Apparel maker PVH Corp (NYSE:PVH) late Wednesday posted better than expected third quarter earnings results, but its fourth quarter outlook was significantly weaker than expected.

The New York City-based company reported Q3 adjusted net income of $2.60 per share, which was a full $0.20 better than the average Wall Street consensus estimate of $2.40. Revenues rose 3.7% from last year to $2.24 billion, slightly edging out estimates for $2.23 billion.

A big standout among the company’s brands was an 11% increase Calvin Klein sales, which was much higher than the 6% gain PVH had anticipated. Calvin Klein growth was driven by better performance in Europe, China and the company’s North America wholesale business.

International Calvin Klein retail comparable store sales increased 7%, while North America retail comps fell 4%. Tommy Hilfiger comps fell 9% in the U.S., but saw strong international growth. Comparable sales are considered a key indicator of a retailer’s health, since they measure the year-over-year performance of stores open at least 12 months.

Looking ahead, PVH forecast Q4 EPS to range from $1.13 to $1.18, which would badly miss Wall Street’s $1.28 estimate. Q4 revenues are expected to rise 1% to $2.13 billion, which is in-line with analysts’ view.

The company commented via press release:

“While our North America wholesale businesses have performed well throughout the year, we have not experienced any significant improvement in traffic and consumer spending trends across our Tommy Hilfiger and Calvin Klein U.S. outlet stores located in international tourist locations.”

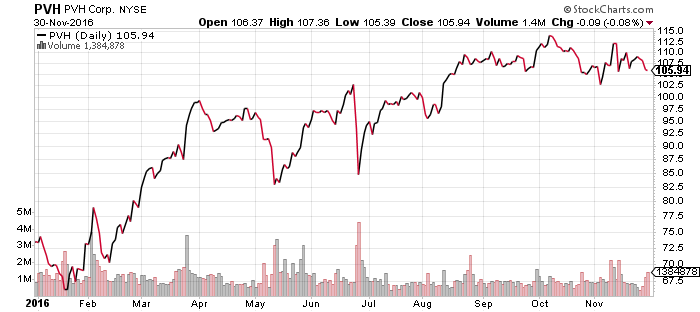

PVH shares fell $1.74 (-1.64%) to $104.20 in after-hours trading Wednesday. Prior to today’s report, PVH had surged 43.84% year-to-date, which is more than five times the return of the benchmark S&P 500 index during the same period.