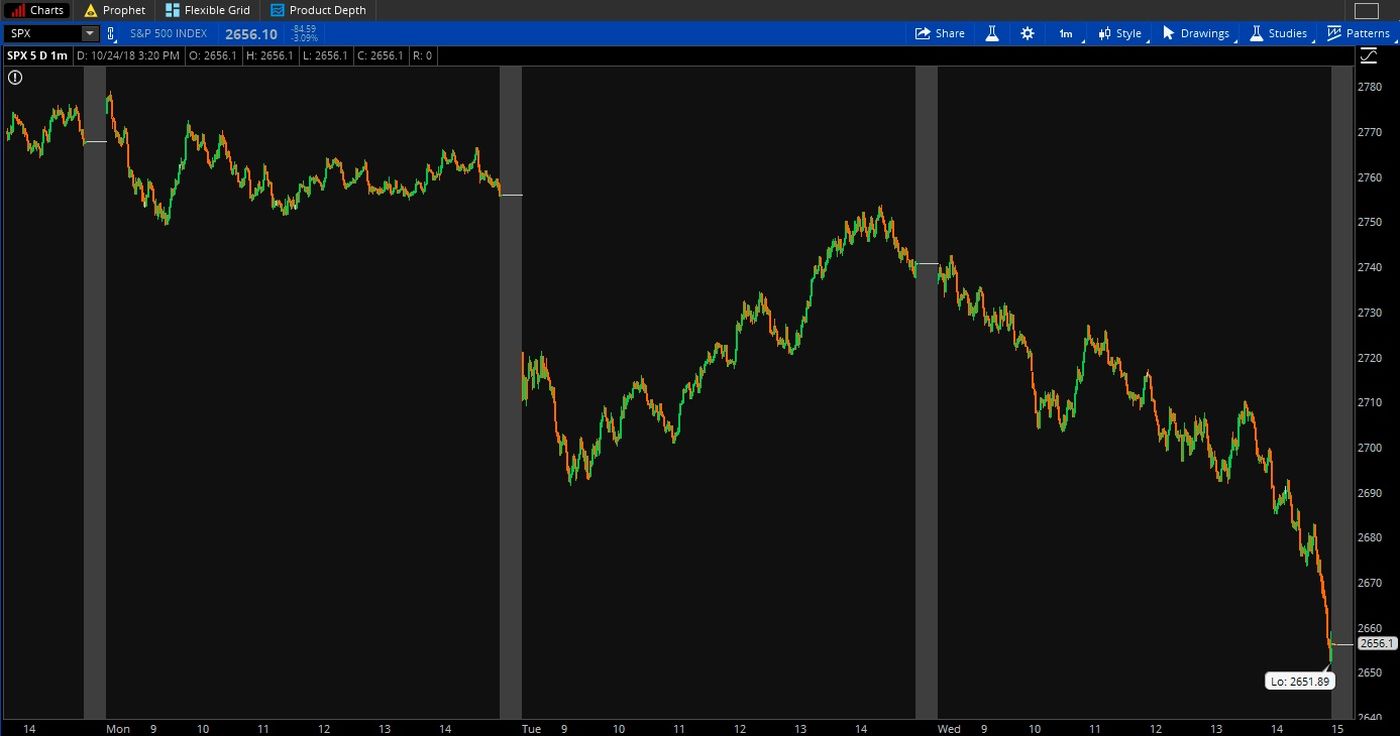

(Wednesday Market Close) Yesterday it was FAANGs to the rescue. Today, they didn’t show up to give the market a lift, and stocks fell sharply to new five-month lows in another Wednesday washout.

Selling seemed to accelerate in the last hour, wiping out all of the market’s gains for the year and taking the S&P 500 Index (SPX) down to just above correction territory. All of the major indices got crushed, with losses ranging from 2% to 4%. Small-caps, large-caps, techs, transports—few escaped the carnage.

Almost every SPX sector got hit, with info tech, communication services, and energy fighting to be the worst performer of the day. Of the 11 sectors, eight finished deep in the red. The SPX, which at one point last month had 10% gains for the year, is now just below flat since Dec. 31 and is approaching correction territory for the second time this year. A correction is defined as a 10% decline from recent highs.

The SPX hit a high of nearly 2941 in late September, and a drop down to 2647—roughly nine points below today’s close—would put it back into correction mode. This was its sixth-straight lower session. Meanwhile, volatility keeps cranking higher, with the VIX jumping more than 21% to above 25 by the end of the session.

