside of the government re-opening, is a huge day for economic reports, with expected Jobless Claims, Housing Starts, Building Permits, Industrial Production, Capacity Utilization, and Philly Fed updates all due out in the morning. And, because the government is now open, we may actually get them all!

And for our fun fact of the day: According to CNN.com, Oreo cookies are apparently as addictive as cocaine in lab rats. The study says so. Make sure to keep your pantry door shut!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500: Look For A Decline

Published 10/17/2013, 09:51 AM

Updated 05/14/2017, 06:45 AM

S&P 500: Look For A Decline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.