Market movers today - Market focus remains on the probability of forthcoming central bank easing with most prominently rates markets re-adjusting the probability mass between a 25bp (our eventual call) and a 50bp FOMC rate cut at the end of the month.

- Today, our eyes will primarily be on Sweden and the Riksbank minutes set for release at 09:30 CEST. As the decision to leave the repo rate path was unanimous, it will be interesting to see how the board has interpreted and processed recent dovish signals from ECB and Fed. We would have assumed at least perma-dove Per Jansson to enter a reservation in light of recent financial developments, but not so. Swedish inflation (and inflation expectations) are still reasonably close to target, which might be one reason for the relative 'hawkishness' of the Riksbank despite looming rate cuts from both Fed and ECB. However, the Swedish economy is poorly insulated against a substantial global downturn and recent Riksbank communication (e.g. Ingves' press conference following the June-meeting) diverges from the ECB narrative, painting a much brighter picture of the global, and especially European, economy. We will therefore scrutinise the minutes for any arguments underpinning that divergence.

- In Norway , Norway Statistics publishes Q2 house prices this morning. However, given the close correlation to Real Estate Norway's monthly prints this release should not have any market impact. Overall, the housing market in Norway has been modestly on the rise in 2019 and recently stronger than pencilled in by Norges Bank. This in turn has supported the central bank's signal of a September rate hike, the third this year.

- In the euro area, we get a further piece of the puzzle on where GDP growth will arrive in Q2 with the industrial production data for May . The April figures pointed to a weak start for the industrial sector into Q2 and country figures already released paint a mixed picture for May. We still think that the industrial sector will likely have returned as an outright drag on growth in Q2. We also get Chinese trade data for June . Although volatile on a monthly basis, markets will scrutinise these data for indications of the state of Chinese and global demand ahead of the trade truce reached at the end of June.

Selected market news

This morning most Asian equity indices are modestly higher despite trade war concerns resurfacing (see below) and US core CPI dampening speculations of a 50bp FOMC rate cut at the end of this month. 2Y swap rates have erased roughly half of the decline triggered by Fed Chair Powell's first part of his semi-annual policy testimony on Wednesday leaving a roughly 18% probability of a 50bp cut (82% for 25bp). While we ultimately expect a 25bp cut, we think it is fair that markets price a non-zero probability of a larger cut.

Late in yesterday's European session, US President Trump lashed out at China on Twitter for ' letting us down in that they have not been buying the agricultural products from our great Farmers that they said they would'. According to US officials, China promised to step up US farm product purchases at the G20 summit last month as an important part of securing the trade truce. Chinese state media, however, report that no official deal on farm products was reached at the summit. Meanwhile, the first high-level trade negotiations between China and the US re-started this week.

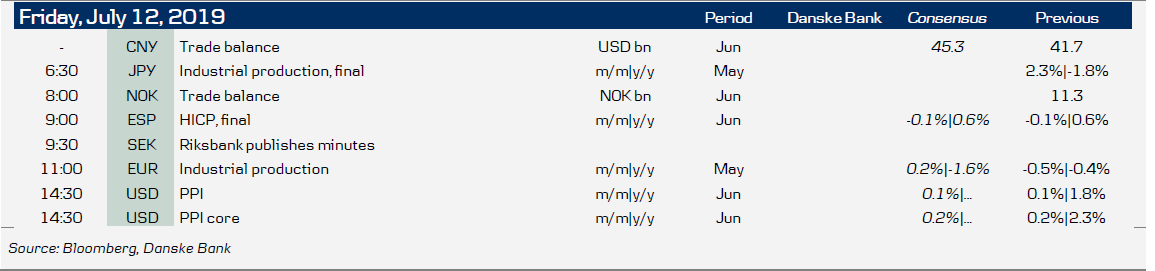

Key figures and events