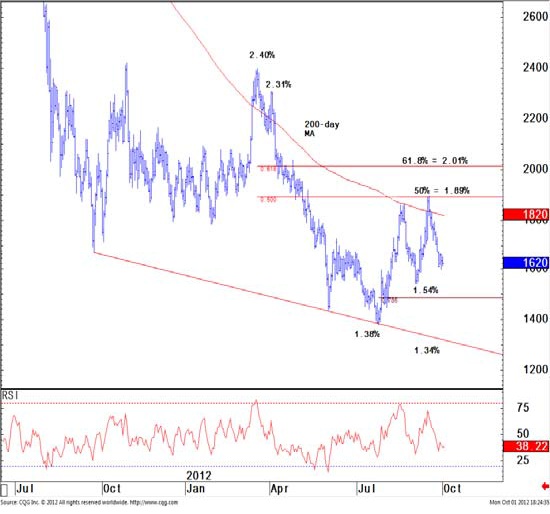

With yesterday’s close at 1.62%, the 10-Year U.S. Treasury has held support at 1.63%. Given this, the yield on the benchmark note may probe lower and test the 1.54% resistance level.

Despite this potential direction, the Credit Suisse technical analyst team of David Sneddon, Christopher Hine, Pamela McCloskey, and Cilline Bain think the price on the 10-Year U.S. Treasury appears rich and would look to position for higher rates. In their latest U.S. Fixed Income Daily, they wrote the following:

10yr US yields were unable to sustain early selling after finding support at accelerated trend props at 1.63%. We must allow for strength to potentially extend a little further, but yields are now stretched and we look to fade further strength to the 1.54% September barrier, which we expect to hold. Only below here would expose the bottom end of the range to 1.45/44% next.

Above 1.63% looks to the 1.66% yield high. Through here is needed for a small base for 1.73/75%.

In addition, they see important resistance at 1.38% and support at 1.79/1.80%.

The technical analyst team’s strategy is to sell or short at 1.60% with Stop-Loss below 1.53% and a target for 1.80%. They are currently flat and do not have an existing position.

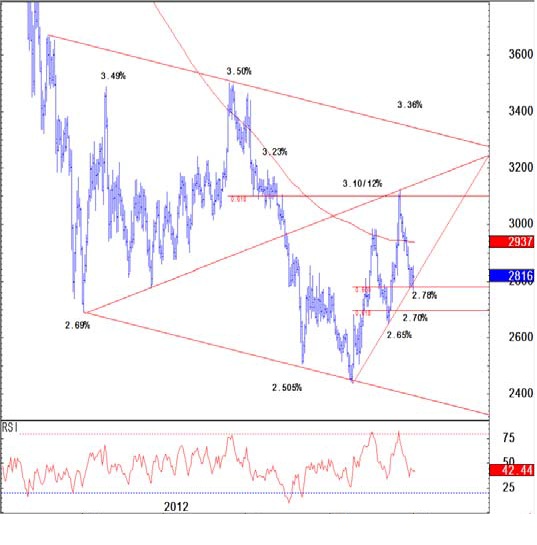

As for the longer end of the yield curve, the 30-Year U.S. Treasury closed yesterday at 2.82%. Currently, the team from Credit Suisse needs to see an uptick in yields beyond support before jumping on board the bear wagon. Until then, they maintain their bullish bias.

30yr US saw a choppy and indecisive session yesterday that saw it end forming a “Doji” candle line. Yields remain stretched short-term, but minimally above 2.85/86% is needed to put in a small base and remove remaining bullish risks. Should 2.78/77% be removed this would aim at 2.70% ahead of a bigger test at the September 2.65% chart low

Above 2.85/86% would put in a small yield base for 2.92% level. Above here is needed to look on to 2.99/3.00%.

In addition to the aforementioned levels, they see important support at 3.03% and 3.09/3.125%

Currently, the team is long the 30-Year U.S. Treasury with a Stop-Loss set above 2.86%. Their target is for 2.70%.

Disclaimer: The above content is provided for educational and informational purposes only, does not constitute a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in such content, and does not represent the opinions of Bondsquawk or its employees.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Recent Rally In U.S. Treasuries May Be Short-Lived

Published 10/03/2012, 06:39 AM

Updated 07/09/2023, 06:31 AM

Recent Rally In U.S. Treasuries May Be Short-Lived

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.