Last week’s broad market rally puts us at an interesting crossroads…

While the primary bullish trend lines were clearly broken earlier in the month, the price action has rebounded – putting key indices back above important EMA support areas.

But at the same time the market has been pushing higher, the fundamental data has been less than encouraging. The first quarter GDP report came in at 2.2% annual growth – well below expectations – as business investment showed particular weakness.

This “bad news” was essentially shrugged off by equity traders, who saw the weakness as a great opportunity for the Fed to renew its promises of ample liquidity with essentially zero interest charges for the foreseeable future. Incidentally, Treasuries posted their 6th straight positive week despite a modestly more “hawkish” FOMC announcement this week.

Midway through April, we had the chance to take a solid shot on some attractive R (reward to risk) bear scenarios. A few of these trades resulted in quick profits. And a few hit our tightened risk points during the rally last week.

The net result is that our overall exposure has been whittled down quite a bit in response to the market environment. This type of situation is normal. There are times when you get the chance to step on the gas, and then quickly have to maneuver around new obstacles.

Considering the cross currents that were introduced last week, the waters are a bit more muddy for short-term trades. At the same time, there are a number of sectors and industries that look very promising. More data this week in the form of earnings announcements and economic reports should help to clarify the action – giving us opportunities to set up new trades along the way.

Below are some of the area’s we’re watching this week…

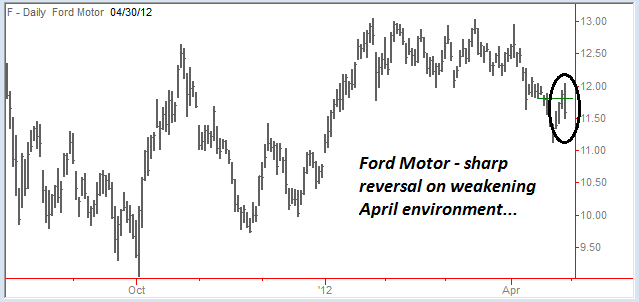

Auto-Makers Backfire

Last week Ford Motor (F) reversed sharply lower after reporting earnings for the first quarter. While the headline numbers were good, Ford reported an operating loss in China. More importantly, management comments frightened investors as the picture is souring early in the second quarter.

During the conference call, management stated that “April has been challenging.” Considering the fact that the stock has already broken below a key support area, this bearish fundamental data didn’t help the bull’s case at all.

After drifting higher early in the week, Ford reversed sharply – setting up a great bearish continuation pattern.

The bearish environment is confirmed by the price action in General Motors (GM), as well as key supplier Goodyear Tire & Rubber (GT). Goodyear expects weakening volume as the company adopts a strategy to focus on premium tires – and investors interpret this to mean the company is finding less demand for its “standard” lines.

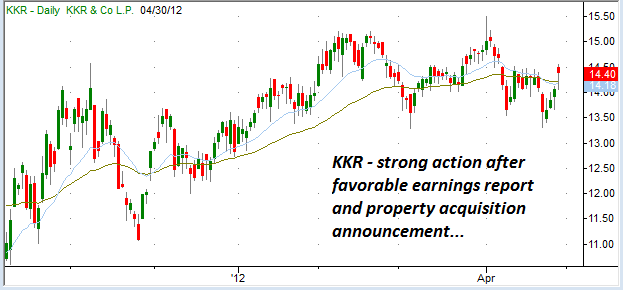

Private Equity Capitalizing on Opportunity

On the bullish side of the ledger, things are looking better for several private equity companies…

Last week, KKR & Co. (KKR) announced “economic earnings” of 99 cents – well above estimates for 73 cents per share. The stock had a decent week, and is rebounding off a key support area (after bottoming in 2010).

It’s interesting to note that the company has been much less aggressive on the acquisition side. KKR only made 2 major purchases in the first quarter – and is likely to see more profits from distribution of assets, IPO transactions, or other selling transactions. When these events occur, it allows the PE firms to book incentive allocations – obviously good news for KKR shareholders.

An interesting note from the earnings presentation is that KKR made a $196 million shopping mall acquisition last week. Commercial real estate (particularly retail-based) has been fairing well over the last several quarters. Simon Property Group (SPG) has been trending sharply higher and had a blowout earnings announcement last week as well.

Picking up exposure to strong retail properties should be a cash-flow positive proposition for KKR in the short-run, with plenty of opportunity for capital gains if and when they decide to book profits on the property.

Both KKR and Fortress Investment Group (FIG) look like strong bullish candidates, provided the patterns remain intact and the overall equity environment doesn’t fall apart.

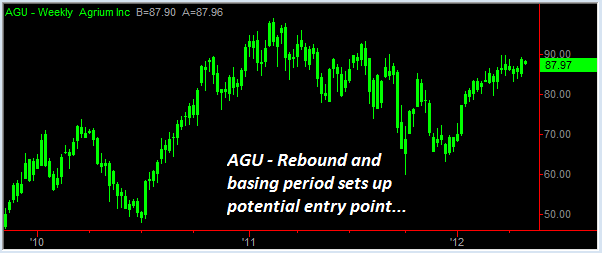

Fertilizer Stocks Back on the Radar

We have taken a step back from fertilizer stocks after the group faded into the end of the year. But the recent action for the group has been much more encouraging, and last week CF Industries (CF) broke to a new high.

A warm spring across the northern hemisphere has led to a record planting season. This of course leads to stronger demand for fertilizer – and inventories are being drawn down.

During the quarterly earnings call, Mosaic Co. (MOS) management stated that both domestic and international markets had strengthened significantly – comments which helped boost investor sentiment for the group.

Production activity is picking up for the group, and even larger conglomerates like BHP Billiton (BHP) and VALE Sa. (VALE) are exploring ways to boost their exposure to the area.

Earnings season is still in full swing and there are plenty of data points both on an individual stock level as well as reports that could move entire sectors or asset classes.

Risk management is the name of the game this week. We’re managing our exposure carefully while still keeping an open mind for potential entries in attractive sectors.

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Risk Management Is The Name Of The Game

Published 05/01/2012, 12:30 AM

Updated 07/09/2023, 06:31 AM

Risk Management Is The Name Of The Game

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.