The bearish sentiment in the options market surrounding the ProShares UltraShort 20+ Year Treasury (NYSE:TBT) has been overdone, and the invest leveraged bond fund is due for a snap-back rally.

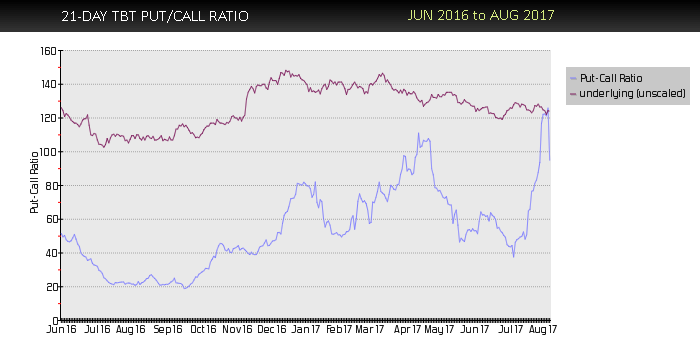

That’s the message from the options experts at McMillan Analysis Corp., who today published a note that their computer generated Put-Call Ratio Buy Signal has been visually confirmed by TBT’s chart (see below):

As you can see above, the put-call ratio (blue line) has absolutely surged over the past month or so, and is now at the highest levels we’ve seen in well over a year. In essence, this means that bearish options bets on a volume basis are dwarfing those on the bullish side.

This sort of severe imbalance typically ends with a sharp turn in the other direction, and in TBT’s case, could mean a quick rally in the short term.

For more on put-call ratio and its value as a contrarian indicator, check out McMillan’s explanation:

Put-call ratios are useful, sentiment-based, indicators. The put-call ratio is simply the volume of all puts that traded on a given day divided by the volume of calls that traded on that day. The ratio can be calculated for an individual stock, index, or futures underlying contract, or can be aggregated – for example, we often refer to the equity-only put-call ratio, which is the sum of all equity put options divided by all equity call options on any given day. Once the ratios are calculated, a moving average is generally used to smooth them out. We prefer the 21-day moving average for that purpose, although it is certainly acceptable to use moving averages of other lengths.

While a surging put-call ratio is by no means a guarantee that an ETF will rise, it is a historically reliable tool for traders and investors to use to identify ETFs that are due for short-term jumps (or pullbacks). It pays to closely monitor TBT’s share price over the next several sessions as a result.

The ProShares UltraShort 20 Plus Year Treasury ETF (NYSE:TBT) was trading at $35.90 per share on Tuesday afternoon, up $0.3 (+0.84%). Year-to-date, TBT has declined -12.05%, versus a 12.02% rise in the benchmark S&P 500 index during the same period.

TBT currently has an ETF Daily News SMART Grade of C (Neutral), and is ranked #6 of 21 ETFs in the Inverse Bonds ETFs category.