Alibaba Reports Earnings Before Wednesday's Open

Caterpillar (NYSE:CAT) just had a rough go of its recent quarterly report, with the company citing weak demand out of China. The strength of the mainland's economy has been a concern of Wall Street's recently, and will likely have traders eyeing Chinese e-commerce concern Alibaba Group Holdings (NYSE:BABA) fiscal third-quarter earnings report, due before the open tomorrow, Jan. 30. Plus, options traders are bracing for a larger-than-normal post-earnings move.

Alibaba's earnings history is relatively muted. Overall, the equity has averaged a post-earnings move of 2.7% in the past two years, regardless of direction. This includes a 2.4% drop back in November, and a 3.2% pullback in August. This time around, the options market is pricing in an 8.8% next-day move for the security, according to implied earnings deviation data.

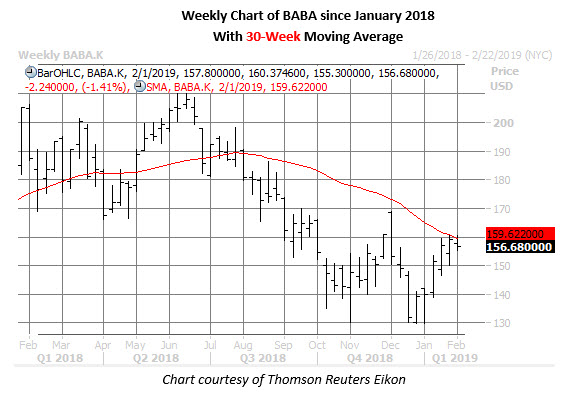

At last check, Alibaba stock was down 1.4% to trade at $156.68. The shares added 14% to start 2019, and are fresh off five straight weekly wins -- distancing themselves from their Christmas Eve annual low of $129.77. However, BABA's 30-week moving average looms overhead as resistance.

In the options pits, the mood has been taken a bearish turn in recent weeks. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), BABA's 10-day put/call volume ratio of 0.73 ranks in the 94th percentile of its annual range. This shows that while calls have outpaced puts on an absolute basis in recent weeks, the rate of put buying has been quicker than usual.

What's more, its Schaeffer's put/call open interest ratio (SOIR) of 1.01 is in the 100th percentile of its annual range, so short-term option players have rarely been more put-heavy in the past 12 months.