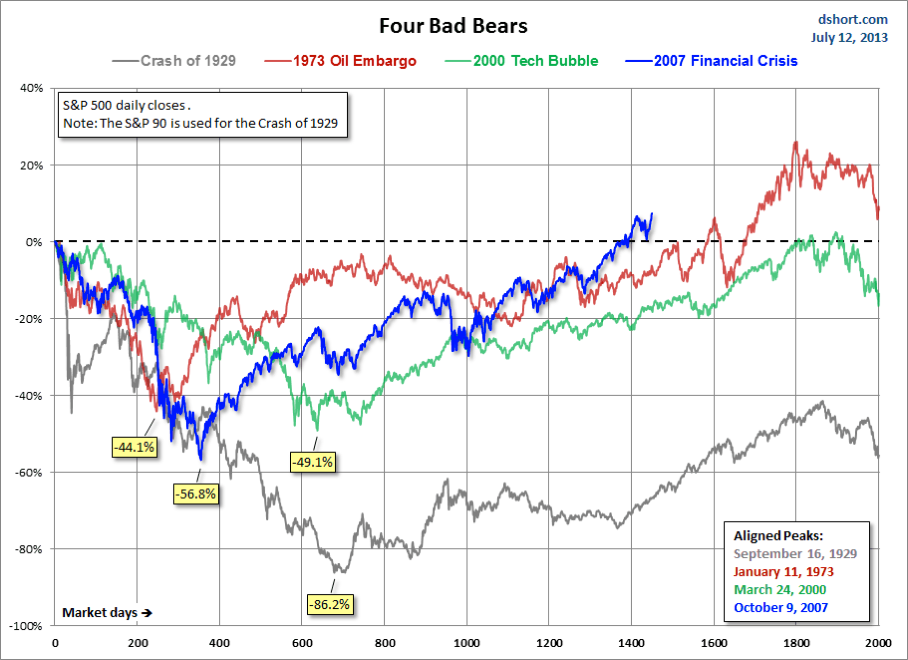

This chart series features an overlay of the Four Bad Bears in U.S. history since the market peak in 1929. They are:

- The Crash of 1929, which eventually ushered in the Great Depression,

- The Oil Embargo of 1973, which was followed by a vicious bout of stagflation,

- The 2000 Tech Bubble bust and,

- The Financial Crisis following the nominal all-time high in 2007.

The series includes four versions of the overlay: nominal, real (inflation-adjusted), total-return with dividends reinvested, and real total-return.

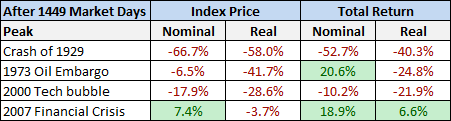

The first chart shows the price, excluding dividends for these four historic declines and their aftermath. As of Friday's close, we are now 1449 market days from the 2007 peak in the S&P 500. In nominal terms (not adjusted for inflation) over the same elapsed time, the Financial Crisis (current market) is our top performer, now at a new all-time high 7.4% above that peak. The 1973 Oil Embargo is in second at -6.5%. The post-Tech Bubble is in third place at -17.9%. The crash of 1929 fared far worse at -66.7%.

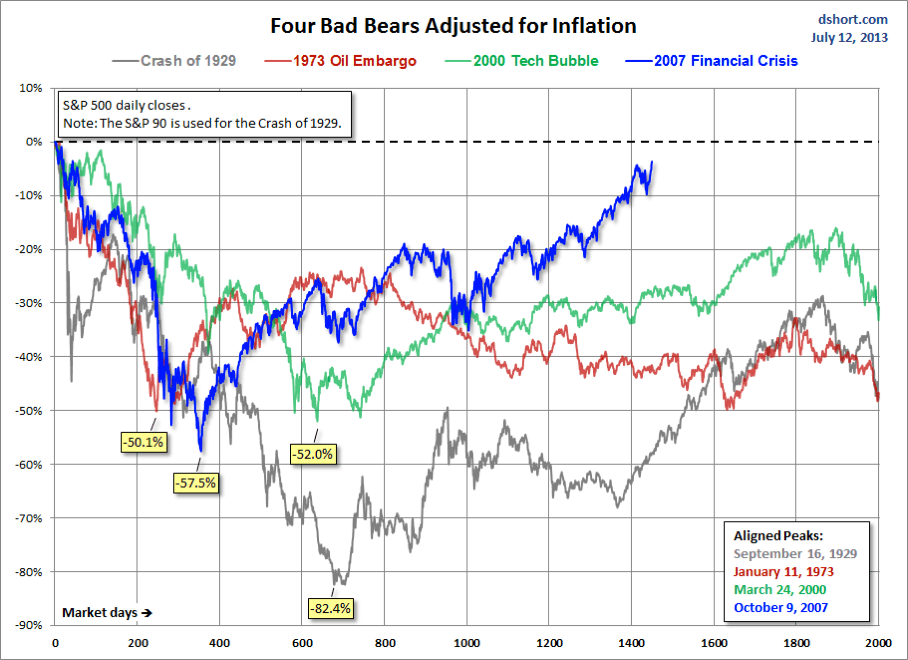

Inflation-Adjusted Performance

When we adjust for inflation, our current secular bear is in the lead, but the real decline from the peak worsens to -3.7%. The other 21st century secular bear comes in second at -28.6.