Technical Support Levels Breached

Things started to get ugly late in the day when the SPX tumbled below 2710, a level that had marked the Oct. 11 low which some analysts had pegged as a possible support point after stocks closed above it yesterday. Then it flirted with technical support lower down at around 2694, near yesterday’s lows. Once again, the support couldn’t hold. Even stocks that had showed strength early in the day, like Boeing (NYSE:BA), had trouble holding onto gains. Once stocks breached the 2694 level, selling pressure seemed to accelerate and took the SPX down almost 40 more points before the session ended.

The rout was really on in some of the FAANG names, as Netflix (NASDAQ:NFLX) tumbled more than 9% and Facebook (NASDAQ:FB) fell 5%. Tech shares, including the beaten down semiconductors, shared in the misery, with Micron (MU) down more than 8% and Advanced Micro Devices (NASDAQ:AMD) off 9%.

What’s interesting to see was strength in some of the big consumer staples names like Coca-Cola Company (NYSE:KO), PepsiCo (NASDAQ:PEP), and Procter & Gamble Company (NYSE:PG). This might support the theory that investors are embracing staples as they sell off info tech and communication services stocks. It also would add to ideas that consumer demand remains strong in what continues to be a booming economy.

Earnings remain front and center. Microsoft (NASDAQ:MSFT) and Ford (F) reported after the close, and they’ll be followed by Twitter Inc (NYSE:TWTR) and Amazon (NASDAQ:AMZN) tomorrow. One thing to watch is whether IBM’s (IBM (NYSE:IBM)) weak cloud performance reported earlier this month reflects AMZN and MSFT perhaps taking share, or perhaps represents more of an industry-wide issue.

MSFT shares rose slightly in post-market trading after the company’s earnings of $1.14 a share easily beat the third-party consensus estimate of $0.96. Revenue of just over $29 billion beat the consensus view of $27.9 billion, but the company reported slower growth in its Azure cloud computing platform. Though shares initially moved higher, it seems like lately just beating estimates hasn’t been good enough for most companies reporting. Instead, many investors seem to be waiting for bad news, whatever it might be, and looking for excuses to punish shares.

Fed Keeps Hawkish Tone Flowing

If investors were looking for support from the Fed, they didn’t really get it on Wednesday. Dallas Fed President Robert Kaplan said the Fed “no longer needs to be stimulating” the economy. This comes one day after similar words from Atlanta Fed President Raphael Bostic. Of course, some people might look back a few weeks to Fed Chairman Jerome Powell’s statement about rates still being a long way from neutral. All this hawkish talk about rates has the market penciling in another rate hike before the end of the year, at least judging from futures prices, and also has some analysts worried about U.S. short-term rates extending an already large gap with European rates.

U.S. 10-year Treasury bonds apparently found some buyers Wednesday, but it’s arguably a bit surprising to not see a bigger rally here considering what stocks are doing. The yield, which moves opposite from the price, fell to 3.11% by late in the day, down from the day’s high of 3.17%. At the same time, the U.S. dollar index extended its recent gain to climb back well above 96 and get close to August highs. A number of reporting companies have already expressed concern about the possible impact of a higher dollar on their business overseas.

No Relief From Housing Woes

The housing news seems to keep getting worse. Homebuilder stocks came under pressure Wednesday after the Commerce Department said new home sales hit a near two-year low in September. New home sales that month fell 5.5% month-over-month and came in way under Wall Street analysts’ average estimate. Average prices also fell. The housing numbers didn’t look good, and might reflect consumer uncertainty heading into the end of the year. Judging from the data, it’s starting to look like at least some people might feel more comfortable spending short-term rather than long term. Higher mortgage rates, which recently climbed above 5%, might be a factor.

In an interesting trend move, utilities stocks, which had been trading pretty much in line with real estate stocks for some time, have begun moving away. Utilities seem to be getting a bid from some investors lately, perhaps in hope that this could be a hiding place from volatility (though no sector is truly “safe”). Both utilities and real estate climbed Wednesday, but utilities had much bigger gains and easily led all sectors. The only other sector to move higher was consumer staples, another one that’s traditionally seen as “defensive.” Over the last month, utilities are up more than 1% and real estate is down about 5%.

Energy shares continued to sink Wednesday even as crude oil came back a little from yesterday’s lows after U.S. weekly stockpiles data showed a drawdown in gasoline supplies. Still, crude remains near recent lows and worries about demand, both here and abroad, continue to mount. Meanwhile, U.S. crude supplies have risen five weeks in a row.

Figure 1: Wednesday Washout: After a relatively placid Monday and a Tuesday session that featured a late comeback, the S&P 500 (SPX) lost its footing late Wednesday and fell to new five-month lows, the weakest levels since early May. Data Source: S&P Dow Jones Indices. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.