Stock futures in the US are pointed toward a higher open with the S&P 500 indicating that we will see prices rise to their highest levels in nearly 4 years (when the main story in markets was the bankruptcy at Lehman Brothers). Part of the reason for the rise is the market consensus for today’s consumer confidence figures, which are expected to come in strongly.

A positive close today will be the fourth consecutive session showing gains in US markets, following yesterdays rally after the better than expected housing numbers in the region. Macro data has been generally supportive of the price activity in equity markets since the beginning of the year but another factor is that we are not seeing any new negative developments relative to the debt situation in Europe.

Today’s figures will be the Consumer Confidence report from the Conference Board and this is expected to have risen to 63 for the month of February (after a rise to 61.1 last month). This will be released along with Durable Goods Orders, but expectations here are that we will see declines for the month. Part of the reason for the negative expectations here are coming from slowing demand in airplanes and falling home prices.

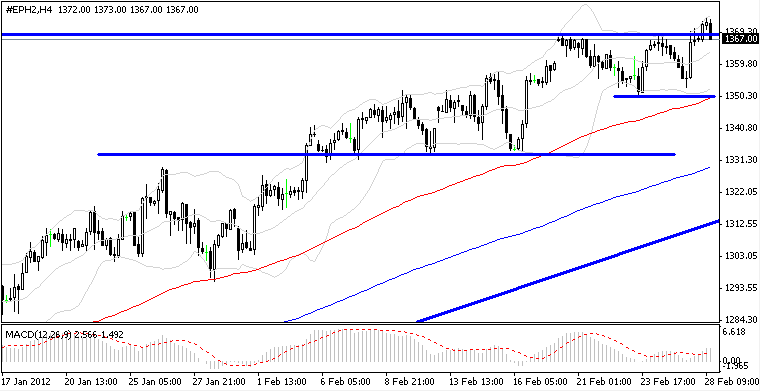

The S&P 500 has seen a rally of 4.2 percent so far this month, and a positive close here will be the third consecutive month in positive territory as corporate earnings and macro releases have been supportive of sentiment. The S&P is currently trading at roughly 14 times earnings, which is still slightly below the 50-year average (approximately 16.5 times earnings).

Also seen supportive of stock prices is the effect of commodity producers, which have rallied on the higher price levels seen in oil and metals. Some of the biggest gainers have been Newmont Mining (the second largest gold producer in the world) and Freeport-McMoRan (the largest copper producer in the world). Copper prices have rallied for the past three days on speculation that policy accommodation in China will spur manufacturing demand. Traders in other markets should remain watchful of the rally in commodities, as this has specific correlations in both equities and currencies. EUR/USD" title="EUR/USD" width="762" height="391">

EUR/USD" title="EUR/USD" width="762" height="391">

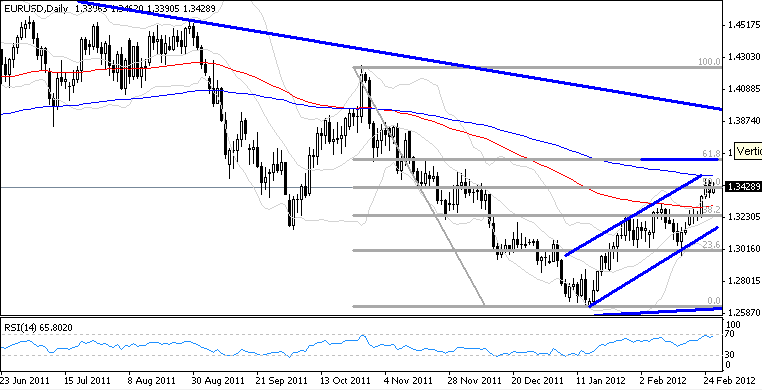

The EUR/USD came within 20 points of testing critical psychological resistance at 1.35, before dropping to 1.3360 in a corrective move. Prices are once again trading close to the highs but a new break is likely to have trouble overcoming 1.35 on the first test. Aggressive traders can take short positions into this area but stops need to be kept very tight here as a break will accelerate gains. A downside break of 1.3360 will turn the bias to consolidative and likely bring some stalling in price action.

The S&P 500 is grinding through some very important long term highs but follow through has been limited and this brings some risk of false breaks going forward. Risk to reward ratios clearly favor short positions at these prices but we have seen little evidence that a top is actually in place here and we will wait for clearer signals before getting short. A break of support at 1350 will remove the bullish bias and target a further retracement back to 1330 first.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

S&P 500 Closes-In on Highest Print Since Lehman Collapse

Published 02/29/2012, 06:22 AM

Updated 07/09/2023, 06:31 AM

S&P 500 Closes-In on Highest Print Since Lehman Collapse

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.