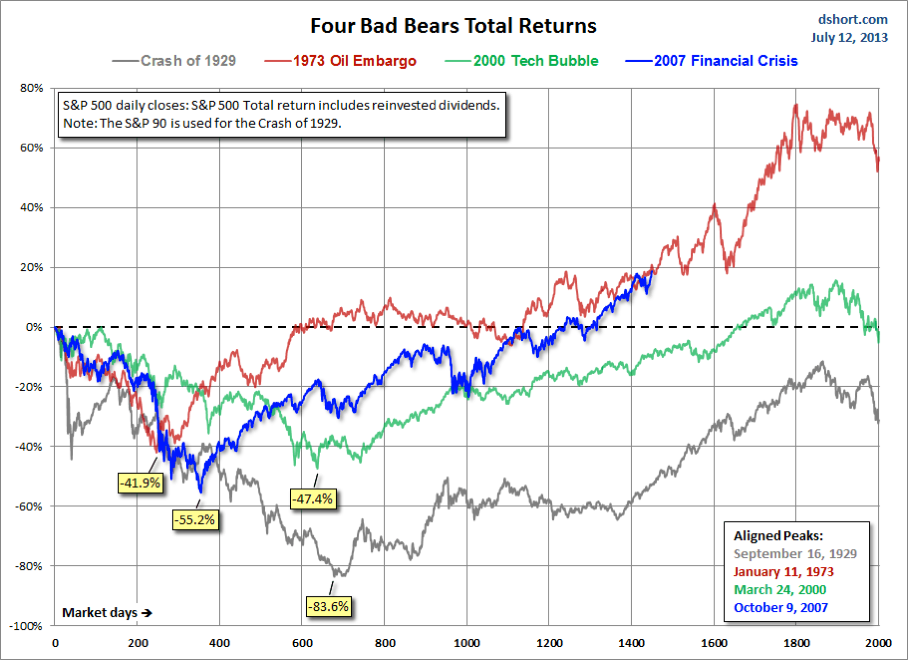

Nominal Total Returns

Now let's look at a total return comparison with dividends reinvested. Interestingly enough, the post-Oil Embargo market is the top performer, up 20.6%. Our current post-Financial Crisis market is second, up 18.9% from the 2007 peak.

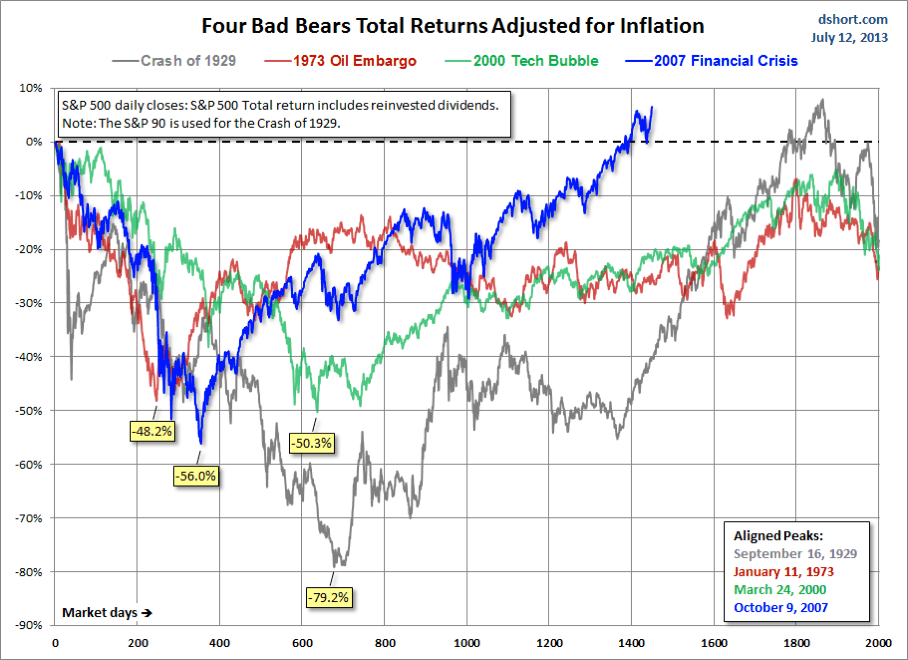

Real (Inflation-Adjusted) Total Returns

But when we adjust total returns for inflation, the picture significantly changes. The spread between the four markets narrows, with the current market in the lead, up 6.6%, and the Great Depression still in last place, but with a statistically less grim -40.3% (those deflated dollars of the 1930s bought more).

Here is a table showing the relative performance of these four cycles at the equivalent point in time.

For a better sense of how these cycles figure into a larger historical context, here's a long-term view of secular bull and bear markets, adjusted for inflation, in the S&P Composite since 1871.

These charts are not intended as a forecast but rather as a way to study the current market in relation to historic market cycles.

Footnote: In previous commentaries on these bad bears, I used the Dow for the first event and the S&P 500 for the other three. However, I'm now including a pair of total return versions of the chart, which requires dividend data. Thus I'm now using the S&P 90, for which I have dividend data. The S&P 90 was a daily index launched by Standard & Poor's in 1926 and preceded the S&P 500, which dates from March 1957.

Inflation adjustment is based on the Consumer Price Index.